Entergy 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

ENTERGY CORPORATION AND SUBSIDIARIES 2003

MANAGEMENT’S FINANCIAL DISCUSSION AND ANALYSIS

continued

EKT also has master netting agreements in place.

These agreements allow EKT to offset cash and

non-cash gains and losses arising from derivative

instruments with the same counterparty. EKT’s policy

is to have such master netting agreements in place

with significant counterparties.

Based on EKT’s policies, risk exposures, and valuation

adjustments related to credit, EKT does not anticipate a

material adverse effect on its financial position as a result

of counterparty nonperformance. As of December 31, 2003,

approximately 91% of EKT’s counterparty credit exposure

is associated with companies that have at least investment

grade credit ratings.

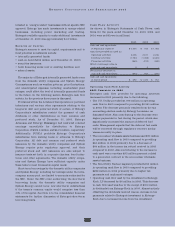

Following are EKT’s mark-to-market assets (liabilities)

and the period within which the assets (liabilities) would be

realized (paid) in cash if they are held to maturity and

market prices are unchanged (in millions):

Maturities and Sources

for Fair Value of Trading 0-12 13-24 25+

Contracts at December 31, 2003 months months months Total

Prices actively quoted $126.3 $(87.1) $(14.6) $24.6

Prices provided by

other sources 4.8 (10.1) 5.6 0.3

Prices based on models (28.0) 14.2 4.9 (8.9)

Total $ 103.1 $ (83.0) $ (4.1) $ 16.0

Following is a roll-forward of the change in the fair value

of EKT’s mark-to-market contracts during 2003 (in millions):

2003

Fair value of contracts outstanding

at December 31, 2002 after implementation

of Emerging Issues Task Force (EITF) 02-03 $ 90.9

(Gain)/loss from contracts

realized/settled during the year (580.0)

Net option premiums received during the year 275.7

Change in fair value of contracts attributable

to market movements during the year 229.4

Net change in contracts outstanding

during the year (74.9)

Fair value of contracts at December 31, 2003 $ 16.0

Foreign Currency Exchange Rate Risk

Entergy Gulf States, System Fuels, and Entergy’s Non-

Utility Nuclear business enter into foreign currency forward

contracts to hedge the Euro-denominated payments due

under certain purchase contracts. The notional amounts of

the foreign currency forward contracts are 142.8 million

Euro and the forward currency rates range from .8641 to

1.085. The maturities of these forward contracts depend on

the purchase contract payment dates and range in time

from January 2004 to January 2007. The mark-to-market

valuation of the forward contracts at December 31, 2003

was a net asset of $50 million. The counterparty banks

obligated on these agreements are rated by Standard &

Poor’s Rating Services at AA on their senior debt obligations

as of December 31, 2003.

Interest Rate and Equity Price Risk -

Decommissioning Trust Funds

Entergy’s nuclear decommissioning trust funds are

exposed to fluctuations in equity prices and interest rates.

The Nuclear Regulatory Commission (NRC) requires

Entergy to maintain trusts to fund the costs of decommis-

sioning ANO 1, ANO 2, River Bend, Waterford 3, Grand

Gulf 1, Pilgrim, Indian Point 1 and 2, and Vermont Yankee

(NYPA currently retains the decommissioning trusts and

liabilities for Indian Point 3 and FitzPatrick). The funds are

invested primarily in equity securities; fixed-rate, fixed-

income securities; and cash and cash equivalents.

Management believes that exposure of the various funds to

market fluctuations will not affect Entergy’s financial

results of operations as it relates to the ANO 1 and 2, River

Bend, Grand Gulf 1, and Waterford 3 trust funds because of

the application of regulatory accounting principles. The

Pilgrim, Indian Point 1 and 2, and Vermont Yankee trust

funds collectively hold approximately $895 million of fixed-

rate, fixed-income securities as of December 31, 2003. These

securities have an average coupon rate of approximately

5.6%, an average duration of approximately 5.2 years, and

an average maturity of approximately 7.9 years. The

Pilgrim, Indian Point 1 and 2, and Vermont Yankee trust

funds also collectively hold equity securities worth

approximately $450 million as of December 31, 2003. These

securities are generally held in funds that are designed to

approximate or somewhat exceed the return of the Standard

& Poor’s 500 Index, and a relatively small percentage of the

securities are held in a fund intended to replicate the return

of the Wilshire 4500 Index. The decommissioning trust

funds are discussed more thoroughly in Notes 1 and 9 to

the consolidated financial statements.

UTILITY RESTRUCTURING

In Entergy’s U.S. Utility service territory, movement to

retail competition either has not occurred or has been

abandoned, with the exception of Texas, where it has been

significantly delayed. At FERC, the pace of restructuring at

the wholesale level has begun but has also been delayed. It

is too early to predict the ultimate effects of changes in U.S.

energy markets. Restructuring issues are complex and are

continually affected by events at the national, regional,

state, and local levels. These changes may result, in the

long-term, in fundamental changes in the way traditional

integrated utilities and holding company systems, like the

Entergy system, conduct their business. Some of these

changes may be positive for Entergy, while others may not be.