Entergy 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

ENTERGY CORPORATION AND SUBSIDIARIES 2003

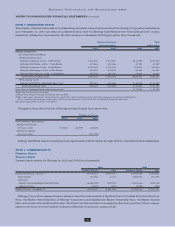

ENTERGY NEW ORLEANS

Effective June 2003, Entergy New Orleans electric rate

schedules include a fuel adjustment tariff designed to reflect

no more than targeted fuel and purchased power costs

adjusted by a surcharge or credit for deferred fuel expense

arising from monthly reconciliations, including carrying

charges. Entergy New Orleans’ gas rate schedules include

estimates for the billing month adjusted by a surcharge or

credit for deferred fuel expense arising from monthly recon-

ciliations, including carrying charges.

RETAIL RATE PROCEEDINGS

Filings with the APSC (Entergy Arkansas)

RETAIL RATES

No significant retail rate proceedings are pending in Arkansas

at this time.

Filings with the PUCT and Texas Cities

(Entergy Gulf States)

RETAIL RATES

Entergy Gulf States is operating in Texas under the terms

of a June 1999 PUCT-approved settlement agreement. The

settlement provided for a base rate freeze that has remained

in effect during the delay in implementation of retail open

access in Entergy Gulf States’ Texas service territory.

RECOVERY OF RIVER BEND COSTS

In March 1998, the PUCT disallowed recovery of $1.4 billion

of company-wide abeyed River Bend plant costs, which have

been held in abeyance since 1988. Entergy Gulf States

appealed the PUCT’s decision on this matter to the Travis

County District Court in Texas. A 1999 settlement agree-

ment limits potential recovery of the remaining plant asset

to $115 million as of January 1, 2002, less depreciation

after that date. Entergy Gulf States accordingly reduced the

value of the plant asset in 1999. Entergy Gulf States has

also agreed that it will not seek recovery of the abeyed plant

costs through any additional charge to Texas ratepayers.

In an interim order approving this agreement, however,

the PUCT recognized that any additional River Bend

investment found prudent, subject to the $115 million cap,

could be used as an offset against stranded benefits, should

legislation be passed requiring Entergy Gulf States to

return stranded benefits to retail customers.

In April 2002, the Travis County District Court issued an

order affirming the PUCT’s order on remand disallowing

recovery of the abeyed plant costs. Entergy Gulf States

appealed this ruling to the Third District Court of Appeals.

In July 2003, the Third District Court of Appeals unani-

mously affirmed the judgment of the Travis County District

Court. After considering the progress of the proceeding in

light of the decision of the Court of Appeals, management

has concluded that it is prudent to accrue for the loss that

would be associated with a final, non-appealable decision

disallowing the abeyed plant costs. The net carrying value

of the abeyed plant costs was $107.7 million as of June 30,

2003, and after this accrual Entergy Gulf States provided

for all potential loss related to current or past contested

costs of construction of the River Bend plant. Accrual of the

loss was recorded in the second quarter 2003 and reduced

net income by $65.6 million. In January 2004, the Texas

Supreme Court asked for full briefing on the merits of the

case in response to Entergy Gulf States’ petition for review.

Filings with the LPSC

ANNUAL EARNINGS REVIEWS (ENTERGY GULF STATES)

In December 2002, the LPSC approved a settlement between

Entergy Gulf States and the LPSC staff pursuant to which

Entergy Gulf States agreed to make a base rate refund of

$16.3 million, including interest, and to implement a

$22.1 million prospective base rate reduction effective

January 2003. The settlement discharged any potential

liability for claims that relate to Entergy Gulf States’ fourth,

fifth, sixth, seventh, and eighth post-merger earnings

reviews. Entergy Gulf States made the refund in February

2003. In addition to resolving and discharging all liability

associated with the fourth through eighth earnings

reviews, the settlement provides that Entergy Gulf States

shall be authorized to continue to reflect in rates a ROE

of 11.1% until a different ROE is authorized by a final

resolution disposing of all issues in the proceeding that was

commenced with Entergy Gulf States’ May 2002 filing.

In May 2002, Entergy Gulf States filed its ninth and last

required post-merger analysis with the LPSC. The filing

included an earnings review filing for the 2001 test year

that resulted in a rate decrease of $11.5 million, which was

implemented effective June 2002. In April 2003, the LPSC

staff filed testimony in which it recommended that the LPSC

require a rate refund of $30.3 million and a prospective rate

reduction of $75.9 million, before taking into account the

$11.5 million rate reduction that Entergy Gulf States imple-

mented effective June 2002. In July 2003, Entergy Gulf

States filed testimony rebutting the LPSC staff’s testimony

and supporting the filing. During discovery, the LPSC staff

requested that Entergy Gulf States provide updated cost of

service data to reflect changes in costs, revenues, and rate

base through December 31, 2002. In September 2003,

Entergy Gulf States supplied the updated data. In December

2003, the LPSC staff recommended a rate refund of

$30.6 million and a prospective rate reduction of approxi-

mately $50 million. Hearings are scheduled to begin in

April 2004. Entergy Gulf States cannot predict the ultimate

outcome of this proceeding.

RETAIL RATES (ENTERGY LOUISIANA)

In January 2004, Entergy Louisiana made a rate filing with

the LPSC requesting a base rate increase of approximately

$167 million. In that filing, Entergy Louisiana noted that

approximately $73 million of the base rate increase was

attributable to certain power purchase agreements, the