Entergy 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

costs and risk. In 2003, EKT expanded this

physical optimization business by adding

3,640 MW to its management portfolio in the

United States. This increases revenues from a

repeatable, lower-risk customer management

business. As EKT expands its presence in the

marketplace, it can demonstrate its

capabilities to asset owners with similar

physical optimization needs.

With the latest additions to its physical

optimization business, EKT now manages

commodity positions for a total of 9.8

gigawatts of generation and 149 BCF of gas

storage in the United States. EKT also

manages 1.2 gigawatts of generation in

Europe, and the company is working to

expand its trading capabilities and physical

optimization there, with a goal of building

operations to the level of the U.S. business.

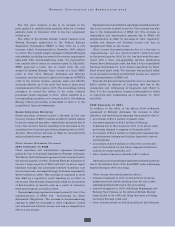

Gulf South Focus on Productivity

Results at Gulf South Pipeline suffered from a 17 percent decline in throughput in 2003, as higher

gas prices led industrial and power plant customers to switch to fuel oil or competitive carriers.

Average production costs increased 55 percent from the prior year, mainly as a result of incremental

legal and consulting expenses incurred primarily in connection with Gulf South’s defense of a

lawsuit which it believes has no merit.

Gulf South’s diversified customer base – with

no customer class accounting for more than

35 percent of revenues – helped to moderate the

throughput decline. Gulf South’s storage

capabilities also reduced the impact of higher

gas prices. The higher volatility associated with

high gas prices increases storage utilization, as

customers seek greater flexibility to respond to

the market. Gulf South’s storage revenues

increased 23 percent over the previous year.

To improve its performance in 2004 and

beyond, Gulf South will continue to focus on

reductions in production costs. In addition, a

recent increase in firm pipeline transportation

rates should improve 2004 results.

In 2003, the Mastio rankings placed Gulf

South among the top five of the nation’s largest

pipelines for meeting commitments to

customers. The ranking enhances Gulf South’s

credibility among the country’s leading gas

pipeline supply companies.

ENTERGY CORPORATION AND SUBSIDIARIES 2003

2003 Goals

(in 2002 Annual Report)

Obtain new customers, primarily by

advancing the physical optimization

business with a goal of doubling

over the next two years.

Achieve global growth in the

weather business by developing

distribution channels.

Continue to improve productivity

at Gulf South Pipeline.

Complete the Magnolia Gas Storage

facility on time and on budget.

Performance Review

Club E-K

The trading business delivered a stellar performance while Gulf South

was out of the groove – a mixed review for a combo whose past

performances have raised audience expectations.

2003 Performance

Increased physical optimization

earnings by 27 percent; added

3,640 MW under management; on

track to double business by year-

end 2005.

Continued efforts on distribution

channels; growth-to-date has been

slower than expected.

Recorded higher production costs

due in part to higher fuel costs and

legal expenses.

Completed on time and on budget

in October 2003, but subsequent

problems have delayed operations.

Rating:

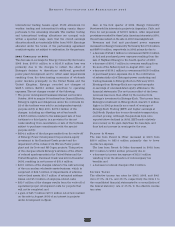

Growing Our Customer Business.

Entergy-Koch Trading expanded its physical optimization business

with the addition of 3,640 MW to its U.S. management portfolio in

2003. Growing EKT’s management of customer-owned power plants

and gas distribution systems in both the United States and Europe

is a key initiative for Entergy-Koch.

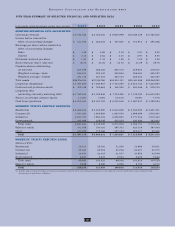

Entergy-Koch Trading

U.S. Assets Under Management

(MW)

4Q 4Q 1Q 2Q 3Q 4Q

01 02 03 03 03 03

5,975 6,065

6,605 6,125

9,395 9,765

19