Entergy 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Entergy Corporation and Subsidiaries 2011

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

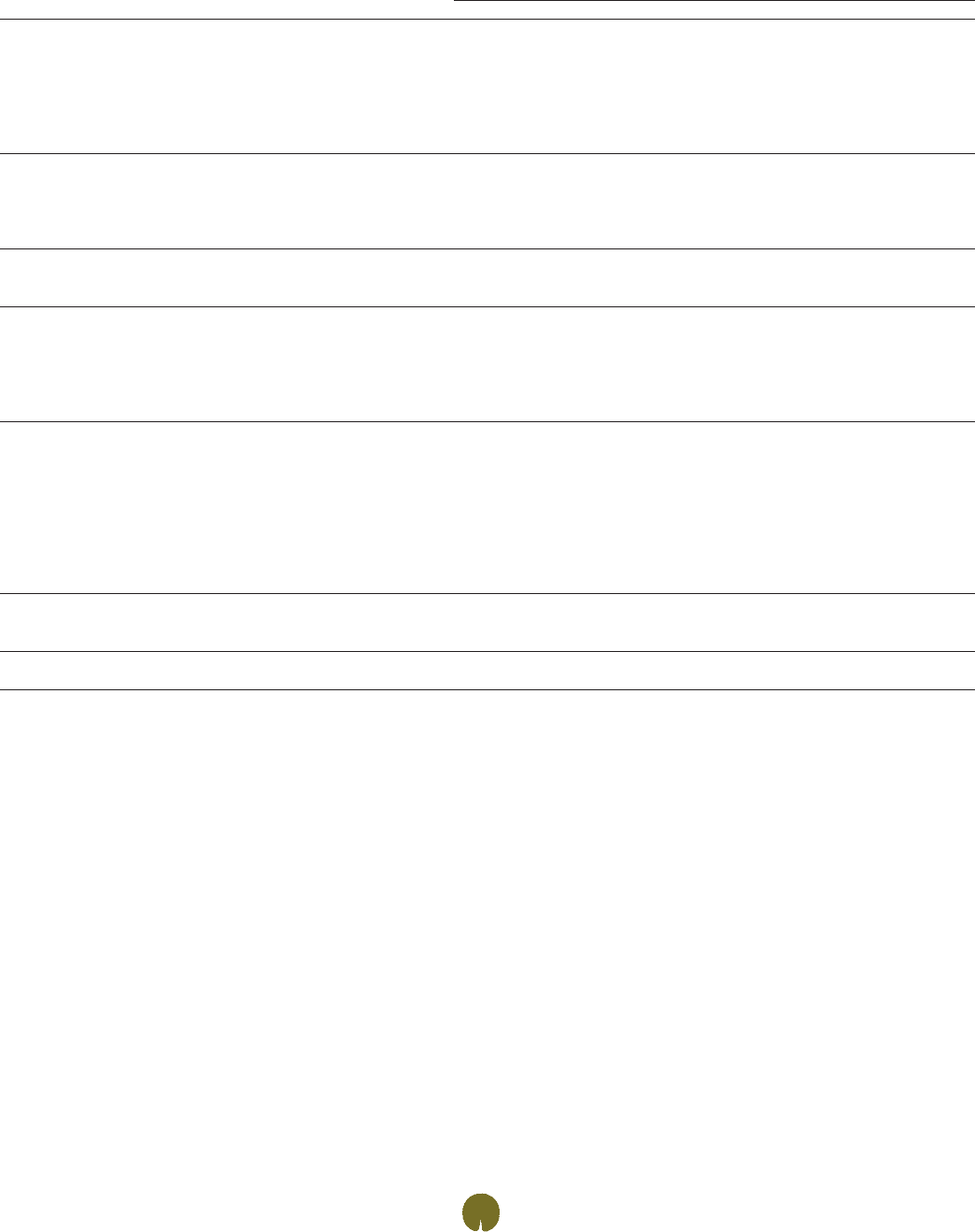

NOTE 5. LONG-TERM DEBT

Long-term debt for Entergy Corporation and subsidiaries as of December 31, 2011 and 2010 consisted of (dollars in thousands):

Weighted-Average Interest Rate Ranges Outstanding at

Interest Rate at December 31, December 31,

Type of Debt and Maturity at December 31, 2011 2011 2010 2011 2010

Mortgage Bonds

2011 - 2016 4.18% 3.25% - 6.20% 3.6% - 6.2% $ 865,000 $ 920,000)

2017 - 2021 5.40% 3.75% - 7.13% 3.75% - 7.125% 2,435,000 2,160,000)

2022 - 2026 5.27% 4.44% - 5.66% 4.44% - 5.66% 1,158,449 1,158,738)

2027 - 2036 6.18% 5.65% - 6.40% 5.65% - 6.4% 868,145 868,546)

2039 - 2051 6.22% 5.75% - 7.88% 5.75% - 7.875% 905,000 755,000

Governmental Bonds(a)

2011 - 2016 3.67% 2.88% - 5.80% 2.875% - 6.75% 42,795 90,135

2017 - 2021 4.83% 4.60% - 5.00% 4.6% - 5.0% 99,700 99,700)

2022 - 2026 5.82% 4.60% - 6.20% 4.6% - 6.2% 415,005 455,005)

2027 - 2030 5.00% 5.0% 5.0% 198,680 198,6800

Securitization Bonds

2013 - 2020 4.05% 2.12% - 5.79% 2.12% - 5.79% 416,899 474,318)

2021 - 2023 3.65% 2.04% - 5.93% 2.30% - 5.93% 653,948 457,100)

Variable Interest Entities Notes Payable (Note 4)

2012 - 2016 4.96% 2.25% - 9.00% 2.125% - 9% 519,400 474,200)

Entergy Corporation Notes

due March 2011 n/a –% 7.06% – 86,000)

due September 2015 n/a 3.625% 3.625% 550,000 550,000)

due September 2020 n/a 5.125% 5.125% 450,000 450,000)

Note Payable to NYPA (b) (b) (b) 133,363 155,971)

5 Year Credit Facility (Note 4) n/a 0.75% 0.78% 1,920,000 1,632,120)

Long-term DOE Obligation(c) –% –% –% 181,031 180,919)

Waterford 3 Lease Obligation(d) n/a 7.45% 7.45% 188,255 223,802)

Grand Gulf Lease Obligation(d) n/a 5.13% 5.13% 178,784 222,280)

Bank Credit Facility -

Entergy Louisiana n/a 0.67% –% 50,000 –)

Unamortized Premium and Discount - Net (9,531) (10,181)

Other 16,523 14,372)

Total Long-Term Debt 12,236,446 11,616,705)

Less Amount Due Within One Year 2,192,733 299,548)

Long-Term Debt Excluding Amount Due Within One Year $10,043,713 $11,317,157)

Fair Value of Long-Term Debt(e) $ 12,176,251 $ 10,988,646)

(a) Consists of pollution control revenue bonds and environmental revenue bonds.

(b) These notes do not have a stated interest rate, but have an implicit interest rate of 4.8%.

(c) Pursuant to the Nuclear Waste Policy Act of 1982, Entergy’s nuclear owner/licensee subsidiaries have contracts with the DOE for spent nuclear fuel disposal

service. The contracts include a one-time fee for generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric power

with nuclear fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term debt.

(d) See Note 10 for further discussion of the Waterford 3 and Grand Gulf Lease Obligations.

(e) The fair value excludes lease obligations of $188 million at Entergy Louisiana and $179 million at System Energy, long-term DOE obligations of $181 million

at Entergy Arkansas, and the note payable to NYPA of $133 million at Entergy, and includes debt due within one year. Fair values are based on prices derived by

independent third parties that use inputs such as benchmark yields, reported trades, broker/dealer quotes, and issuer spreads.

83