Entergy 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

ENTERGY CORPORATION AND SUBSIDIARIES 2003

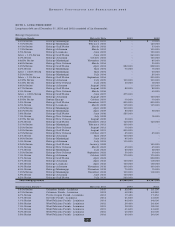

The annual long-term debt maturities (excluding lease

obligations) for debt outstanding as of December 31, 2003,

for the next five years are as follows (in thousands):

2004 2005 2006 2007 2008

$503,215 $462,420 $75,896 $624,539 $941,625

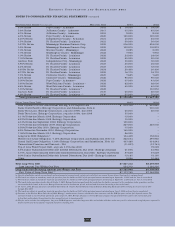

In November 2000, Entergy’s Non-Utility Nuclear busi-

ness purchased the FitzPatrick and Indian Point 3 power

plants in a seller-financed transaction. Entergy issued notes

to New York Power Authority (NYPA) with seven annual

installments of approximately $108 million commencing

one year from the date of the closing, and eight annual

installments of $20 million commencing eight years from

the date of the closing. These notes do not have a stated

interest rate, but have an implicit interest rate of 4.8%. In

accordance with the purchase agreement with NYPA, the

purchase of Indian Point 2 resulted in Entergy’s Non-Utility

Nuclear business becoming liable to NYPA for an additional

$10 million per year for 10 years, beginning in September

2003. This liability was recorded upon the purchase of

Indian Point 2 in September 2001, and is included in the

note payable to NYPA balance above. In July 2003, a

payment of $102 million was made prior to maturity on

the note payable to NYPA. Under a provision in a letter of

credit supporting these notes, if certain of the domestic

utility companies or System Energy were to default on

other indebtedness, Entergy could be required to post

collateral to support the letter of credit.

Covenants in the Entergy Corporation notes require it to

maintain a consolidated debt ratio of 65% or less of its total

capitalization. If Entergy’s debt ratio exceeds this limit, or if

Entergy or certain of the domestic utility companies default

on other indebtedness or are in bankruptcy or insolvency

proceedings, an acceleration of the notes’ maturity dates

may occur.

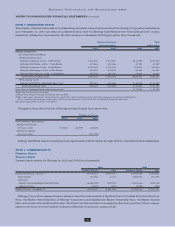

CAPITAL FUNDS AGREEMENT

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with

sufficient capital to:

maintain System Energy’s equity capital at a minimum

of 35% of its total capitalization (excluding short-term

debt);

permit the continued commercial operation of Grand

Gulf 1;

pay in full all System Energy indebtedness for borrowed

money when due; and

enable System Energy to make payments on specific

System Energy debt, under supplements to the

agreement assigning System Energy’s rights in

the agreement as security for the specific debt.

NOTE 6. COMPANY-OBLIGATED REDEEMABLE

PREFERRED SECURITIES

Entergy implemented Financial Accounting Standards

Board (FASB) Interpretation No. 46, “Consolidation of

Variable Interest Entities” effective December 31, 2003. FIN

46 requires existing unconsolidated variable interest

entities to be consolidated by their primary beneficiaries if

the entities do not effectively disperse risks among their

investors. Variable interest entities (VIEs), generally, are

entities that do not have sufficient equity to permit the

entity to finance its operations without additional financial

support from its equity interest holders and/or the group of

equity interest holders are collectively not able to exercise

control over the entity. The primary beneficiary is the party

that absorbs a majority of the entity’s expected losses,

receives a majority of its expected residual returns, or both

as a result of holding the variable interest. A company may

have an interest in a VIE through ownership or other

contractual rights or obligations.

Entergy Louisiana Capital I, Entergy Arkansas Capital I,

and Entergy Gulf States Capital I (Trusts) were established

as financing subsidiaries of Entergy Louisiana, Entergy

Arkansas, and Entergy Gulf States, respectively, (the parent

company or companies, collectively) for the purposes of

issuing common and preferred securities. The Trusts issued

Cumulative Quarterly Income Preferred Securities

(Preferred Securities) to the public and issued common

securities to their parent companies. Proceeds from such

issues were used to purchase junior subordinated

deferrable interest debentures (Debentures) from the parent

company. The Debentures held by each Trust are its only

assets. Each Trust uses interest payments received on the

Debentures owned by it to make cash distributions on the

Preferred Securities and common securities. The parent

companies fully and unconditionally guaranteed payment

of distributions on the Preferred Securities issued by the

respective Trusts. Prior to the application of FIN 46, each

parent company consolidated its interest in its Trust.

Because each parent company’s share of expected losses of

its Trust is limited to its investment in its Trust, the parent

companies are not considered the primary beneficiaries and

therefore de-consolidated their interest in the Trusts upon

application of FIN 46 with no significant impacts to the

financial statements. The parent companies’ investment in

the Trusts and the Debentures issued by each parent company

are included in Other Property and Investments and Long-

Term Debt, respectively. The financial statements as of

December 31, 2002 have been reclassified to reflect the appli-

cation of FIN 46 as of that date.