Entergy 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

ENTERGY CORPORATION AND SUBSIDIARIES 2003

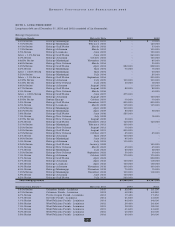

Significant components of net deferred and noncurrent

accrued tax liabilities as of December 31, 2003 and 2002 are

as follows (in thousands):

2003 2002

Deferred and Noncurrent

Accrued Tax Liabilities:

Net regulatory liabilities $(1,072,898) $(1,085,287)

Plant-related basis differences (3,574,593) (3,064,130)

Power purchase agreements (945,495) (866,976)

Nuclear decommissioning (624,429) (237,944)

Other (379,875) (406,703)

Total (6,597,290) (5,661,040)

Deferred Tax Assets:

Accumulated deferred investment

tax credit 141,723 151,930

Capital loss carryforwards 92,423 68,378

Net operating loss carryforwards 129,122 23,086

Sale and leaseback 223,134 232,228

Unbilled/deferred revenues 18,983 309,346

Pension-related items 204,083 139,058

Reserve for regulatory adjustments 138,933 103,843

Customer deposits 108,591 58,165

Nuclear decommissioning 377,952 104,555

Other 399,080 229,555

Valuation allowance (39,210) (36,372)

Total 1,794,814 1,383,772

Net deferred and noncurrent

accrued tax liability $(4,802,476) $(4,277,268)

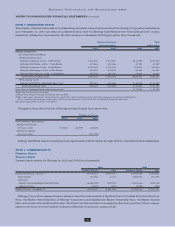

At December 31, 2003, Entergy had $192 million in net

realized federal capital loss carryforwards that will expire

as follows: $12 million in 2006, $163 million in 2007, and

$17 million in 2008.

At December 31, 2003, Entergy had state net operating

loss carryforwards of $1.9 billion, primarily resulting from

Entergy Louisiana’s mark-to-market tax election. If the

state net operating loss carryforwards are not utilized, they

will expire in the years 2010 through 2016.

The 2003 and 2002 valuation allowances are provided

against UK capital loss and UK net operating loss carryfor-

wards, which can be utilized against future UK taxable income.

For UK tax purposes, these carryforwards do not expire.

At December 31, 2003, Entergy had $9.8 million of

indefinitely reinvested undistributed earnings from sub-

sidiary companies outside the U.S. Upon distribution of

these earnings in the form of dividends or otherwise,

Entergy could be subject to U.S. income taxes (subject to

foreign tax credits) and withholding taxes payable to

various foreign countries.

NOTE 4. LINES OF CREDIT AND RELATED

SHORT-TERM BORROWINGS

Entergy Corporation has in place a 364-day bank credit

facility with a borrowing capacity of $1.45 billion, none of

which was outstanding as of December 31, 2003. The

commitment fee for this facility is currently 0.20% of the

line amount. Commitment fees and interest rates on loans

under the credit facility can fluctuate depending on the

senior debt ratings of the domestic utility companies.

Although the Entergy Corporation credit facility expires

in May 2004, Entergy has the discretionary option to

extend the period to repay the amount then outstanding for

an additional 364-day term. Because of this option, which

Entergy intends to exercise if it does not renew the credit

line or obtain an alternative source of financing, the credit

line is reflected in long-term debt on the balance sheet.

Entergy Corporation’s facility requires it to maintain a con-

solidated debt ratio of 65% or less of its total capitalization,

and maintain an interest coverage ratio of 2 to 1. If Entergy

fails to meet these limits, or if Entergy or the domestic

utility companies default on other indebtedness or are in

bankruptcy or insolvency proceedings, an acceleration of

the facility’s maturity date may occur.

The short-term borrowings of Entergy’s subsidiaries are

limited to amounts authorized by the SEC. The current

limits authorized are effective through November 30, 2004.

Also, under the SEC order authorizing the short-term bor-

rowing limits, the domestic utility companies and System

Energy cannot incur new short-term indebtedness if the

issuer’s common equity would comprise less than 30% of its

capital. In addition to borrowing from commercial banks,

Entergy’s subsidiaries are authorized to borrow from the

Entergy System Money Pool (money pool). The money pool

is an inter-company borrowing arrangement designed to

reduce Entergy’s subsidiaries’ dependence on external

short-term borrowings. Borrowings from the money pool

and external borrowings combined may not exceed the SEC

authorized limits. As of December 31, 2003, Entergy’s

subsidiaries’ authorized limit was $1.6 billion and the out-

standing borrowing from the money pool was $147.1 million.

There were no borrowings outstanding from external

sources. There is further discussion of commitments for

long- term financing arrangements in Note 5 to the consol-

idated financial statements.

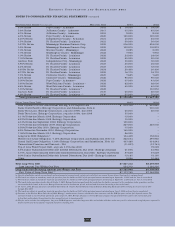

Entergy Arkansas, Entergy Louisiana, and Entergy

Mississippi each have 364-day credit facilities available

as follows:

Expiration Amount of Amount Drawn as

Company Date Facility of Dec. 31, 2003

Entergy Arkansas April 2004 $63 million –

Entergy Louisiana May 2004 $15 million –

Entergy Mississippi May 2004 $25 million –

The facilities have variable interest rates and the average

commitment fee is 0.14%.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

continued