Entergy 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

ENTERGY CORPORATION AND SUBSIDIARIES 2003

Operating Lease Obligations and Guarantees of

Unconsolidated Obligations

In addition to the obligations listed above that are reflected

on the balance sheet, Entergy has a minimal amount of

operating leases and guarantees in support of unconsolidated

obligations that are not reflected as liabilities on the balance

sheet. These items are not on the balance sheet in accor-

dance with generally accepted accounting principles.

Following are Entergy’s payment obligations as of

December 31, 2003 on non-cancelable operating leases with

a term over one year (in millions):

2007- after

2004 2005 2006 2008 2008

Operating lease payments $99 $89 $70 $93 $245

The operating leases are discussed more thoroughly in Note 10

to the consolidated financial statements.

Entergy’s guarantees of unconsolidated obligations out-

standing as of December 31, 2003 total a maximum amount

of $249 million, detailed as follows:

In August 2001, EntergyShaw entered into a turnkey

construction agreement with an Entergy subsidiary,

Entergy Power Ventures, L.P. (EPV), and with Northeast

Texas Electric Cooperative, Inc. (NTEC), providing for

the construction by EntergyShaw of a 550 MW electric

generating station to be located in Harrison County,

Texas. Entergy has guaranteed the obligations of

EntergyShaw to construct the plant, which is 70%

owned by EPV. Entergy’s maximum liability on the

guarantee is $232.5 million, and the guarantee is

expected to remain outstanding through June 2004.

RS Cogen has an interest rate swap agreement that

hedges the interest rate on a portion of its debt. Entergy

guaranteed RS Cogen’s obligations under the interest

rate swap agreement. The guarantee is for $16.5 million

and terminates in October 2017.

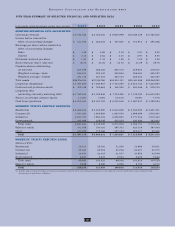

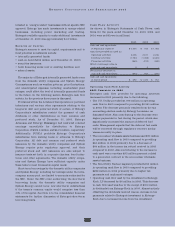

Summary of Contractual Obligations

of Consolidated Entities (in millions)

2005- 2007- after

Contractual Obligations 2004 2006 2008 2008 Total

Long-term debt (1) $524 $ 591 $1,626 $5,106 $7,847

Capital lease obligations (2) $165 $ 148 $ 5 $ 3 $ 321

Operating leases (2) $ 99 $ 159 $ 93 $ 245 $ 596

Purchase obligations (3) $925 $1,007 $ 907 $ 1,446 $ 4,285

(1) Long-term debt is discussed in Note 5 to the consolidated financial statements.

(2) Capital lease obligations include nuclear fuel leases. Lease obligations are discussed

in Note 10 to the consolidated financial statements.

(3) As defined by SEC rule. For Entergy, it includes unconditional fuel and purchased

power obligations and other purchase obligations. Approximately 97% of the total

pertains to fuel and purchased power obligations that are recovered in the

normal course of business through various fuel cost recovery mechanisms in

the U.S. Utility business.

Capital Funds Agreement

Pursuant to an agreement with certain creditors, Entergy

Corporation has agreed to supply System Energy with

sufficient capital to:

maintain System Energy’s equity capital at a minimum

of 35% of its total capitalization (excluding short-term debt);

permit the continued commercial operation of Grand

Gulf 1;

pay in full all System Energy indebtedness for borrowed

money when due; and

enable System Energy to make payments on specific

System Energy debt, under supplements to the

agreement assigning System Energy’s rights in

the agreement as security for the specific debt.

CAPITAL EXPENDITURE PLANS AND

OTHER USES OF CAPITAL

Following are the amounts of Entergy’s planned construction

and other capital investments by operating segment for

2004 through 2006 (in millions):

Planned construction

and capital investment 2004 2005 2006

Maintenance Capital:

U.S. Utility $ 767 $ 767 $759

Non-Utility Nuclear 73 68 76

Energy Commodity Services 7 2 2

Parent and Other 7 10 14

854 847 851

Capital Commitments:

U.S. Utility 569 295 112

Non-Utility Nuclear 123 – –

Energy Commodity Services 73 – –

Parent and Other 32 – –

797 295 112

Total $1,651 $1,142 $963

Maintenance Capital refers to amounts Entergy plans to

spend on routine capital projects that are necessary to

support reliability of its service, equipment, or systems and

to support normal customer growth.

Capital Commitments refers to non-routine capital

investments that Entergy is either contractually obligated

or otherwise required to make pursuant to a regulatory

agreement or existing rule or law with which Entergy is

required to comply. Amounts reflected in this category

include the following:

Replacement of the Arkansas Nuclear One Unit 1

(ANO 1) steam generators and reactor vessel closure

head. Entergy estimates the cost of the ANO 1 project to

be approximately $235 million, of which approximately

$135 million will be incurred through 2004. Entergy

expects the replacement to occur during a planned

refueling outage in 2005. Entergy Arkansas filed in

January 2003 a request for a declaratory order by the