Entergy 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The dividend is part of a broader set of financial aspirations that reflect Entergy’s financial

strength and business prospects, guided by a well-developed market point of view. The overarching

financial goal is to achieve and maintain returns to shareholders – a combination of earnings

growth and yield – that rank in the top quartile among peers.

Our goal is to return cash to

shareholders in the most efficient way possible, while maintaining financial flexibility and liquidity

to support continued growth in both earnings and the dividend.

We will look to increase the dividend annually consistent with progress toward achievement

of our financial aspirations. Those aspirations include maintaining near-term earnings growth

of

8-10 percent, comprised of 6 percent intrinsic growth and 2-4 percent growth from asset

acquisitions.

We also seek long-term growth of 5-6 percent, equal to top-quartile growth in our

industry over the last 20 years.

A critical element in realizing these financial aspirations is achieving improvements in

productivity. Entergy’s financial plans include incremental operation and maintenance cost

savings totaling $145 million, comprised of $10 million in the utility and $135 million in

Entergy’s competitive nuclear business, compared to 2002 baseline amounts. We expect to achieve

these productivity improvements by 2006.

In December 2003, Entergy completed a Voluntary Severance Program, designed to achieve

necessary staff reductions by offering enhanced severance benefits to eligible employees. A total

of 1,100 employees participated. Entergy recorded a one-time after-tax charge of $123 million

in 2003 for the severance costs associated with the VSP, while the staff reductions are expected

to produce annual savings of about $70 million after tax.

Environmental and Social Leadership

Entergy believes that strong financial performance goes hand in hand with serving the best

interests of all our stakeholders. That approach was reflected in Entergy’s selection for listing

on the Dow Jones Sustainability Index for 2004. This is the second consecutive year that Entergy

has been listed, one of only three U.S. electric utilities to be included. DJSI-listed companies

must not only demonstrate strong financial performance, but must also show outstanding

leadership in environmental and social commitment.

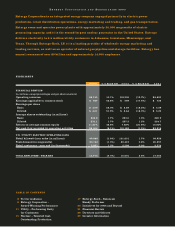

Operational

Earnings Per Share

(in dollars)

98

As-

Reported Operational

03

As-

Reported

2.222.22 3.00

4.25 4.01

Strong, Balanced Earnings Growth.

In the five years since Entergy adopted a refocused

strategy, the company has produced strong earnings

growth. Since 1998, operational earnings have

increased by a total of 91 percent. All areas of

Entergy’s business have contributed: the core utility

as well as growth initiatives in nuclear generation

and energy commodities. Entergy’s strategy is

to develop multiple sources of continued earnings

growth to help ensure consistent performance,

no matter what obstacles arise.

ENTERGY CORPORATION AND SUBSIDIARIES 2003

9

Components of

Operational EPS

(in dollars)

98 03

Parent and Other

Utility

Entergy Nuclear

Energy Commodity Services

Total

2.22

Total

4.25

0.02

2.36

(0.01)

(0.15) (0.09)

0.78

0.85

2.71