Entergy 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT

Adapting

TO A CHANGING WORLD

Table of contents

-

Page 1

2 0 1 1 A N N U A L R E P O R T Adapting TO A C H A N G I N G WO R L D -

Page 2

... Making Progress on Many Fronts Our Point of View on Transmission Entergy Corporation Utility Entergy Wholesale Commodities Our 2011 Environmental Initiatives and Point of View on Climate Change Managing Future Change Financial Review Investor Information Directors and Executive Ofï¬cers 24 28 29... -

Page 3

... behaviors to survive even as other species have disappeared. In our 2011 annual report, we present the strategies and capabilities we have developed and are implementing to adapt to our changing world. Our strategies are multidimensional but share a common goal: to consistently deliver value over... -

Page 4

...transmission business, but Entergy Corporation will not. Immediately after the spin-off, Transco will then merge into a subsidiary of ITC. Prior to the merger, ITC expects to effectuate a $700 million recapitalization, currently anticipated to take the form of a one-time special dividend. The merger... -

Page 5

...vertically integrated utility and generation company, we handle nuclear operations, license renewal of nuclear plants, establishment of new distribution standards to meet the risks of rising sea levels, storm surges, and stronger and more frequent hurricanes, and a host of other issues. ITC wakes up... -

Page 6

... generation portfolio in both businesses. We announced proposals to move the utility operating companies to MISO and then a separate transaction to spin off and merge our transmission business with ITC. We also continued our ongoing efforts towards securing renewed licenses for our Northeast nuclear... -

Page 7

...to MISO. Our utility operating companies also moved to address their ongoing generation capacity needs. Examples of the build, buy or contract actions taken in 2011 include: Entergy Arkansas and Entergy Mississippi each announced plans to purchase a combined-cycle gas-turbine unit; Entergy Louisiana... -

Page 8

... exists in our wholesale generation portfolio. Operationally, EWC set the second highest annual net generation for its nuclear ï¬,eet in 2011. EWC also completed its purchase of the Rhode Island State Energy Center, a 583-megawatt CCGT plant located in the ISO New England market. The investment adds... -

Page 9

... Nuclear Station's 20-year license renewal application closed without any contentions ï¬led. As a result, the NRC's schedule to make a decision on Grand Gulf's license renewal is tentatively set for September 2013. Also at Indian Point, at the state level, the administrative law judges of the New... -

Page 10

...Vermont Yankee Nuclear Power Station for 20 years and, in January 2012, a federal district court ruled against the state of Vermont's previous attempt to close Vermont Yankee in March 2012. We raised $2.9 million in bill payment assistance funds from customers, employees and shareholders. This total... -

Page 11

... we have grown operational earnings per share at a rate 2.5 times the average and total annual shareholder return at 1.5 times the average of Philadelphia Utility Index members or top quartile. However, 2012 will be a difï¬cult year on earnings as commodity prices are at the lowest point in years... -

Page 12

... and securely connect an increasing number of customers and devices to central and distributed generation sources. Renewables, energy storage and demand response also may play new or larger roles in grid operations. Yet, given the existing state of the U.S. electric transmission infrastructure... -

Page 13

..., Louisiana, Mississippi and Texas. By spinning off these assets and combining them with an industry-leading transmission operator, our utility customers can realize the beneï¬ts of the independent transmission model in addressing these future realities. We thank Clark W. Gellings, Electric Power... -

Page 14

... magazine, which annually ranks the performance of the 1,000 largest companies in the areas of climate change abatement, corporate governance, employee relations, environmental impact, ï¬nancial performance, human rights and philanthropy. In 2011, we again received the highest overall rating of 10... -

Page 15

... investment opportunity, acquiring the Rhode Island State Energy Center, a 583-megawatt power plant. In addition, our current long-term ï¬nancial outlook supports maintaining the common dividend at the current $3.32 per share annualized level after the ITC transaction. Any dividend from ITC... -

Page 16

...'s utility operating companies, about 25 percent require government assistance to meet their basic needs. Our Low-Income Initiative, which began more than 10 years ago, is designed to improve the ï¬,ow of assistance funds, help customers better manage their energy use and support education, job... -

Page 17

... in response to extreme summer heat. As a result of this effort, total 2011 contributions increased 19 percent over 2010. Entergy continued its customer assistance fundraising efforts under its systemwide The Power to Care program. In 2011, The Power to Care fund provided bill payment assistance to... -

Page 18

...our utility operating companies excelled in providing affordable, reliable and clean power. Customer service performance as measured by outage frequency, outage duration and regulatory outage complaints improved signiï¬cantly over this period. Average residential rates for Entergy utility customers... -

Page 19

... a positive online experience. Site Selection magazine recognized Entergy for the fourth consecutive year as one of the Top 10 utilities in North America for its support of economic development in Arkansas, Louisiana, Mississippi and Texas. Employees throughout our utility operating companies strive... -

Page 20

...Service Our utility operating companies pursue build, buy and contract options to address current capacity needs and meet long-term load growth. In 2011, we continued to pursue generation supply alternatives with the following actions: n Entergy Arkansas announced its plan to purchase the Hot Spring... -

Page 21

... 2012 with commercial operation expected by mid-2015. Entergy Mississippi announced its plan to purchase the Hinds Energy Facility, a 450-megawatt CCGT unit in Jackson, Miss., with a targeted closing date of mid-2012. Entergy Texas entered into a power purchase agreement with Calpine Energy Services... -

Page 22

...-hour in 2010. Our EWC nuclear team completed two record runs in 2011: a 642-day run at Pilgrim Nuclear Power Station and a 483-day run at Cooper Nuclear Station, which EWC manages under a long-term contract for the Nebraska Public Power District. In addition, the team at Indian Point Energy Center... -

Page 23

... State Energy Center, a 583-megawatt combined-cycle gas-turbine unit located in Johnston, R.I. The Rhode Island State Energy Center enhances the value of EWC's portfolio by adding a fossil generation asset in the New England market, which is also served by Pilgrim and Vermont Yankee Nuclear Power... -

Page 24

... dedicated Vermont Yankee employees. Shortly after the order, Entergy ï¬led a motion requesting that the VPSB grant, based on the existing record in its proceeding, Vermont Yankee's pending application for a new CPG, and the state of Vermont ï¬led a notice of appeal of the District Court's ruling... -

Page 25

Entergy Corporation and Subsidiaries 2011 Increasing Net Generation With a focus on operational excellence, EWC has improved its nuclear ï¬,eet capacity factor and added capacity through productive uprate investments. In 2011, EWC recorded its second highest annual net generation ever for its ... -

Page 26

.... In 2002, our board of directors adopted an Environmental Vision Statement that established commitments in the areas of sustainable development, performance excellence and environmental advocacy. For more than 10 years, we have invested in clean generation technologies and pursued a comprehensive... -

Page 27

... Carbon Registry, a voluntary offset program with strong environmental integrity standards. Following a 2010 study, Entergy awarded a $250,000 grant to America's WETLAND Foundation to help build public support for policies to protect the Gulf Coast region against a changing environment. The effort... -

Page 28

... our utility operating companies' abilities to provide power to customers or expose Entergy to massive ï¬nes for noncompliance. For example, the EPA's model assumes many Entergy fossil plants would not run beginning in 2012, so state allowance budgets do not include realistic emission levels for... -

Page 29

...revenue generated should be used to address the regressive effects of a carbon tax on low- and moderate-income households and fund immediate adaptation efforts in high-risk areas such as the Gulf Coast. The tax should adjust every three to ï¬ve years as new information on the cost of climate change... -

Page 30

... Operating the business with the highest expectations and standards, n Executing earnings growth opportunities while managing commodity and other business risks, n Delivering returns at or above the risk-adjusted cost of capital for each initiative, project and business, n Maintaining credit quality... -

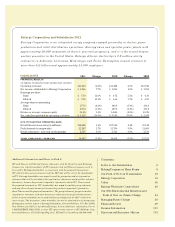

Page 31

Financial Review Forward-Looking Information Five-Year Summary of Selected Financial and Operating Data Comparison of Five-Year Cumulative Return Management's Financial Discussion and Analysis Report of Management Reports of Independent Registered Public Accounting Firm Internal Control Over ... -

Page 32

...must purchase for its Utility customers, and Entergy's ability to meet credit support requirements for fuel and power supply contracts; volatility and changes in markets for electricity, natural gas, uranium, and other energy-related commodities; changes in law resulting from federal or state energy... -

Page 33

...$0 2006 (a) Assumes $100 invested at the closing price on December 31, 2006 in Entergy Corporation common stock, the S&P 500 Index, and the Philadelphia Utility Index, and reinvestment of all dividends. 2007 2008 S&P 500 Index 2009 2010 2011 Entergy Corporation Philadelphia Utility Index 31 -

Page 34

...: Utility and Entergy Wholesale Commodities. n The UTILITY business segment includes the generation, transmission, distribution, and sale of electric power in portions of Arkansas, Mississippi, Texas, and Louisiana, including the City of New Orleans; and operates a small natural gas distribution... -

Page 35

... May 2011; a formula rate plan increase at Entergy Louisiana effective May 2011; and a base rate increase at Entergy Arkansas effective July 2010. Following are key performance measures for Entergy Wholesale Commodities for 2011 and 2010: Owned capacity GWh billed Average realized price per... -

Page 36

... by FERC's acceptance of a change in the treatment of funds received from independent power producers for transmission interconnection projects; and n interest expense accrued in 2010 related to the expected result of the LPSC Staff audit of Entergy Gulf States Louisiana's fuel adjustment clause... -

Page 37

...retail electric price variance is primarily due to: increases in the formula rate plan riders at Entergy Gulf States Louisiana effective November 2009, January 2010, and September 2010, at Entergy Louisiana effective November 2009, and at Entergy Mississippi effective July 2009; a base rate increase... -

Page 38

... estate by Entergy Louisiana Properties, LLC. Net MW in operation at December 31 Average realized revenue per MWh GWh billed Capacity factor Refueling outage days: FitzPatrick Indian Point 2 Indian Point 3 Palisades Pilgrim Vermont Yankee The decrease was partially offset by: an increase of $24... -

Page 39

... for the planned spin-off of its non-utility nuclear business; and n the recognition of a $14 million Louisiana state income tax beneï¬t related to storm cost ï¬nancing. Partially offsetting the decreased effective income tax rate was a charge of $16 million resulting from a change in tax... -

Page 40

...: $.51 billion for Entergy Arkansas, $.27 billion for Entergy Gulf States Louisiana, $.38 billion for Entergy Louisiana, $.29 billion for Entergy Mississippi, $.01 billion for Entergy New Orleans, and $.30 billion for Entergy Texas. Entergy and the Utility operating companies may, subject to certain... -

Page 41

...System Energy sale-leaseback transactions, which are included in long-term debt on the balance sheet (in millions): Long-Term Debt Maturities and Estimated Interest Payments 20152016 After 2016 2012 2013 2014 Utility $ 721 $ 1,197 Entergy Wholesale Commodities 24 15 Parent & Other 1,972 43 Total... -

Page 42

... 2011 - - $50 - - - - After 2016 $11,466 $ 38 $ 166 $ 5,199 Total $18,266 $ 65 $ 508 $11,260 Company Entergy Arkansas Entergy Gulf States Louisiana August 2012 Entergy Louisiana August 2012 Entergy Mississippi May 2012 Entergy Mississippi May 2012 Entergy Mississippi May 2012 Entergy Texas August... -

Page 43

... site and agreements by two of the Utility operating companies to acquire the 620 MW Hot Spring Energy Facility and the 450 MW Hinds Energy Facility. Ninemile Point Unit 6 Self-Build Project In June 2011, Entergy Louisiana ï¬led with the LPSC an application seeking certiï¬cation that the public... -

Page 44

...Louisiana's current formula rate plan. The next formula rate plan ï¬ling, for the 2011 test year, will be made in May 2012 and will include a separate identiï¬cation of any operating and maintenance expense savings that are expected to occur once the Waterford 3 steam generator replacement project... -

Page 45

...Louisiana and Texas, and to a lesser extent in Arkansas and Mississippi. The storms resulted in widespread power outages, signiï¬cant damage to distribution, transmission, and generation infrastructure, and the loss of sales during the power outages. In September 2009, Entergy Gulf States Louisiana... -

Page 46

... to 2010 Net cash used in investing activities increased $873 million in 2011 compared to 2010 primarily due to the following activity: n the purchase of the Acadia Power Plant by Entergy Louisiana for approximately $300 million in April 2011, the purchase of the Rhode Island State Energy Center... -

Page 47

... Other Uses of Capital - Dividends and Stock Repurchases" section above. R ATE , COST- RECOVERY AND OTHER REGUL ATION State and Local Rate Regulation and Fuel-Cost Recovery The rates that the Utility operating companies and System Energy charge for their services signiï¬cantly inï¬,uence Entergy... -

Page 48

... Agreement) and interstate transmission of electricity, as well as rates for System Energy's sales of capacity and energy from Grand Gulf to Entergy Arkansas, Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans pursuant to the Unit Power Sales Agreement. The Utility operating companies... -

Page 49

..., Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans ï¬led applications with their local regulators concerning their proposal to join the MISO RTO and transfer control of each company's transmission assets to the MISO RTO. Entergy Texas... -

Page 50

...it operates primarily under cost-based rate regulation. To the extent approved by their retail rate regulators, the Utility operating companies hedge the exposure to natural gas price volatility of their fuel and gas purchased for resale costs, which are recovered from customers. Entergy's commodity... -

Page 51

... of operations, or cash ï¬,ows. Entergy estimates that a $10 per MWh change in the annual average energy price in the markets in which the Entergy Wholesale Commodities nuclear business sells power, based on the respective year-end market conditions, planned generation volumes, and hedged positions... -

Page 52

... its Utility and Entergy Wholesale Commodities business units. Regulations require Entergy subsidiaries to decommission the nuclear power plants after each facility is taken out of service, and money is collected and deposited in trust funds during the facilities' operating lives in order to provide... -

Page 53

...; n Projected health care cost trend rates; n Expected long-term rate of return on plan assets; n Rate of increase in future compensation levels; n Retirement rates; and n Mortality rates. Entergy reviews the ï¬rst four assumptions listed above on an annual basis and adjusts them as... -

Page 54

... on plan assets Rate of increase in compensation (0.25%) (0.25%) 0.25% Increase/(Decrease) $17,145 $ 8,863 $ 7,503 $188,246 $ - $ 41,227 In 2011, Entergy's total qualiï¬ed pension cost was $154 million. Entergy anticipates 2012 qualiï¬ed pension cost to be $264 million. Pension funding was... -

Page 55

.... The offset was recorded in 2010 as a $16 million charge to income tax expense or, for the Utility, including each Registrant Subsidiary, as a regulatory asset. L ITI GATI ON Entergy is regularly named as a defendant in a number of lawsuits involving employment, customers, and injuries and damages... -

Page 56

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Entergy Corporation and Subsidiaries New Orleans, Louisiana We have audited the accompanying consolidated balance sheets of Entergy Corporation and Subsidiaries (the "Corporation") as of December 31, 2011 and 2010, and the related... -

Page 57

... LLP New Orleans, Louisiana February 27, 2012 INTERNAL CONTROL OVER FINANCIAL REPORTING The management of Entergy Corporation is responsible for establishing and maintaining adequate internal control over ï¬nancial reporting for Entergy. Entergy's internal control system is designed to provide... -

Page 58

...: Fuel, fuel-related expenses, and gas purchased for resale Purchased power Nuclear refueling outage expenses Other operation and maintenance Decommissioning Taxes other than income taxes Depreciation and amortization Other regulatory charges (credits) - net Total Gain on sale of business OPERATING... -

Page 59

... stock repurchases Common stock issuances in settlement of equity unit purchase contracts Common stock issuances related to stock plans Common stock dividends declared Preferred dividend requirements of subsidiaries(a) Capital stock and other expenses Adjustment for implementation of new accounting... -

Page 60

... CURRENT ASSETS 2011 2010 Cash and cash equivalents: Cash Temporary cash investments Total cash and cash equivalents Securitization recovery trust account Accounts receivable: Customer Allowance for doubtful accounts Other Accrued unbilled revenues Total accounts receivable Deferred fuel costs... -

Page 61

... 2010 Currently maturing long-term debt Notes payable Accounts payable Customer deposits Taxes accrued Accumulated deferred income taxes Interest accrued Deferred fuel costs Obligations under capital leases Pension and other postretirement liabilities System agreement cost equalization Other Total... -

Page 62

... used during construction Nuclear fuel purchases Proceeds from sale/leaseback of nuclear fuel Proceeds from sale of assets and businesses Payment for purchases of plants Insurance proceeds received for property damages Changes in transition charge account NYPA value sharing payment Payments to storm... -

Page 63

...CASH FLOW INFORMATION Cash paid (received) during the period for: Interest - net of amount capitalized Income taxes Noncash ï¬nancing activities: Long-term debt retired (equity unit notes) Common stock issued in settlement of equity unit purchase contracts See Notes to Financial Statements. $ 532... -

Page 64

...of December 31, 2011 and 2010, is shown below (in millions): Entergy Wholesale Commodities Parent & Other Revenues and Fuel Costs Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi, and Entergy Texas generate, transmit, and distribute electric power primarily to... -

Page 65

... the units to operate for the next operating cycle without having to be taken off line. Generating Stations Investment Utility Business: Entergy Arkansas Independence Unit 1 Coal Common Facilities Coal White Bluff Units 1 and 2 Coal Ouachita(2) Common Facilities Gas Entergy Gulf States Louisiana... -

Page 66

...) on investment securities in other regulatory liabilities/assets. For the portion of River Bend that is not rate-regulated, Entergy Gulf States Louisiana has recorded an offsetting amount of unrealized gains/ (losses) in other deferred credits. Decommissioning trust funds for Pilgrim, Indian Point... -

Page 67

... availability of the assets and generating units, and the future market and price for energy over the remaining life of the assets. Three nuclear power plants in the Entergy Wholesale Commodities business segment (Pilgrim, Indian Point 2 and Indian Point 3) have applications pending for renewed NRC... -

Page 68

... time as the dividends in arrears are paid. Therefore, Entergy Arkansas, Entergy Mississippi, and Entergy New Orleans present their preferred securities outstanding between liabilities and shareholders' equity on the balance sheet. Entergy Gulf States Louisiana and Entergy Louisiana, both organized... -

Page 69

... E RY Entergy Arkansas, Entergy Gulf States Louisiana, Entergy Louisiana, Entergy Mississippi, Entergy New Orleans, and Entergy Texas are allowed to recover fuel and purchased power costs through fuel mechanisms included in electric and gas rates that are recorded as fuel cost recovery revenues. The... -

Page 70

... Mississippi Entergy New Orleans (a) Entergy Texas (a) 2011 and 2010 include $100.1 million for Entergy Gulf States Louisiana, $68 million for Entergy Louisiana, and $4.1 million for Entergy New Orleans of fuel, purchased power, and capacity costs, which do not currently earn a return on investment... -

Page 71

... fuel factor to recover fuel and purchased power costs, including carrying charges, not recovered in base rates. Semi-annual revisions of the ï¬xed fuel factor are made in March and September based on the market price of natural gas and changes in fuel mix. The amounts collected under Entergy Texas... -

Page 72

...25% - 11.25% Gas n Entergy Texas 10.125% n retail base rates implemented in the July 2010 billing cycle pursuant to a settlement approved by the APSC. Current retail electric base rates implemented based on Entergy Gulf States Louisiana's 2010 test year formula rate plan ï¬ling approved by... -

Page 73

... power purchase agreement with Acadia, Entergy Gulf States Louisiana's allocation of capacity related to this unit ended, resulting in a reduction in the additional capacity revenue requirement. In May 2011, Entergy Gulf States Louisiana made its formula rate plan ï¬ling with the LPSC for the 2010... -

Page 74

... reduction and substantial realignment of Grand Gulf cost recovery from fuel to electric base rates, and a $4.95 million gas base rate increase, both effective June 1, 2009, with adjustment of the customer charges for all rate classes. A new three-year formula rate plan was also adopted, with terms... -

Page 75

... total production cost of each Utility operating company, which assumptions include the mix of solid fuel and gas-ï¬red generation available to each company and the costs of natural gas and purchased power. Entergy Louisiana, Entergy Gulf States Louisiana, Entergy Texas, and Entergy Mississippi... -

Page 76

... the Utility operating companies for 2012 (in millions): Entergy Arkansas Entergy Gulf States Louisiana Entergy Louisiana Entergy Mississippi Entergy New Orleans Entergy Texas Payments or (Receipts) $ 37 $ - $(37 The actual payments/receipts for 2012, based on calendar year 2011 production costs... -

Page 77

...operating companies, including whether the Utility operating companies had properly reï¬,ected generating units' minimum operating levels for purposes of making unit commitment and dispatch decisions, whether Entergy Arkansas's sales to third parties from its retained share of the Grand Gulf nuclear... -

Page 78

... FERC were to order Entergy Arkansas to pay refunds on rehearing in the interruptible load proceeding the APSC's decision would trap FERCapproved costs at Entergy Arkansas with no regulatory-approved mechanism to recover them. In August 2011, Entergy Arkansas ï¬led a complaint in the United States... -

Page 79

... widespread power outages, signiï¬cant damage to electric distribution, transmission, and generation and gas infrastructure, and the loss of sales and customers due to mandatory evacuations and the destruction of homes and businesses. In March 2008, Entergy Gulf States Louisiana, Entergy Louisiana... -

Page 80

... 2011 in connection with planning, evaluation, monitoring, and other and related generation resource development activities for new nuclear generation at Grand Gulf. The costs shall be treated as a regulatory asset until the proceeding is resolved. The Mississippi Public Utilities Staff and Entergy... -

Page 81

...net (430,807) Power purchase agreements (17,138) Nuclear decommissioning trusts (553,558) Other (686,006) Total (9,037,499) Deferred tax assets: Accumulated deferred investment tax credit 108,338 Pension and other post-employment beneï¬ts 315,134 Nuclear decommissioning liabilities 612,945 Sale and... -

Page 82

..., if any, related to unrecognized tax beneï¬ts in income tax expense. Entergy's December 31, 2011, 2010, and 2009 accrued balance for the possible payment of interest is approximately $99 million, $45 million, and $48 million, respectively. decision to the United States Court of Appeals for the... -

Page 83

... for Entergy Mississippi, $45 million for Entergy Texas, $13 million for Entergy New Orleans, and $180 million for System Energy. During the second quarter 2011, Entergy ï¬led an Application for Change in Accounting Method with the IRS related to the allocation of overhead costs between production... -

Page 84

...fuel expense. In February 2012, System Energy VIE issued $50 million of 4.02% Series H notes due February 2017. System Energy used the proceeds to purchase additional nuclear fuel. Entergy Arkansas Entergy Gulf States Louisiana Entergy Louisiana Entergy Mississippi Entergy New Orleans Entergy Texas... -

Page 85

... April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric power with nuclear fuel prior to that date and includes the one-time fee, plus accrued interest, in long-term debt. (d) See Note 10 for further discussion of the Waterford 3 and Grand Gulf Lease Obligations. (e) The... -

Page 86

... of 1.875% Series ï¬rst mortgage bonds due December 2014. Entergy Louisiana used the proceeds to repay short-term borrowings under the Entergy System money pool. In November 2000, Entergy's non-utility nuclear business purchased the FitzPatrick and Indian Point 3 power plants in a seller-ï¬nanced... -

Page 87

... all of the scheduled principal payments for 2013-2016 are for Tranche A-2. With the proceeds, Entergy Gulf States Reconstruction Funding purchased from Entergy Texas the transition property, which is the right to recover from customers through a transition charge amounts sufï¬cient to service the... -

Page 88

...the related company (dollars in thousands): Shares/Units Authorized 2011 Entergy Corporation Utility: Preferred Stock or Preferred Membership Interests without sinking fund: Entergy Arkansas, 4.32% - 6.45% Series 3,413,500 Entergy Gulf States Louisiana, Series A 8.25% 100,000 Entergy Louisiana, 6.95... -

Page 89

... indentures, Entergy Arkansas and Entergy Mississippi had retained earnings unavailable for distribution to Entergy Corporation of $394.9 million and $68.5 million, respectively. Entergy Corporation received dividend payments from subsidiaries totaling $595 million in 2011, $580 million in 2010, and... -

Page 90

... to Entergy Louisiana, current production projections would require estimated payments of approximately $172.1 million in 2012, and a total of $2.5 billion for the years 2013 through 2031. Entergy Louisiana currently recovers the costs of the purchased energy through its fuel adjustment clause... -

Page 91

... April 1, 2011, the maximum amounts of such possible assessments per occurrence were as follows (in millions): Utility: Entergy Arkansas Entergy Gulf States Louisiana Entergy Louisiana Entergy Mississippi Entergy New Orleans Entergy Texas System Energy Entergy Wholesale Commodities $20.1 $16... -

Page 92

... incurred removal costs and estimated removal costs recovered in rates (in millions): December 31, Entergy Arkansas Entergy Gulf States Louisiana Entergy Louisiana Entergy Mississippi Entergy New Orleans Entergy Texas System Energy 2011 $(16.4) $(30.3) $(62.6) $ 48.5 $ 16.3 $ 4.5 $ 11.8 2010 $(24... -

Page 93

...): Change Liabilities in Cash as of Dec. Flow 31, 2010 Accretion Estimate Liabilities as of Dec. 31, 2011 Spending Utility: Entergy Arkansas Entergy Gulf States Louisiana Entergy Louisiana Entergy Mississippi Entergy New Orleans Entergy Texas System Energy Entergy Wholesale Commodities $ 602... -

Page 94

... 31, 2011, Entergy Louisiana had future minimum lease payments (reï¬,ecting an overall implicit rate of 7.45%) in connection with the Waterford 3 sale and leaseback transactions, which are recorded as long-term debt, as follows (in thousands): 2012 2013 2014 2015 2016 Years thereafter Total Less... -

Page 95

... of the plans include common and preferred stocks, ï¬xed-income securities, interest in a money market fund, and insurance contracts. The Registrant Subsidiaries' pension costs are recovered from customers as a component of cost of service in each of their respective jurisdictions. Total recognized... -

Page 96

... Arkansas, Entergy Mississippi, Entergy New Orleans, Entergy Texas, and System Energy contribute the other postretirement beneï¬t costs collected in rates into external trusts. System Energy is funding, on behalf of Entergy Operations, other postretirement beneï¬ts associated with Grand Gulf... -

Page 97

... employees. Entergy recognized net periodic pension cost related to these plans of $24 million in 2011, $27.2 million in 2010, and $23.6 million in 2009. In 2011, 2010 and 2009 Entergy recognized $4.6 million, $9.3 million and $6.7 million, respectively in settlement charges related to the payment... -

Page 98

... for the qualiï¬ed pension and other postretirement plans measured at fair value on a recurring basis at December 31, 2011 and December 31, 2010 (in thousands): Qualiï¬ed Pension Trust 2011 Level 1 Level 2 Level 3 Total C ONCENTRATIONS OF C REDIT R ISK Entergy's investment guidelines mandate the... -

Page 99

Entergy Corporation and Subsidiaries 2011 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued Qualiï¬ed Pension Trust 2010 Level 1 Level 2 Level 3 Total Other Postretirement Trusts 2010 Level 1 Level 2 Level 3 Total Equity securities: Corporate stocks: Preferred $ - $ 8,354(a) (b) Common 1,375,... -

Page 100

...ï¬ed pension Weighted-average rate of increase in future compensation levels 5.10% - 5.20% 5.10% 4.40% 4.23% 2010 5.60% - 5.70% 5.50% 4.90% 4.23% Deï¬ned Contribution Plans Entergy sponsors the Savings Plan of Entergy Corporation and Subsidiaries (System Savings Plan). The System Savings Plan is... -

Page 101

... cost capitalized as part of ï¬xed assets and inventory $10.4 $ 4.0 $ 2.0 2010 $15.0 $ 5.8 $ 2.9 2009 $16.8 $ 6.5 $ 3.2 Stock price volatility Expected term in years Risk-free interest rate Dividend yield Dividend payment per share Entergy determines the fair value of the stock option grants... -

Page 102

... grants long-term incentive awards earned under its stock beneï¬t plans in the form of performance units, which are equal to the cash value of shares of Entergy Corporation common stock at the end of the performance period, which is the last trading day of the year. Performance units will pay... -

Page 103

...SEGMENT INFORMATION Entergy's reportable segments as of December 31, 2011 are Utility and Entergy Wholesale Commodities. Utility includes the generation, transmission, distribution, and sale of electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, and natural gas utility service... -

Page 104

... R In December 2011 a subsidiary in the Entergy Wholesale Commodities business segment purchased the Rhode Island State Energy Center, a 583 MW natural gas-ï¬red combined-cycle generating plant located in Johnston, Rhode Island, from a subsidiary of NextEra Energy Resources, for approximately $346... -

Page 105

... Utility, Entergy Wholesale Commodities Entergy Wholesale Commodities Entergy manages fuel price volatility for its Louisiana jurisdictions (Entergy Gulf States Louisiana, Entergy Louisiana, and Entergy New Orleans) and Entergy Mississippi primarily through the purchase of short-term natural gas... -

Page 106

... portion) $197 $112 $(25) $(1) Entergy Wholesale Commodities Entergy Wholesale Commodities Balance Sheet Location Fair Value(a) Offset(a) Business Derivatives not designated as hedging instruments Assets: Electricity forwards, swaps, and options Electricity forwards, swaps, and options Liabilities... -

Page 107

... used to manage fuel price volatility for the Utility's Louisiana and Mississippi customers. All beneï¬ts or costs of the program are recorded in fuel costs. The total volume of natural gas swaps outstanding as of December 31, 2011 is 37,980,000 MMBtu for Entergy. Credit support for these natural... -

Page 108

...as cash ï¬,ow hedges of power sales at merchant power plants. The values for the cash ï¬,ow hedges that are recorded as derivative contract assets or liabilities are based on both observable inputs including public market prices and unobservable inputs such as model-generated prices for longer-term... -

Page 109

... TRUST FUNDS Entergy holds debt and equity securities, classified as availablefor-sale, in nuclear decommissioning trust accounts. The NRC requires Entergy subsidiaries to maintain trusts to fund the costs of decommissioning ANO 1, ANO 2, River Bend, Waterford 3, Grand Gulf, Pilgrim, Indian Point... -

Page 110

... More than 12 months Total The unrealized losses in excess of twelve months on equity securities above relate to Entergy's Utility operating companies and System Energy. The fair value of debt securities, summarized by contractual maturities, as of December 31, 2011 and 2010 are as follows (in... -

Page 111

...to provide ï¬nancial support apart from their scheduled lease payments. See Note 4 to the ï¬nancial statements for details of the nuclear fuel companies' credit facility and commercial paper borrowings and long-term debt that are reported by Entergy, Entergy Arkansas, Entergy Gulf States Louisiana... -

Page 112

... FINANCIAL STATEMENTS concluded Entergy Louisiana and System Energy are also considered to each hold a variable interest in the lessors from which they lease undivided interests representing approximately 9.3% of the Waterford 3 and 11.5% of the Grand Gulf nuclear plants, respectively. Entergy... -

Page 113

... without charge by calling 1-888-ENTERGY or writing to: Entergy Corporation Investor Relations P.O. Box 61000 New Orleans, LA 70161 INSTITUTIONAL INVESTOR INQUIRIES Securities analysts and representatives of financial institutions may contact Paula Waters, Vice President, Investor Relations at... -

Page 114

...Vice President, Human Resources and Administration. Joined Entergy in 1999. Former President of Cincinnati Gas and Electric Company. Age, 54 Stewart C. Myers Robert C. Merton (1970) Professor of Financial Economics, MIT Sloan School of Management, Cambridge, Massachusetts. An Entergy director since... -

Page 115

Board of Directors Maureen S. Bateman Gary W. Edwards Alexis M. Herman Donald C. Hintz J. Wayne Leonard Stuart L. Levenick Blanche L. Lincoln Stewart C. Myers William A. Percy, II W. J. "Billy" Tauzin Steven V. Wilkinson -

Page 116

..., Entergy Corporation saved the following resources: Trees Water Energy Solid Waste CO 2 Equiv. Emissions 2,166 Trees 989,926 Gallons 685 Million BTUs 60,103 Pounds 205,540 Pounds Environmental impact estimates were made using the Environmental Defense Fund Paper Calculator. For more information...