Entergy 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

ENTERGY CORPORATION AND SUBSIDIARIES 2003

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS

continued

MARKET AND CREDIT RISKS

Market risk is the risk of changes in the value of commodity

and financial instruments, or in future operating results or

cash flows, in response to changing market conditions.

Entergy is exposed to the following significant market risks:

The commodity price risk associated with Entergy’s

Non-Utility Nuclear and Energy Commodity Services

segments.

The foreign currency exchange rate risk associated

with certain of Entergy’s contractual obligations.

The interest rate and equity price risk associated with

Entergy’s investments in decommissioning trust funds.

Entergy is also exposed to credit risk. Credit risk is the risk

of loss from nonperformance by suppliers, customers, or

financial counterparties to a contract or agreement. Where

it is a significant consideration, counterparty credit risk is

addressed in the discussions that follow.

Commodity Price Risk

POWER GENERATION

The sale of electricity from the power generation plants

owned by Entergy’s Non-Utility Nuclear business and

Energy Commodity Services, unless otherwise contracted,

is subject to the fluctuation of market power prices.

Entergy’s Non-Utility Nuclear business has entered into

power purchase agreements (PPAs) and other contracts to

sell the power produced by its power plants at prices

established in the PPAs. Entergy continues to pursue oppor-

tunities to extend the existing PPAs and to enter into

new PPAs with other parties. Following is a summary of

the amount of the Non-Utility Nuclear business’ output

that is currently sold forward under physical or financial

contracts at fixed prices:

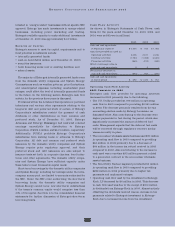

2004 2005 2006 2007 2008

Non-Utility Nuclear:

% of planned generation

sold forward 100% 52% 32% 16% 4%

Planned generation (GWh) 32,787 34,164 34,853 34,517 34,513

Average price per MWh $38 $37 $35 $34 $38

The Vermont Yankee acquisition included a 10-year PPA,

which is through the expiration of the current operating

license for the plant, under which the former owners will

buy the power produced by the plant. The PPA includes an

adjustment clause under which the prices specified in the

PPA will be adjusted downward annually, beginning in

November 2005, if power market prices drop below PPA

prices. Accordingly, because the price is not fixed, the table

above does not report power from that plant as sold forward

after October 2005. Approximately 2% of Non-Utility

Nuclear’s planned generation in 2005, 13% in 2006, 12% in

2007, and 13% in 2008 is under contract from Vermont

Yankee after October 2005.

Under the PPAs with NYPA for the output of power from

Indian Point 3 and FitzPatrick, the Non-Utility Nuclear

business is obligated to produce at an average capacity

factor of 85% with a financial true-up payment to NYPA

should NYPA’s cost to purchase power due to an output

shortfall be higher than the PPAs’ price. The calculation of

any true-up payments is based on two two-year periods. For

the first period, which ran through November 20, 2002,

Indian Point 3 and FitzPatrick operated at 95% and 97%,

respectively, under the true-up formula. Credits of up to 5%

reflecting period one generation above 85% can be used to

offset any output shortfalls in the second period, which

runs through the end of the PPAs on December 31, 2004.

Included in the planned generation sold forward

percentages are contracts entered into in 2003 that are not

unit contingent but are firm contracts containing liquidated

damages provisions. These firm contracts are for 1% of

Non-Utility Nuclear’s planned generation in 2005, 4% in

2006, 2% in 2007, and 0% in 2008.

In addition to selling the power produced by its plants,

the Non-Utility Nuclear business sells installed capacity to

load-serving distribution companies in order for those

companies to meet requirements placed on them by the

Independent System Operators in their area. Following is

a summary of the amount of the Non-Utility Nuclear busi-

ness’ installed capacity that is currently sold forward, and

the blended amount of the Non-Utility Nuclear business’

planned generation output and installed capacity that is

currently sold forward:

2004 2005 2006 2007 2008

Non-Utility Nuclear:

Percent of capacity sold forward:

Bundled capacity and

energy contracts 55% 15% 12% 13% 13%

Capacity contracts 28% 15% 6% 3% –

Total 83% 30% 18% 16% 13%

Planned MW in operation 4,111 4,203 4,203 4,203 4,203

Average capacity contract

price per kW per month $2.4 $1.3 $0.6 $0.7 N/A

Blended Capacity and Energy

(based on revenues)

% of planned generation and

capacity sold forward 99% 49% 28% 13% 4%

Average contract

revenue per MWh $ 39 $ 37 $ 35 $ 34 $ 38

As of December 31, 2003, approximately 99% of Entergy’s

counterparties to Non-Utility Nuclear’s energy and capacity

contracts have investment grade credit ratings.