Entergy 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

ENTERGY CORPORATION AND SUBSIDIARIES 2003

The decrease was partially offset by an increase in “miscel-

laneous – net” of $26.7 million due to the cessation of amor-

tization of goodwill in January 2002 upon implementation

of SFAS 142 and settlement of liability insurance coverage

at Entergy Gulf States.

Interest and other charges decreased primarily due to:

a decrease of $31.9 million in interest on long-term debt

primarily due to the retirement of long-term debt in late

2001 and early 2002; and

a decrease of $76.0 million in other interest expense

primarily due to interest recorded on System Energy’s

provision for rate refund in 2001 resulting from the

effects of the final FERC order addressing System

Energy’s 1995 rate filing. The refund was made in

December 2001.

NON-UTILITY NUCLEAR

Following are key performance measures:

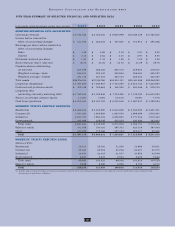

2003 2002 2001

Net MW in operation at December 31 4,001 3,955 3,445

Average realized price per MWh $38.54 $40.49 $34.90

Generation in GWh for the year 32,379 29,953 22,614

Capacity factor for the year 92.4% 92.8% 92.7%

2003 COMPARED TO 2002

The increase in earnings for Non-Utility Nuclear from

$200.5 million to $300.8 million was primarily due to the

$154.5 million net-of-tax cumulative effect of a change in

accounting principle recognized in the first quarter of 2003

upon implementation of SFAS 143. See “Critical Accounting

Estimates – SFAS 143” below for discussion of the imple-

mentation of SFAS 143. Income before the cumulative effect

of accounting change decreased by $54.2 million. The

decrease was primarily due to $83.0 million ($50.6 million

net-of-tax) of charges recorded in connection with the

voluntary severance program. Except for the effect of the

voluntary severance program, operation and maintenance

expenses in 2003 per MWh of generation were in line with

2002 operation and maintenance expenses.

2002 COMPARED TO 2001

The increase in earnings for Non-Utility Nuclear from

$127.9 million to $200.5 million was primarily due to

the acquisitions of Indian Point 2, purchased in September

2001, and Vermont Yankee, purchased in July 2002. Also

contributing to the increase in earnings was higher pricing

under certain purchase power contracts.

ENERGY COMMODITY SERVICES

Earnings for Energy Commodity Services in 2003 were

primarily driven by Entergy’s investment in Entergy-Koch.

Following are key performance measures for Entergy-

Koch’s operations for 2003, 2002, and 2001:

2003 2002 2001

Entergy-Koch Trading

Gas volatility 62% 61% 72%

Electricity volatility 59% 48% 78%

Gas marketed (BCF/D) (1) 6.5 5.8 4.5

Electricity marketed (GWh) 445,979 408,038 180,893

Gain/loss days 1.5 1.8 2.8

Gulf South Pipeline

Throughput (BCF/D) 1.99 2.40 2.45

Production cost ($/MMBtu) $0.146 $0.094 $0.093

(1) Previously reported volumes, which included only U.S. trading, have been adjusted

to reflect both U.S. and Europe volumes traded.

2003 COMPARED TO 2002

The increase in earnings for Energy Commodity Services in

2003 from a $145.8 million loss to $180.5 million in earnings

was primarily due to $428.5 million ($238.3 million net-of-

tax) of charges recorded in 2002, as discussed in the 2002 to

2001 comparison below. Higher earnings from Entergy’s

investment in Entergy-Koch also contributed to the increase

in earnings. The income from Entergy’s investment in

Entergy-Koch was $73 million higher in 2003 primarily as a

result of higher earnings at Entergy-Koch Trading (EKT).

Volatility was slightly up and trading earnings reflected

solid point-of-view trading results. In addition, EKT’s phys-

ical optimization business continued to contribute earnings,

and its European business earnings increased as trading

activities continued to expand beyond the United Kingdom.

Earnings at Gulf South Pipeline were lower due to lower

throughput and higher production costs. The decreased

throughput was due to shifting gas flow patterns in a

sustained high gas price environment that led to higher

fuel costs. Production costs were higher as the result of

incremental legal and consultant expenses incurred primarily

in connection with Gulf South’s defense of a lawsuit which it

believes has no merit.

Entergy accounts for its 50% share in Entergy-Koch

under the equity method of accounting. Earnings from

Entergy-Koch are reported as equity in earnings of uncon-

solidated equity affiliates in the financial statements.

Certain terms of the partnership arrangement allocated

income from various sources, and the taxes on that income,

on a significantly disproportionate basis through 2003.

Losses and distributions from operations are allocated to

the partners equally. Substantially all of Entergy-Koch’s

profits were allocated to Entergy in 2003, 2002, and 2001.

Effective January 1, 2004, a revaluation of Entergy-Koch’s

assets for legal capital account purposes occurred, and

future profit allocations changed after the revaluation.

The profit allocations other than for weather trading and

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS

continued

“Non-Utility Nuclear contributed

over 30% of Entergy’s 2003

net income.”