Entergy 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

ENTERGY CORPORATION AND SUBSIDIARIES 2003

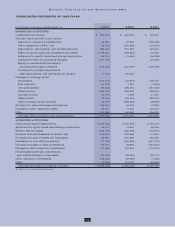

EARNINGS PER SHARE

The following table presents Entergy’s basic and diluted

earnings per share (EPS) calculation included on the consol-

idated income statement (in millions, except per share data):

For the years ended December 31, 2003 2002 2001

$/share $/share $/share

Income before cumulative

effect of accounting change $789.9 $599.4 $702.7

Average number of common

shares outstanding - basic 226.8 $3.48 223.0 $2.69 220.9 $3.18

Average dilutive effect of:

Stock options (1) 4.1 (0.062) 3.9 (0.046) 3.6 (0.052)

Equity awards 0.2 (0.004) 0.4 (0.005) 0.2 (0.002)

Average number of common

shares outstanding - diluted 231.1 $3.42 227.3 $2.64 224.7 $3.13

Earnings applicable to

common stock $926.9 $599.4 $726.2

Average number of common

shares outstanding - basic 226.8 $4.09 223.0 $2.69 220.9 $3.29

Average dilutive effect of:

Stock options (1) 4.1 (0.073) 3.9 (0.046) 3.6 (0.054)

Equity awards 0.2 (0.004) 0.4 (0.005) 0.2 (0.002)

Average number of common

shares outstanding - diluted 231.1 $4.01 227.3 $2.64 224.7 $3.23

(1) Options to purchase approximately 15,231, 109,897, and 148,500 shares of common

stock at various prices were outstanding at the end of 2003, 2002, and 2001,

respectively, that were not included in the computation of diluted earnings per

share because the exercise prices were greater than the average market price of

the common shares at the end of each of the years presented.

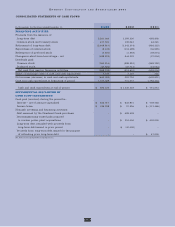

STOCK-BASED COMPENSATION PLANS

Entergy has two plans that grant stock options, which are

described more fully in Note 8 to the consolidated financial

statements. Prior to 2003, Entergy applied the recognition

and measurement principles of APB Opinion 25,

“Accounting for Stock Issued to Employees,” and related

Interpretations in accounting for those plans. No stock-

based employee compensation expense is reflected in 2002

and 2001 net income as all options granted under those

plans have an exercise price equal to the market value of the

underlying common stock on the date of grant. Effective

January 1, 2003, Entergy prospectively adopted the fair

value based method of accounting for stock options

prescribed by SFAS 123, “Accounting for Stock-Based

Compensation.” Awards under Entergy’s plans vest over

three years. Therefore, the cost related to stock-based

employee compensation included in the determination of net

income for 2003 is less than that which would have been

recognized if the fair value based method had been applied to

all awards since the original effective date of SFAS 123. The

following table illustrates the effect on net income and

earnings per share if Entergy would have historically

applied the fair value based method of accounting to stock-based

employee compensation. (In thousands, except per share data)

For the years ended December 31, 2003 2002 2001

Earnings applicable

to common stock $926,943 $599,360 $726,196

Add back: Stock-based compensation

expense included in earnings

applicable to common stock, net

of related tax effects 2,818 – –

Deduct: Total stock-based employee

compensation expense determined

under fair value method for all

awards, net of related tax effects 24,518 28,110 19,472

Pro forma earnings applicable

to common stock $905,243 $571,250 $706,724

Earnings per average common share:

Basic $4.09 $2.69 $3.29

Basic - pro forma $3.99 $2.56 $3.20

Diluted $4.01 $2.64 $3.23

Diluted - pro forma $3.92 $2.51 $3.14

APPLICATION OF SFAS 71

The domestic utility companies and System Energy currently

account for the effects of regulation pursuant to SFAS 71,

“Accounting for the Effects of Certain Types of Regulation.”

This statement applies to the financial statements of a rate-

regulated enterprise that meets three criteria. The enterprise

must have rates that (i) are approved by a body empowered

to set rates that bind customers (its regulator); (ii) are cost-

based; and (iii) can be charged to and collected from

customers. These criteria may also be applied to separable

portions of a utility’s business, such as the generation or

transmission functions, or to specific classes of customers.

If an enterprise meets these criteria, it capitalizes costs that

would otherwise be charged to expense if the rate actions of

its regulator make it probable that those costs will be recov-

ered in future revenue. Such capitalized costs are reflected

as regulatory assets in the accompanying financial state-

ments. A significant majority of Entergy’s regulatory

assets, net of related regulatory and deferred tax liabilities,

earn a return on investment during their recovery periods.

SFAS 71 requires that rate-regulated enterprises assess the

probability of recovering their regulatory assets at each

balance sheet date. When an enterprise concludes that recov-

ery of a regulatory asset is no longer probable, the regulatory

asset must be removed from the entity’s balance sheet.

SFAS 101, “Accounting for the Discontinuation of

Application of Financial Accounting Standards Board

(FASB) Statement No. 71,” specifies how an enterprise that

ceases to meet the criteria for application of SFAS 71 for all