Entergy 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

n 2003, the people of Entergy turned in another great performance. In December 2003, Entergy

was named the Global Energy Company of the Year, at the Platts/BusinessWeek Global Energy

Awards. We’re glad that Entergy employees have been recognized for their efforts, and we’re

proud of what they have accomplished on behalf of customers, investors, and all Entergy stakeholders.

But we don’t seek awards for their own sake. What counts is performance. And that’s what this

report is all about.

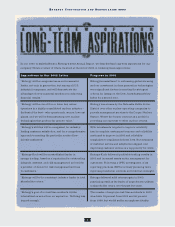

Focus on Performance

Our focus on charting performance – execution – may seem at odds with the idea that an annual report

should be strategic or forward-looking. But we believe you can clearly see our strategy in our

performance. And because our strategy has been consistent, you can see our plans for the future in

what we have done. What you see is what you get. We don’t hide bad performance in strategic talk, or

discount a bad year with visions of future grandeur.

We lay out specific goals on page 20, so you can measure our progress. We also report on the goals

we set in last year’s annual report – including the goals we did not fully achieve. Our strategy is

designed to reach our overall financial targets even if not everything goes right. We establish goals that

require us to stretch, and we know that some things will not turn out as we expect – economy, weather,

competitors’ behavior. So we’re not surprised when we don’t hit or exceed every target, but we’re not

satisfied with anything less, either.

The reliability of our service continues to improve, but measures of customer service and satisfaction

declined. Employee lost-time accidents reached a new low in 2003, but we have suffered an employee

fatality in each of the past two years. Entergy’s balance sheet and cash flow continue to strengthen, but

our credit rating lags both our performance and our industry peers. Entergy’s stock price has reached

a number of record highs when many in the industry have been hitting lows, but our market-to-book

ratio remains below the industry average.

We strongly believe we still have very real and substantial opportunities to make further progress on

the extraordinary performance improvement path we have established over the past five years.

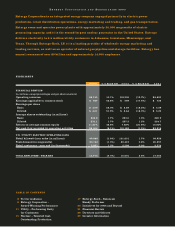

Financial Performance in 2003

In 2003, Entergy added to its record of steady growth in earnings since we adopted our refocused

strategy in 1998. For the year 2003, Entergy’s as-reported earnings were $4.01 per share, up 52 percent

from $2.64 per share in 2002. Operational earnings were $4.25 per share, up 12 percent from $3.81 per

share in 2002, and above our goal of 8-10 percent average annual growth.

In July 2003, the Board of Directors raised Entergy’s dividend 29 percent to $1.80 per share on an

annual basis. Even with the higher dividend, our payout ratio of 40 percent remains well below the

industry average of just over 50 percent, providing us not just added financial security but also a lot

of options for the future.

Entergy was honored as the top performer in the Edison Electric Institute’s Index of Shareholder-Owned

Electric Utilities, with a total return of 110.7 percent for the five-year period ended September 30, 2003.

In 2003, Entergy completed a $3.3 billion refinancing program that resulted in a stronger balance

sheet, increased flexibility, and reduced financing costs. We will continue to work hard to demonstrate

to the rating agencies that the financial improvements we’ve made are worthy of upward revisions in

our credit ratings.

To Our Audience

I

ENTERGY CORPORATION AND SUBSIDIARIES 2003

2