Entergy 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

ENTERGY CORPORATION AND SUBSIDIARIES 2003

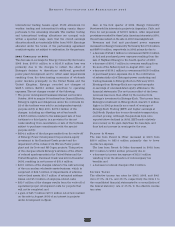

Following is a summary of the amount of Energy

Commodity Services’ output and installed capacity that

is currently sold forward under physical or financial

contracts at fixed prices:

2004 2005 2006 2007 2008

Energy Commodity Services:

Capacity

Planned MW in operation 1,911 1,911 1,911 1,911 1,911

% of capacity sold forward 43% 43% 34% 31% 26%

Energy

Planned generation (GWh) 3,321 3,348 3,337 3,545 4,015

% of planned generation

sold forward 64% 67% 52% 42% 39%

Blended Capacity and Energy

(based on revenues)

% of planned energy and

capacity sold forward 62% 66% 50% 41% 35%

Average contract

revenue per MWh $26 $25 $27 $31 $28

The increase in the planned generation sold forward

percentages from the percentages in the 2002 Annual

Report is attributable to Entergy Louisiana and Entergy

New Orleans contracts involving RS Cogen and

Independence 2 entered into in 2003. These contracts are

still subject to a FERC review proceeding scheduled for

hearing later in 2004.

Entergy continually monitors industry trends in order to

determine whether asset impairments or other losses could

result from a decline in value, or cancellation, of merchant

power projects, and records provisions for impairments and

losses accordingly.

MARKETING AND TRADING

The earnings of Entergy’s Energy Commodity Services

segment are exposed to commodity price market risks

primarily through Entergy’s 50%-owned, unconsolidated

investment in Entergy-Koch. Entergy-Koch Trading (EKT)

uses value-at-risk models as one measure of the market risk

of a loss in fair value for EKT’s natural gas and power

trading portfolio. Actual future gains and losses in portfolios

will differ from those estimated based upon actual fluctua-

tions in market rates, operating exposures, and the timing

thereof, and changes in the portfolio of derivative financial

instruments during the year.

To manage its portfolio, EKT enters into various

derivative and contractual transactions in accordance with

the policy approved by the trading committee of the governing

board of Entergy-Koch. The trading portfolio consists of

physical and financial natural gas and power as well as other

energy and weather-related contracts. These contracts take

many forms, including futures, forwards, swaps, and options.

Characteristics of EKT’s value-at-risk method and the use

of that method are as follows:

Value-at-risk is used in conjunction with stress testing,

position reporting, and profit and loss reporting in

order to measure and control the risk inherent in the

trading and mark-to-market portfolios.

EKT estimates its value-at-risk using a model based on

J.P. Morgan’s Risk Metrics methodology combined with

a Monte Carlo simulation approach.

EKT estimates its daily value-at-risk for natural gas

and power using a 97.5% confidence level. EKT’s daily

value-at-risk is a measure that indicates that, if prices

moved against the positions, the loss in neutralizing the

portfolio would not be expected to exceed the calculated

value-at-risk.

EKT seeks to limit the daily value-at-risk on any given

day to a certain dollar amount approved by the trading

committee.

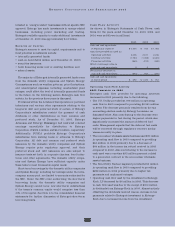

EKT’s value-at-risk measures, which it calls Daily Earnings

at Risk (DE@R), for its trading portfolio were as follows

(in millions):

2003 2002 2001

DE@R at the end of the year $ 9.6 $15.2 $5.5

Average DE@R for the year $13.6 $10.8 $6.4

Low DE@R for the year $ 5.9 $ 6.6 $3.6

High DE@R for the year $35.2 $16.9 $8.0

EKT’s DE@R at the end of the year was lower in 2003

compared to 2002 as a result of reduced strength of point-of-

view during the second half of 2003. EKT’s average DE@R

increased in 2003 compared to 2002 as a result of an increase

in the size of the position held, particularly during the first

quarter of 2003. EKT’s average DE@R increased in 2002

compared to 2001 as a result of an increase in the size of the

position held and an increase in the volatility of natural gas

prices in the latter part of the year.

For all derivative and contractual transactions, EKT is

exposed to losses in the event of nonperformance by counter-

parties to these transactions. Relevant considerations when

assessing EKT’s credit risk exposure include:

EKT’s operations are primarily concentrated in the

energy industry.

EKT’s trade receivables and other financial instruments

are predominantly with energy, utility, and financial

services related companies, as well as other trading

companies in the U.S., UK, and Western Europe.

EKT maintains credit policies, which its management

believes minimize overall credit risk.

Prospective and existing customers are reviewed for

creditworthiness based upon pre-established standards,

with customers not meeting minimum standards

providing various secured payment terms, including

the posting of cash collateral.