Entergy 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Chairman

Robert v.d. Luft

and former Secretary

of Labor Alexis

Herman, who was

elected to Entergy’s

board in 2003.

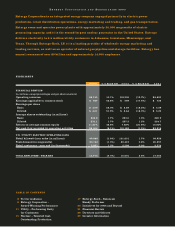

Productivity Improvement

A critical near-term initiative is to reduce total annual operation and maintenance expense by

$145 million, and to reduce maintenance capital outlays by $350 million, by 2006. The increase in

productivity improvements, combined with planned uprates to expand the capacity of our nuclear

plants, will move us closer to achieving consistent 10 percent returns on total invested capital.

We took a significant step toward this operation and maintenance expense goal with the

completion of our Voluntary Severance Program in December 2003. The VSP was well designed,

targeting specific processes or functions where best practices or technology enhancements have

been proven. We are eliminating work, and the VSP aligns the workforce with the remaining

business needs. A total of 1,100 employees participated in the program. The long-term value of

effective and efficient processes will clearly exceed the initial costs, which resulted in an after-tax

charge of $123 million. The initiative will produce annual savings of about $70 million after tax,

resulting in a three-year net present value of $90 million.

In our benchmarking efforts, we’ve found that the safest, most reliable operations are also the

lowest cost over the long run, and we firmly believe these productivity increases are sustainable.

U.S. capital-intensive industries have achieved 5 percent productivity improvements year after year

for decades. That doesn’t mean that everybody can do it – high-performing companies break from

the pack. For example, ten years ago we honestly could not see how we could get nuclear costs

below $25/MWh. But at the same time we knew that if we didn’t, we’d face a huge competitive

disadvantage. Now we’re operating plants at $15/MWh, and we’ve identified more room for

reducing inefficiencies, without compromising safety and reliability standards.

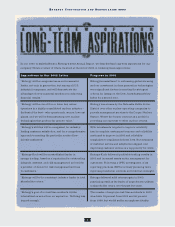

Innovative Regulatory Initiatives

Over the coming year, we’ll continue to focus on advancing creative regulatory solutions that are

good for all our stakeholders.

This is what we did in our New Orleans rate case last year. Entergy New Orleans obtained a

$30 million base rate increase, but the customers’ retail bill was less as we implemented an

innovative plan to acquire generation supplies at the lowest cost, replacing more expensive power

purchases and less-reliable, less-efficient generation. In addition, we gained the opportunity to

earn a higher return on equity through a performance-based incentive plan.

ENTERGY CORPORATION AND SUBSIDIARIES 2003

Entergy was honored as the top performer in the Edison Electric Institute’s Index

of Shareholder-Owned Electric Utilities, with a total return of 110.7 percent for the

five-year period ended September 30, 2003.

“

”