Entergy 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nuclear –

Talented Cast, Outstanding Production

s the nation’s second-largest nuclear generator with 10 units totaling nearly

9,000 MW, Entergy has broad, deep expertise. We’re applying that expertise to

increase production and reduce costs at our own plants, and to provide management

and decommissioning services to other nuclear owners.

Building a Nuclear Services Business

Entergy Nuclear opened up a new avenue of growth when the Nebraska Public Power District

selected Entergy over other nuclear operating companies to provide management services to the

Cooper Nuclear Station. Entergy began managing the 800 MW plant in October 2003.

Providing management services to nuclear owners represents another way – in addition to

acquisitions – that we can grow revenues and earnings from the nuclear business. The Cooper

contract will provide Entergy $10-20 million in annual earnings in a business that requires no

capital investment, while providing NPPD’s customers the benefits of more efficient operations

and lower costs.

Our management contract at Cooper is a model we believe that other nuclear owners will find

attractive. We have ample expertise within Entergy to supply management services to more

plants. In the future, we hope to secure additional plant management contracts that not only

provide a source of income but also include a right of first refusal should the plant be sold.

Setting the Stage for Further Growth

Entergy is taking steps to maintain growth in our nuclear business by increasing capacity,

reducing costs, securing cash flows, and extending the lives of our plants.

In 2003, Entergy completed uprates that added 46 MW of nuclear capacity to our Northeast

fleet, and we plan 110 MW of additional uprates in 2004. As a general rule of thumb, we can

increase earnings by about 1 percent for every 50 MW of nuclear uprates.

Entergy Nuclear has a productivity

improvement target to reduce annual

operation and maintenance expenses by

$135 million by 2006 compared to 2002

baseline amounts. We took a big step when we

completed the Voluntary Severance Program

in December 2003. Almost 375 nuclear

employees in the Northeast participated,

producing annual savings of nearly $26

million after tax from reduced staffing. We

carefully identified and timed staff reductions

to ensure the continued safety, security, and

reliability of our nuclear plants.

We continue to reduce the time that nuclear

plants are off line for refueling by performing

more maintenance work while plants are

operating, and by better planning and

preparation in advance of outages. In October

2003, ANO Unit 2 completed the shortest and

ENTERGY CORPORATION AND SUBSIDIARIES 2003

A

2003 Goals

(in 2002 Annual Report)

Continue to improve productivity

at Northeast plants, reducing

average fleet operating costs.

Sell or hedge at least 75 percent of

2005 output and 50 percent of

2006 output from our Northeast

plants by year-end 2003.

Increase output at Pilgrim and

Indian Point 2 through power

uprates scheduled for 2003, on

time and on budget.

Performance Review

Club Nuclear

Virtuoso performance in every way from hitting the high notes on

productivity to building the power through successful uprates – and

closing the deal on forward sales.

2003 Performance

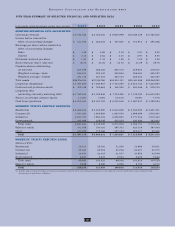

Achieved average production costs of

$20/MWh, 31 percent below $29/MWh

prior to Entergy ownership.

Reached agreements to sell forward

54 percent of 2005 output and 45

percent of 2006 output.

Completed 14 MW uprates at IP 2

and IP 3 and 18 MW uprate at

Pilgrim in 2003. Additional 44 MW

uprate scheduled for IP 2 in 2004.

Rating:

15