Entergy 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

ENTERGY CORPORATION AND SUBSIDIARIES 2003

GOODWILL

Entergy implemented SFAS 142, “Goodwill and Other

Intangible Assets,” effective January 1, 2002. The adoption

of SFAS 142 required an initial impairment assessment

involving a comparison of the fair value of goodwill and

other intangible assets to the current carrying value.

Goodwill and other intangible assets determined to have

indefinite useful lives are not amortized, whereas goodwill

and other intangible assets determined to have definite

useful lives are amortized over their useful lives.

Goodwill and other intangible assets are subject to annual

impairment testing.

The implementation of SFAS 142 resulted in the cessation

of Entergy’s amortization of the remaining plant acquisition

adjustment recorded in conjunction with its acquisition of

Entergy Gulf States. The following table is a reconciliation

of reported earnings applicable to common stock to

earnings applicable to common stock without goodwill

amortization for the years ended December 31, 2003, 2002,

and 2001 (in thousands, except share data):

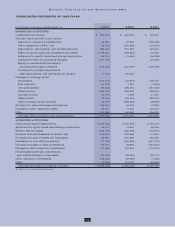

For the years ended December 31, 2003 2002 2001

Reported earnings applicable

to common stock $926,943 $599,360 $726,196

Add back: Goodwill amortization – – 16,265

Adjusted earnings applicable

to common stock without

goodwill amortization $926,943 $599,360 $742,461

Basic earnings per

average common share:

Reported earnings applicable

to common stock $4.09 $2.69 $3.29

Goodwill amortization – – 0.07

Adjusted earnings applicable

to common stock without

goodwill amortization $4.09 $2.69 $3.36

Diluted earnings per

average common share:

Reported earnings applicable

to common stock $4.01 $2.64 $3.23

Goodwill amortization – – 0.07

Adjusted earnings applicable

to common stock without

goodwill amortization $4.01 $2.64 $3.30

During 2001, Entergy acquired certain intangible assets

in connection with the formation of Entergy-Koch, LP,

an unconsolidated 50/50 limited partnership between

subsidiaries of Entergy and Koch Industries, Inc. Because

the intangible assets were assigned definite useful lives,

which correspond to the useful lives of Entergy-Koch’s

fixed assets, Entergy is amortizing them on a straight-line

basis over a period of 30 years. Entergy’s consolidated

balance sheet at December 31, 2003 includes $53 million of

unamortized intangible assets acquired in forming

Entergy-Koch.

NUCLEAR REFUELING OUTAGE COSTS

Entergy records nuclear refueling outage costs in accordance

with regulatory treatment and the matching principle. These

refueling outage expenses are incurred to prepare the units to

operate for the next operating cycle without having to be

taken off line. Except for the River Bend plant, the costs are

deferred during the outage and amortized over the period to

the next outage. In accordance with the regulatory treatment

of the River Bend plant, River Bend’s costs are accrued in

advance and included in the cost of service used to establish

retail rates. Entergy Gulf States relieves the accrued liability

when it incurs costs during the next River Bend outage.

ALLOWANCE FOR FUNDS USED

DURING CONSTRUCTION

AFUDC represents the approximate net composite interest

cost of borrowed funds and a reasonable return on the

equity funds used for construction in the U.S. Utility

segment. Although AFUDC increases both the plant balance

and earnings, it is realized in cash through depreciation

provisions included in rates.

INCOME TAXES

Entergy Corporation and its subsidiaries file a U.S. consoli-

dated federal income tax return. Income taxes are allocated

to the subsidiaries in proportion to their contribution to

consolidated taxable income. Securities and Exchange

Commission (SEC) regulations require that no Entergy

subsidiary pay more taxes than it would have paid if a

separate income tax return had been filed. In accordance

with SFAS 109, “Accounting for Income Taxes,” deferred

income taxes are recorded for all temporary differences

between the book and tax basis of assets and liabilities,

and for certain credits available for carryforward.

Deferred tax assets are reduced by a valuation allowance

when, in the opinion of management, it is more likely than

not that some portion of the deferred tax assets will not be

realized. Deferred tax assets and liabilities are adjusted for

the effects of changes in tax laws and rates in the period in

which the tax or rate was enacted.

Investment tax credits are deferred and amortized based

upon the average useful life of the related property, in

accordance with ratemaking treatment.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

continued