Entergy 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

ENTERGY CORPORATION AND SUBSIDIARIES 2003

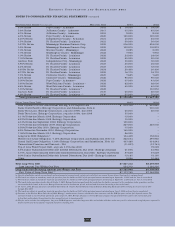

OTHER POSTRETIREMENT BENEFIT OBLIGATIONS,

PLAN ASSETS, FUNDED STATUS, AND AMOUNTS

NOT YET RECOGNIZED AND RECOGNIZED IN THE

BALANCE SHEET AS OF DECEMBER 31, 2003

AND 2002 (IN THOUSANDS):

2003 2002

Change in APBO

Balance at beginning of year $ 799,506 $ 590,731

Service cost 37,799 29,199

Interest cost 52,746 44,819

Actuarial loss 115,966 159,143

Benefits paid (48,379) (35,861)

Plan amendments (a) (84,722) –

Plan participant contributions 7,074 –

Curtailment 56,369 –

Special termination benefits 5,444 –

Acquisition of subsidiary – 11,475

Balance at end of year $ 941,803 $ 799,506

Change in Plan Assets

Fair value of assets at

beginning of year $ 182,692 $ 158,190

Actual return on plan assets 22,794 (11,559)

Employer contributions 63,265 59,542

Plan participant contributions 7,074 –

Benefits paid (48,379) (35,861)

Acquisition of subsidiary – 12,380

Fair value of assets

at end of year $ 227,446 $ 182,692

Funded status $(714,357) $(616,814)

Amounts not yet recognized

in the balance sheet:

Unrecognized transition obligation 44,815 114,724

Unrecognized prior service cost (20,746) 3,522

Unrecognized net loss 336,005 245,795

Accrued other postretirement benefit

cost recognized in the balance sheet $(354,283) $(252,773)

(a) Reflects plan design changes, including a change in the participation assumption for

non-bargaining employees effective August 1, 2003.

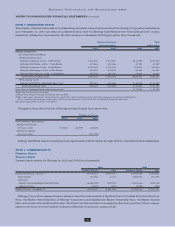

PENSION AND OTHER POSTRETIREMENT

PLANS’ ASSETS

Entergy’s pension and postretirement plans weighted-

average asset allocations by asset category at December 31,

2003 and 2002 are as follows:

Pension Postretirement

2003 2002 2003 2002

Domestic Equity Securities 56% 50% 37% 34%

International Equity Securities 14% 10% – 1%

Fixed Income Securities 28% 37% 60% 64%

Other 2% 3% 3% 1%

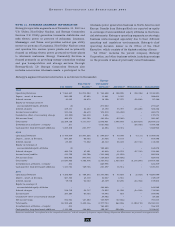

Entergy’s trust asset investment strategy is to invest the

assets in a manner whereby long-term earnings on the

assets (plus cash contributions) provide adequate funding

for retiree benefit payments. Adequate funding is described

as a 90% confidence that assets equal or exceed liabilities

due five years in the future, and a corresponding 75%

confidence level ten years out. The mix of assets is based on

an optimization study that identifies asset allocation targets

in order to achieve the maximum return for an acceptable

level of risk while minimizing the expected contributions

and pension and postretirement expense.

To perform such an optimization study, Entergy first makes

assumptions about certain market characteristics, such as

expected asset class investment returns, volatility (risk) and

correlation coefficients among the various asset classes.

Entergy does so by examining (or hiring a consultant to

provide such analysis) historical market characteristics of the

various asset classes over all of the different economic

conditions that have existed. Entergy then examines and

projects the economic conditions expected to prevail over the

study period. Finally, the historical characteristics to reflect

the expected future conditions are adjusted to produce the

market characteristics that will be assumed in the study.

The optimization analysis utilized in Entergy’s latest

study produced the following approved asset class target

allocations.

Pension Postretirement

Domestic Equity Securities 54% 37%

International Equity Securities 12% 8%

Fixed Income Securities 30% 55%

Other (Cash and GACs) 4% –

These allocation percentages combined with each asset

class’ expected investment return produced an aggregate

return expectation of 9.59% for pension assets, 5.45% for

taxable postretirement assets, and 7.19% for non-taxable

postretirement assets. These returns are consistent with

Entergy’s disclosed expected return on assets of 8.75% (non-

taxable assets) and 5.5% (taxable assets).

Since precise allocation targets are inefficient to manage

security investments, the following ranges were established

to produce an acceptable economically efficient plan to

manage to targets:

Pension Postretirement

Domestic Equity Securities 49% to 59% 32% to 42%

International Equity Securities 7% to 17% 3% to 12%

Fixed Income Securities 25% to 35% 50% to 60%

Other 0% to 10% 0% to 5%

ACCUMULATED PENSION BENEFIT OBLIGATION

The accumulated benefit obligation for Entergy’s pension

plans was $2.1 billion and $1.7 billion at December 31, 2003

and 2002, respectively.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

continued