Entergy 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In January 2004, EKT reached a settlement with the CFTC relating to its investigation. The CFTC

filed an order citing EKT for reporting false price information. The company agreed to pay a civil

penalty of $3 million without admitting or denying the findings. There were no charges of price

manipulation or wash trading filed against the company. The CFTC has notified EKT that this

settlement concludes the issues that were the subject of their investigation.

Goals and Measures of Future Performance

Entergy will grow its dividend annually consistent with progress toward achievement of our

financial aspirations. Our key aspirations are:

to achieve a return of 9 percent on average invested capital in the near term, and 10 percent in

the long term;

to maintain near-term earnings growth of 8-10 percent, comprised of 6 percent intrinsic growth

and 2-4 percent growth from asset acquisitions, and long-term growth of 5-6 percent, equal to

top-quartile industry growth over the last 20 years; and

to earn a single A credit rating over the long term by maintaining or improving our 45-50

percent net debt to net capital ratio and 4 times or better interest coverage.

Entergy is developing multiple business plans and scenarios to ensure that we can meet our

growth targets in a variety of different futures. One way to look at this is to consider different

operational achievements that could generate an additional 1 percent growth in earnings. Just a

few examples include: increasing utility ROE by 20 basis points, reducing nuclear operation and

maintenance expenses by 50 cents per MWh, completing a nuclear power uprate of 50 MW, signing

an operating contract with a nuclear plant owner, or signing contracts to manage power and gas

assets. The more we can get done, the more earnings growth we achieve.

In addition, we can improve capital productivity by redeploying capital into high-performance

investments. We project more than $3 billion of cash to be available through the end of 2006 for

new investments, debt/equity repayments, and/or dividend increases. Our acquisition priorities

have not changed. They are: gas pipelines and gas storage; nuclear generating plants and fossil

plants which can be used to meet the needs of our utility customers.

We determine the optimal capital structure for Entergy to best manage financial risk, given the

company’s overall business risk. In our judgment, the optimal debt ratio lies in the range of 45 to 50

percent, given our risk profile and the opportunities we see on the horizon. As we develop forecasts

that indicate we could well get outside that range, we begin implementing strategies to make sure

that doesn’t continue for long periods, lest we destroy shareholder value.

ENTERGY CORPORATION AND SUBSIDIARIES 2003

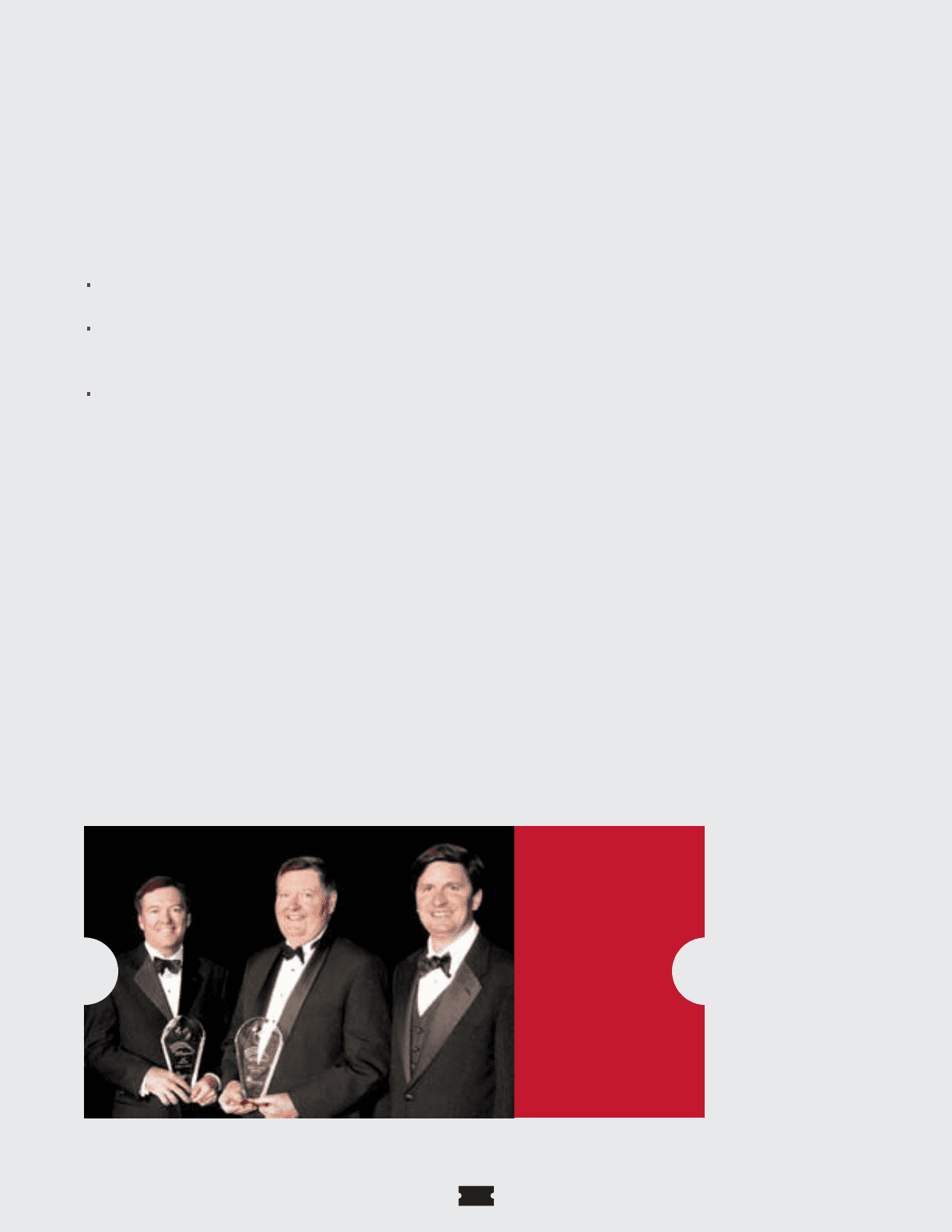

Entergy officers Wayne

Leonard, Don Hintz, and

Curt Hébert gather at the

Platts/

BusinessWeek

Global Energy Awards

in December 2003,

with awards presented

to Entergy as the Global

Energy Company of the Year,

and to Leonard as the energy

industry’s CEO of the Year.

5