Entergy 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

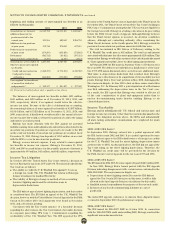

In August 2011, Entergy entered into a settlement agreement with

the IRS relating to the mark-to-market income tax treatment of various

wholesale electric power purchase and sale agreements, including

Entergy Louisiana’s contract to purchase electricity from the Vidalia

hydroelectric facility. See Note 8 to the financial statements for

further details regarding this contract and a previous LPSC-approved

settlement regarding sharing of tax benefits from the tax treatment of

the contract.

With respect to income tax accounting for wholesale electric power

purchase agreements, Entergy recognized income for tax purposes of

approximately $1.5 billion, which represents a reversal of previously

deducted temporary differences on which deferred taxes had been

provided. Also in connection with this settlement, Entergy recognized

a gain for income tax purposes of approximately $1.03 billion on the

formation of a wholly-owned subsidiary in 2005 with a corresponding

step-up in the tax basis of depreciable assets resulting in additional

tax depreciation at Entergy Louisiana. Because Entergy Louisiana

is entitled to deduct additional tax depreciation of $1.03 billion in

the future, Entergy Louisiana recorded a deferred tax asset for this

additional tax basis. The tax expense associated with the gain is offset

by recording the deferred tax asset and by utilization of net operating

losses. With the recording of the deferred tax asset, there was a

corresponding increase to Entergy Louisiana’s member’s equity account.

The agreement with the IRS effectively settled the tax treatment of

various wholesale electric power purchase and sale agreements,

resulting in the reversal in third quarter 2011 of approximately

$422 million of deferred tax liabilities and liabilities for uncertain

tax positions at Entergy Louisiana, with a corresponding reduction

in income tax expense. Under the terms of an LPSC-approved final

settlement, Entergy Louisiana will share over a 15-year period a

portion of the benefits of the settlement with its customers, and

recorded a $199 million regulatory charge and a corresponding net-of-

tax regulatory liability to reflect this obligation.

After consideration of the taxable income recognition and the

additional depreciation deductions provided for in the settlement,

Entergy’s net operating loss carryover was reduced by approximately

$2.5 billion.

Other Tax Matters

Entergy regularly negotiates with the IRS to achieve settlements.

The results of all pending litigations and audit issues could result in

significant changes to the amounts of unrecognized tax benefits, as

discussed above.

When Entergy Louisiana, Inc. restructured effective December 31,

2005, Entergy Louisiana agreed, under the terms of the merger plan,

to indemnify its parent, Entergy Louisiana Holdings, Inc. (formerly,

Entergy Louisiana, Inc.) for certain tax obligations that arose from the

2002-2003 IRS partial agreement. Because the agreement with the IRS

was settled in the fourth quarter 2009, Entergy Louisiana paid Entergy

Louisiana Holdings approximately $289 million pursuant to these

intercompany obligations in the fourth quarter 2009.

On November 20, 2009, Entergy Corporation and subsidiaries

amended the Entergy Corporation and Subsidiary Companies

Intercompany Income Tax Allocation Agreement such that Entergy

Corporation shall be treated, under all provisions of such Agreement,

in a manner that is identical to the treatment afforded all subsidiaries,

direct or indirect, of Entergy Corporation.

In the fourth quarter 2009, Entergy filed Applications for Change in

Method of Accounting with the IRS for certain costs under Section

263A of the Internal Revenue Code. In the Applications, Entergy

proposed to treat the nuclear decommissioning liability associated

with the operation of its nuclear power plants as a production cost

properly includable in cost of goods sold. The effect of this change for

Entergy was a $5.7 billion reduction in 2009 taxable income within the

Entergy Wholesale Commodities segment.

In March 2010, Entergy filed an Application for Change in Accounting

Method with the IRS. In the application Entergy proposed to change

the definition of unit of property for its generation assets to determine

the appropriate characterization of costs associated with such units as

capital or repair under the Internal Revenue Code and related Treasury

Regulations. The effect of this change was an approximate $1.3 billion

reduction in 2010 taxable income for Entergy, including reductions of

$292 million for Entergy Arkansas, $132 million for Entergy Gulf States

Louisiana, $185 million for Entergy Louisiana, $48 million for Entergy

Mississippi, $45 million for Entergy Texas, $13 million for Entergy New

Orleans, and $180 million for System Energy.

During the second quarter 2011, Entergy filed an Application for

Change in Accounting Method with the IRS related to the allocation

of overhead costs between production and non-production activities.

The accounting method affects the amount of overhead that will be

capitalized or deducted for tax purposes. The accounting method is

expected to be implemented for the 2014 tax year.

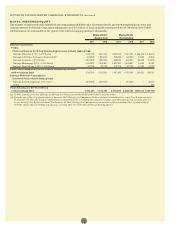

NOTE 4. REVOLVING CREDIT FACILITIES, LINES OF

CREDIT AND SHORT-TERM BORROWINGS

Entergy Corporation has in place a credit facility that has a borrowing

capacity of approximately $3.5 billion and expires in August 2012,

which Entergy intends to renew before expiration. Because the

facility is now within one year of its expiration date, borrowings

outstanding on the facility are classified as currently maturing long-

term debt on the balance sheet. Entergy Corporation also has the

ability to issue letters of credit against the total borrowing capacity

of the credit facility. The facility fee is currently 0.125% of the

commitment amount. Facility fees and interest rates on loans under

the credit facility can fluctuate depending on the senior unsecured

debt ratings of Entergy Corporation. The weighted average interest

rate for the year ended December 31, 2011 was 0.745% on the drawn

portion of the facility. Following is a summary of the borrowings

outstanding and capacity available under the facility as of December

31, 2011 (in millions):

Capacity Borrowings Letters of Credit Capacity Available

$3,451 $1,920 $28 $1,503

Entergy Corporation’s facility requires it to maintain a consolidated

debt ratio of 65% or less of its total capitalization. Entergy is in

compliance with this covenant. If Entergy fails to meet this ratio,

or if Entergy Corporation or one of the Utility operating companies

(except Entergy New Orleans) defaults on other indebtedness or

is in bankruptcy or insolvency proceedings, an acceleration of the

facility maturity date may occur.

81