Entergy 2003 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

ENTERGY CORPORATION AND SUBSIDIARIES 2003

85

In accordance with the partnership agreement, Entergy

contributed $72.7 million to Entergy-Koch in January 2004.

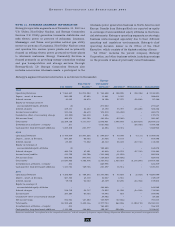

The following is a summary of combined financial

information reported by Entergy’s equity method investees

(in thousands):

2003 2002 2001

Income Statement Items

Operating revenues $ 585,404 $ 551,853 $693,400

Operating income $ 207,301 $ 159,342 $309,752

Net income $ 172,595 $ 68,095 $226,039

Balance Sheet Items

Current assets $2,576,630 $2,334,133

Noncurrent assets $1,675,334 $1,490,355

Current liabilities $1,757,663 $1,782,385

Noncurrent liabilities $1,166,540 $ 729,817

Two of the unconsolidated 50/50 joint ventures, Entergy-

Koch and RS Cogen, have obtained debt financing for their

operations. As of December 31, 2003, the debt financing

outstanding for those two entities totals $773.8 million,

which is included in the liability figures given above. This

debt is nonrecourse to Entergy.

RELATED-PARTY TRANSACTIONS AND GUARANTEES

During 2003, 2002, and 2001, Entergy procured various

services from Entergy-Koch consisting primarily of

pipeline transportation services for natural gas and risk

management services for electricity and natural gas. The

total cost of such services in 2003, 2002, and 2001 was

approximately $15.9 million, $11.2 million, and $7.8 million,

respectively. In 2003, Entergy Louisiana and Entergy New

Orleans entered purchase power agreements with RS

Cogen, and purchased a total of $26.0 million of capacity

and energy from RS Cogen in 2003. Entergy’s operating

transactions with its other equity method investees were

not material in 2003, 2002, or 2001.

EntergyShaw constructed the Harrison County project

for Entergy that was completed in 2003. Entergy guaran-

teed EntergyShaw’s obligation to construct the plant until

approximately June 2004. Entergy’s maximum liability on

the guarantee is $232.5 million.

RS Cogen has an interest rate swap agreement that

hedges the interest rate on a portion of its debt. Entergy

guaranteed RS Cogen’s obligations under the interest

rate swap agreement. The guarantee is in the amount of

$16.5 million and terminates in October 2017.

NOTE 14. ACQUISITIONS AND

DISPOSITIONS

ASSET ACQUISITIONS

Vermont Yankee

In July 2002, Entergy’s Non-Utility Nuclear business

purchased the 510 MW Vermont Yankee nuclear power

plant located in Vernon, Vermont, from Vermont Yankee

Nuclear Power Corporation for $180 million. Entergy

received the plant, nuclear fuel, inventories, and related real

estate. The liability to decommission the plant, as well as

related decommissioning trust funds of approximately

$310 million, was also transferred to Entergy. The acquisition

included a 10-year power purchase agreement (PPA) under

which the former owners will buy the power produced by

the plant, which is through the expiration of the current

operating license for the plant. The PPA includes an adjust-

ment clause which provides that the prices specified in the

PPA will be adjusted downward annually, beginning in

2006, if power market prices drop below the PPA prices.

The acquisition was accounted for using the purchase

method. The results of operations of Vermont Yankee subse-

quent to the purchase date have been included in Entergy’s

consolidated results of operations. The purchase price has

been allocated to the assets acquired and liabilities assumed

based on their estimated fair values on the purchase date.

Indian Point 2

In September 2001, Entergy’s Non-Utility Nuclear business

acquired the 970 MW Indian Point 2 nuclear power plant

located in Westchester County, New York from Consolidated

Edison. Entergy paid approximately $600 million in cash at

the closing of the purchase and received the plant, nuclear

fuel, materials and supplies, a PPA, and assumed certain

liabilities. On the second anniversary of the Indian Point 2

acquisition, Entergy’s nuclear business will also begin to

pay NYPA $10 million per year for up to 10 years in accor-

dance with the Indian Point 3 purchase agreement. Under

the PPA, Consolidated Edison will purchase 100% of Indian

Point 2’s output through 2004. Consolidated Edison trans-

ferred a $430 million decommissioning trust fund, along

with the liability to decommission Indian Point 2 and Indian

Point 1, to Entergy. Entergy acquired Indian Point 1 in the

transaction, a plant that has been shut down and in safe

storage since the 1970s.

The acquisition was accounted for using the purchase

method. The results of operations of Indian Point 2 subse-

quent to the purchase date have been included in Entergy’s

consolidated results of operations. The purchase price has

been allocated to the acquired assets, including identifiable

intangible assets, and liabilities assumed based on their

estimated fair values on the purchase date. Intangible

assets are being amortized straight-line over the remaining

life of the plant.