Entergy 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

ENTERGY CORPORATION AND SUBSIDIARIES 2003

Entergy Corporation is an investor-owned public utility

holding company that operates primarily through three

business segments.

U.S. UTILITY generates, transmits, distributes, and

sells electric power, with a small amount of natural gas

distribution.

NON-UTILITY NUCLEAR owns and operates five nuclear

power plants and sells the electric power produced by

those plants to wholesale customers. This business also

provides services to other nuclear power plant owners.

ENERGY COMMODITY SERVICES provides energy

commodity trading and gas transportation and storage

services through Entergy-Koch, LP. Energy Commodity

Services also includes Entergy’s non-nuclear wholesale

assets business, which sells electric power produced by

those assets to wholesale customers while it focuses on

selling the majority of those assets.

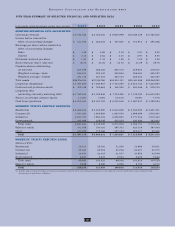

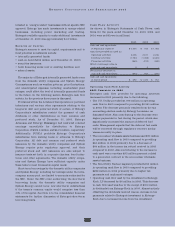

Following are the percentages of Entergy’s consolidated

revenues and net income generated by these segments and

the percentage of total assets held by them:

% of Revenue

Segment 2003 2002 2001

U.S. Utility 82 82 77

Non-Utility Nuclear 14 14 8

Energy Commodity Services 2 4 14

Parent & Other 2 – 1

% of Net Income

Segment 2003 2002 2001

U.S. Utility 52 97 77

Non-Utility Nuclear 32 32 17

Energy Commodity Services 19 (23) 14

Parent & Other (3) (6) (8)

% of Total Assets

Segment 2003 2002 2001

U.S. Utility 79 79 78

Non-Utility Nuclear 15 16 13

Energy Commodity Services 7 8 9

Parent & Other (1) (3) –

RESULTS OF OPERATIONS

Earnings applicable to common stock for the years ended

December 31, 2003, 2002, and 2001 by operating segment

are as follows (in thousands):

Operating Segment 2003 2002 2001

U.S. Utility $469,050 $583,251 $550,243

Non-Utility Nuclear 300,799 200,505 127,880

Energy Commodity Services 180,454 (145,830) 105,939

Parent & Other (23,360) (38,566) (57,866)

Total $926,943 $599,360 $726,196

Entergy’s income before taxes is discussed according to

the business segments listed above. Earnings for 2003

include the $137.1 million net-of-tax cumulative effect of

changes in accounting principle that increased earnings in

the first quarter of 2003, almost entirely resulting from the

implementation of Statement of Financial Accounting

Standards (SFAS) 143. Earnings were negatively affected in

the fourth quarter of 2003 by voluntary severance program

expenses of $122.8 million net-of-tax. As part of an initia-

tive to achieve productivity improvements with a goal of

reducing costs, primarily in the Non-Utility Nuclear and

U.S. Utility businesses, in the second half of 2003 Entergy

offered a voluntary severance program to employees in

various departments. Approximately 1,100 employees,

including 650 employees in nuclear operations from the

Non-Utility Nuclear and U.S. Utility businesses, accepted

the offers.

Earnings for 2002 were negatively affected by net

charges ($238.3 million net-of-tax) reflecting the effect of

Entergy’s decision to discontinue additional greenfield

power plant development and asset impairments resulting

from the deteriorating economics of wholesale power

markets principally in the United States and the United

Kingdom. The net charges are discussed more fully below

in the Energy Commodity Services discussion. See Note 12

to the consolidated financial statements for further discussion

of Entergy’s business segments and their financial results

in 2003, 2002, and 2001.

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS