Entergy 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

option grants. The 2011 Plan, which only applies to awards made on or

after May 6, 2011, will expire after 10 years. As of December 31, 2011,

there were 5,495,276 authorized shares remaining for stock-based

awards, including 2,000,000 for incentive stock option grants.

Stock Options

Stock options are granted at exercise prices that equal the closing

market price of Entergy Corporation common stock on the date of

grant. Generally, stock options granted will become exercisable in

equal amounts on each of the first three anniversaries of the date

of grant. Unless they are forfeited previously under the terms of the

grant, options expire ten years after the date of the grant if they are

not exercised.

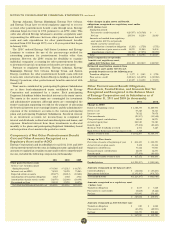

The following table includes financial information for stock

options for each of the years presented (in millions):

2011 2010 2009

Compensation expense included in

Entergy’s consolidated net income $10.4 $15.0 $16.8

Tax benefit recognized in Entergy’s

consolidated net income $ 4.0 $ 5.8 $ 6.5

Compensation cost capitalized as

part of fixed assets and inventory $ 2.0 $ 2.9 $ 3.2

Entergy determines the fair value of the stock option grants

by considering factors such as lack of marketability, stock

retention requirements, and regulatory restrictions on exercisability

in accordance with accounting standards. The stock option

weighted-average assumptions used in determining the fair values

are as follows:

2011 2010 2009

Stock price volatility 24.25% 25.73% 24.39%

Expected term in years 6.64% 5.46 5.33

Risk-free interest rate 2.70% 2.57% 2.22%

Dividend yield 4.20% 3.74% 3.50%

Dividend payment per share $3.32 $3.24 $3.00

Stock price volatility is calculated based upon the weekly public

stock price volatility of Entergy Corporation common stock over the

last four to five years. The expected term of the options is based

upon historical option exercises and the weighted average life of

options when exercised and the estimated weighted average life of

all vested but unexercised options. In 2008, Entergy implemented

stock ownership guidelines for its senior executive officers. These

guidelines require an executive officer to own shares of Entergy

common stock equal to a specified multiple of his or her salary. Until

an executive officer achieves this ownership position the executive

officer is required to retain 75% of the after-tax net profit upon

exercise of the option to be held in Entergy Corporation common

stock. The reduction in fair value of the stock options due to this

restriction is based upon an estimate of the call option value of the

reinvested gain discounted to present value over the applicable

reinvestment period.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

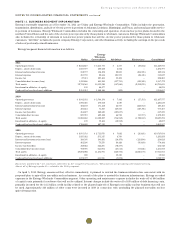

A summary of stock option activity for the year ended December 31, 2011 and changes during the year are presented below:

The weighted-average grant-date fair value of options granted during the year was $13.18 for 2010 and $12.47 for 2009. The total intrinsic value

of stock options exercised was $29.6 million during 2011, $36.6 million during 2010, and $35.6 million during 2009. The intrinsic value, which

has no effect on net income, of the stock options exercised is calculated by the difference in Entergy Corporation’s common stock price on

the date of exercise and the exercise price of the stock options granted. Because Entergy’s year-end stock price is less than the weighted

average exercise price, the aggregate intrinsic value of outstanding stock options as of December 31, 2011 was zero. The intrinsic value of “in

the money” stock options is $67 million as of December 31, 2011. Entergy recognizes compensation cost over the vesting period of the options

based on their grant-date fair value. The total fair value of options that vested was approximately $16 million during 2011, $21 million during

2010, and $22 million during 2009.

Options outstanding as of January 1, 2011

Options granted

Options exercised

Options forfeited/expired

Options outstanding as of December 31, 2011

Options exercisable as of December 31, 2011

Weighted-average grant-date fair value of options granted during 2011

Weighted-Average Aggregate Weighted-Average

Number of Options Exercise Price Intrinsic Value Contractual Life

11,225,725 $72.45

388,200 $72.79

(1,079,008) $42.43

(75,499) $86.62

10,459,418 $75.46 $ – 4.7 years

9,011,257 $75.36 $ – 4.1 years

$11.48

99