Entergy 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

ENTERGY CORPORATION AND SUBSIDIARIES 2003

APSC that the investment in the replacement is in the

public interest analogous to the order received in 1998

prior to the replacement of the Arkansas Nuclear One

Unit 2 (ANO 2) steam generators. The APSC found that

the replacement is in the public interest in a declaratory

order issued in May 2003.

Purchase of the Perryville power plant in Louisiana. In

January 2004, Entergy Louisiana signed an agreement

to acquire the 718 MW Perryville power plant for

$170 million. The plant is owned by a subsidiary of

Cleco Corporation, which subsidiary submitted a bid in

response to Entergy’s Fall 2002 request for proposals

for supply-side resources. The signing of the agreement

followed a voluntary Chapter 11 bankruptcy filing by

the plant’s owner. Entergy expects that Entergy

Louisiana will own 100 percent of the Perryville plant,

and that Entergy Louisiana will sell 75 percent of the

output to Entergy Gulf States under a long-term cost-of-

service purchased power agreement. The purchase of

the plant, expected to be completed by December 2004,

is contingent upon obtaining necessary approvals from

the bankruptcy court and from state and federal

regulators, including approval of full cost recovery,

giving consideration to the need for the power and the

prudence of Entergy Louisiana and Entergy Gulf States

for engaging in the transaction. In addition, Entergy

Louisiana and Entergy Gulf States executed a purchased

power agreement with the plant’s owner through the

date of the acquisition’s closing (as long as that occurs

by September 2005) for 100 percent of the output of the

Perryville plant.

Nuclear power plant uprates.

Entergy’s obligation in the Energy Commodity Services

business to make a $72.7 million cash contribution to

Entergy-Koch in January 2004. Entergy made the

contribution on January 2, 2004.

From time to time, Entergy considers other capital invest-

ments as potentially being necessary or desirable in the

future, including additional nuclear plant power uprates,

generation supply assets, various transmission upgrades,

environmental compliance expenditures or investments in

new businesses or assets. Because no contractual obligation

or commitment exists to pursue these investments, they are

not included in Entergy’s planned construction and capital

investments. These potential investments are also subject

to evaluation and approval in accordance with Entergy’s

policies before amounts may be spent. In addition, Entergy’s

capital spending plans do not include spending for trans-

mission upgrades requested by merchant generators, other

than projects currently underway, because Entergy’s

contracts with the generators require the generators to

fund the upgrades, which Entergy then repays through

credits against billings to the generators.

Estimated capital expenditures are subject to periodic

review and modification and may vary based on the

ongoing effects of business restructuring, regulatory

constraints, environmental regulations, business opportu-

nities, market volatility, economic trends, and the ability to

access capital.

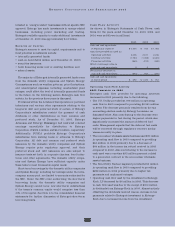

Dividends and Stock Repurchases

Declarations of dividends on Entergy’s common stock are

made at the discretion of the Board. Among other things,

the Board evaluates the level of Entergy’s common stock

dividends based upon Entergy’s earnings, financial

strength, and future investment opportunities. At its July

2003 meeting, the Board increased Entergy’s quarterly

dividend per share by 29%, to $0.45. Entergy expects the

next review of a potential dividend increase will occur

in October 2004. Given the current number of Entergy

common shares outstanding, Entergy expects the July

2003 dividend increase to result in an incremental annual

increase in cash used of approximately $90 million. In

2003, Entergy paid $363 million in cash dividends on its

common stock.

In accordance with Entergy’s stock option plans, Entergy

periodically grants stock options to its employees, which

may be exercised to obtain shares of Entergy’s common

stock. According to the plans, these shares can be newly

issued shares, treasury stock, or shares purchased on the

open market. Entergy’s management has been authorized

to repurchase on the open market shares up to an amount

sufficient to fund the exercise of grants under the plans. In

2003, Entergy repurchased 155,000 shares of common

stock for a total purchase price of $8.1 million.

Public Utility Holding Company Act (PUHCA)

Restrictions on Uses of Capital

Entergy’s ability to invest in electric wholesale generators

and foreign utility companies is subject to the SEC’s regula-

tions under PUHCA. As authorized by the SEC, Entergy is

allowed to invest earnings in electric wholesale generators

and foreign utility companies in an amount equal to 100%

of its average consolidated retained earnings. As of

December 31, 2003, Entergy’s investments subject to this

rule totaled $2.59 billion constituting 58.3% of Entergy’s

average consolidated retained earnings.

Entergy’s ability to guarantee obligations of Entergy’s

non-utility subsidiaries is also limited by Securities and

Exchange (SEC) regulations under PUHCA. In August

2000, the SEC issued an order, effective through December

31, 2005, that allows Entergy to issue up to $2 billion of

guarantees for the benefit of its non-utility companies.

Entergy currently has sufficient capacity under this order

for its foreseeable needs.

Under PUHCA, the SEC imposes a limit equal to 15% of

consolidated capitalization on the amount that may be

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS

continued