Entergy 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

ENTERGY CORPORATION AND SUBSIDIARIES 2003

The Office of Public Utility Counsel has appealed this

decision to the Texas courts. Management cannot predict

the ultimate outcome of the proceeding at this time.

In November 2003, Entergy Gulf States initiated a

proceeding to certify the Entergy Transmission

Organization as the independent organization. The PUCT

is scheduled to conduct a hearing on the certification appli-

cation in June 2004.

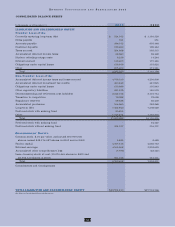

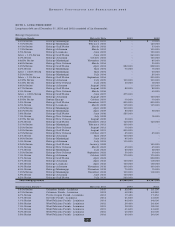

REGULATORY ASSETS

Other Regulatory Assets

The domestic utility companies and System Energy are

subject to the provisions of SFAS 71, “Accounting for the

Effects of Certain Types of Regulation.” Regulatory assets

represent probable future revenues associated with certain

costs that are expected to be recovered from customers

through the ratemaking process. In addition to the regula-

tory assets that are specifically disclosed on the face of the

balance sheets, the table below provides detail of “Other

regulatory assets” that are included on the balance sheets

as of December 31, 2003 and 2002 (in millions):

2003 2002

DOE Decommissioning

and Decontamination Fees - $ 32.9 $ 40.3

recovered through fuel rates

until December 2006 (Note 9)

Asset Retirement Obligation - 464.9 –

recovery dependent upon

timing of decommissioning (Note 9)

Removal costs - 72.4 79.6

recovered through depreciation rates

Provisions for storm damages - 123.3 93.9

recovered through cost of service

Postretirement benefits - 21.5 23.9

recovered through 2013 (Note 11)

Pension costs (Note 11) 134.0 157.8

Depreciation re-direct - 79.1 79.1

recovery begins at start of

retail open access (Note 1)

River Bend AFUDC - 39.4 41.3

recovered through August 2025 (Note 1)

Spindletop gas storage lease 38.0 35.0

recovered through December 2032

Low-level radwaste - 19.4 19.4

recovery timing dependent

upon pending lawsuit

1994 FERC Settlement - 4.0 12.1

recovered through June 2004 (Note 2)

Sale-leaseback deferral - 131.7 123.9

recovered through June 2014 (Note 10)

Deferred fuel - non-current - 28.2 17.3

recovered through rate riders

redetermined annually

Unamortized loss on reacquired debt - 164.4 155.2

recovered over term of debt

Other - various 71.9 94.4

Total $1,425.1 $973.2

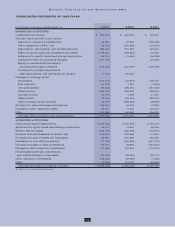

Deferred fuel costs

The domestic utility companies are allowed to recover certain

fuel and purchased power costs through fuel mechanisms

included in electric rates that are recorded as fuel cost recovery

revenues. The difference between revenues collected and the

current fuel and purchased power costs is recorded as

“Deferred fuel costs” on the domestic utility companies’ finan-

cial statements. The table below shows the amount of

deferred fuel costs as of December 31, 2003 and 2002 that has

been or will be recovered or (refunded) through the fuel

mechanisms of the domestic utility companies (in millions):

2003 2002

Entergy Arkansas $ 10.6 $ (42.6)

Entergy Gulf States $118.4 $100.6

Entergy Louisiana $ 30.6 $ (25.6)

Entergy Mississippi $ 89.1 $ 38.2

Entergy New Orleans $ (2.7) $ (14.9)

ENTERGY ARKANSAS

Entergy Arkansas’ rate schedules include an energy cost

recovery rider to recover fuel and purchased energy costs in

monthly bills. The rider utilizes prior calendar year energy

costs and projected energy sales for the twelve-month

period commencing on April 1 of each year to develop an

annual energy cost rate. The energy cost rate includes a

true-up adjustment reflecting the over-recovery or under-

recovery, including carrying charges, of the energy cost for

the prior calendar year.

In March 2003, Entergy Arkansas filed with the APSC its

energy cost recovery rider for the period April 2003

through March 2004. The energy cost rate filed was

approximately the same as the interim energy cost rate that

was in effect since October 2002. The current energy cost

rate is designed to eliminate the over-recovery during the

annual rider period.

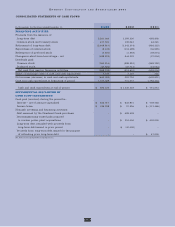

ENTERGY GULF STATES

In the Texas jurisdiction, Entergy Gulf States’ rate schedules

include a fixed fuel factor to recover fuel and purchased power

costs, including carrying charges, not recovered in base rates.

Under current methodology, semi-annual revisions of the

fixed fuel factor may be made in March and September based

on the market price of natural gas. Entergy Gulf States will

likely continue to use this methodology until the start of retail

open access. The amounts collected under Entergy Gulf States’

fixed fuel factor and any interim surcharge implemented until

the date retail open access commences are subject to fuel

reconciliation proceedings before the PUCT. In the Texas

jurisdiction, Entergy Gulf States’ deferred electric fuel costs

are $116.6 million as of December 31, 2003, which includes

the following:

Interim surcharge $87.0

Items to be addressed as part of unbundling $29.0

Imputed capacity charges $ 9.3

Other (includes over-recovery from 9/03 - 12/03) $ (8.7)