Entergy 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

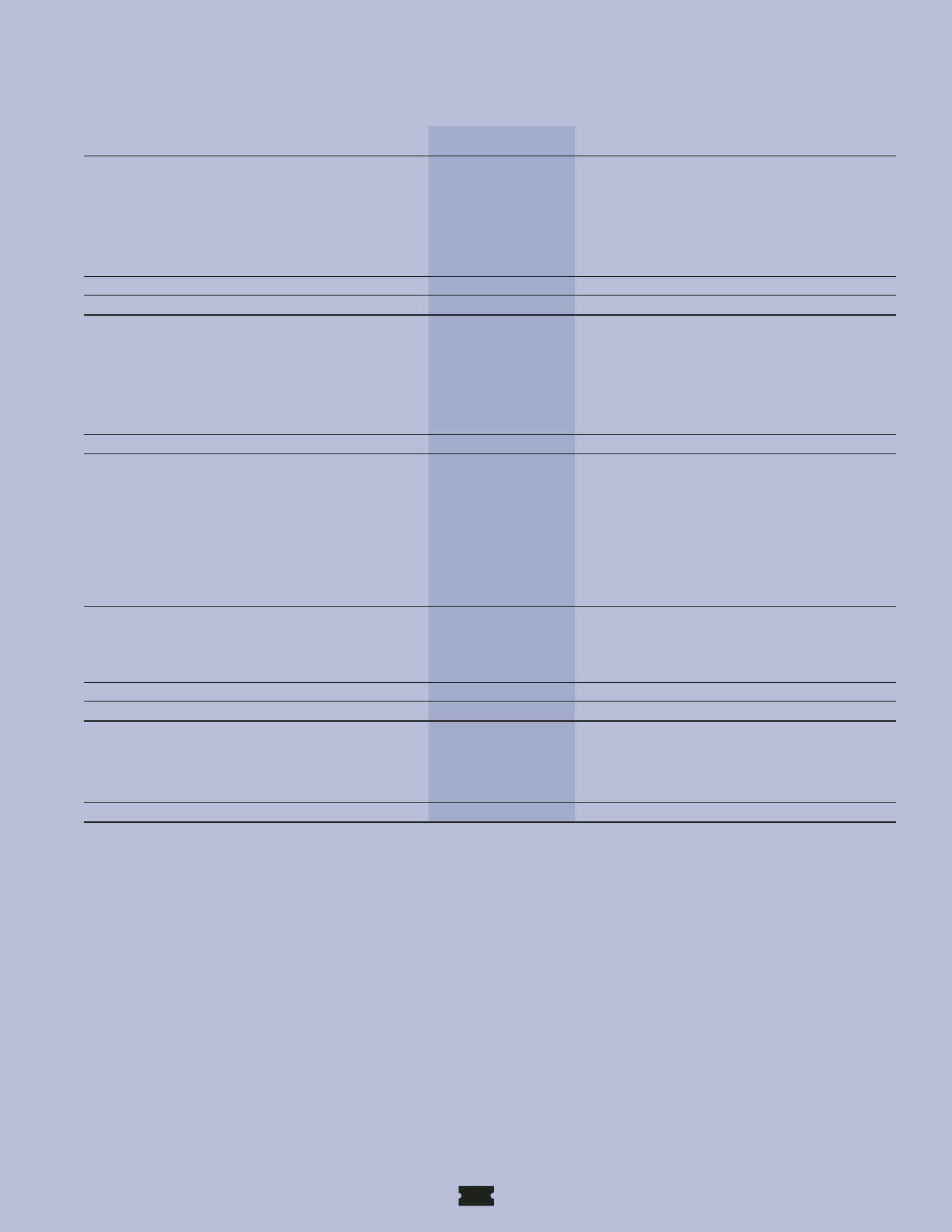

ENTERGY CORPORATION AND SUBSIDIARIES 2003

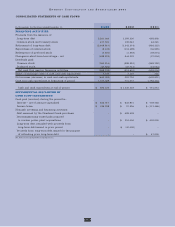

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS, COMPREHENSIVE INCOME, AND PAID-IN CAPITAL

In thousands, for the years ended December 31, 2003 2002 2001

RETAINED EARNINGS

Retained Earnings – Beginning of period $3,938,693 $3,638,448 $3,190,639

Add: Earnings applicable to common stock 926,943 $926,943 599,360 $599,360 726,196 $726,196

Deduct:

Dividends declared on common stock 362,941 299,031 278,342

Capital stock and other expenses 187 84 45

Total 363,128 299,115 278,387

Retained Earnings – End of period $4,502,508 $3,938,693 $3,638,448

ACCUMULATED OTHER

COMPREHENSIVE INCOME (LOSS) (NET OF TAXES):

Balance at beginning of period:

Accumulated derivative instrument

fair value changes $ 17,313 $ (17,973) $ –

Other accumulated comprehensive (loss) items (39,673) (70,821) (75,033)

Total (22,360) (88,794) (75,033)

Cumulative effect to January 1, 2001

of accounting change regarding

fair value of derivative instruments – – (18,021)

Net derivative instrument fair value

changes arising during the period (43,124) (43,124) 35,286 35,286 48 48

Foreign currency translation adjustments 4,169 4,169 65,948 (15,487) 4,615 4,615

Minimum pension liability adjustment 1,153 1,153 (10,489) (10,489) – –

Net unrealized investment gains (losses) 52,367 52,367 (24,311) (24,311) (403) (403)

Balance at end of period:

Accumulated derivative

instrument fair value changes (25,811) 17,313 (17,973)

Other accumulated comprehensive income (loss) items 18,016 (39,673) (70,821)

Total $ (7,795) $ (22,360) $ (88,794)

Comprehensive Income $941,508 $584,359 $730,456

PAID-IN CAPITAL

Paid-in Capital – Beginning of period $4,666,753 $4,662,704 $4,660,483

Add:

Common stock issuances related to stock plans 100,862 4,049 2,221

Paid-in Capital – End of period $4,767,615 $4,666,753 $4,662,704

See Notes to Consolidated Financial Statements.