Entergy 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

ENTERGY CORPORATION AND SUBSIDIARIES 2003

included in the fuel adjustment filings. Testimony was filed

on behalf of the plaintiffs in this proceeding asserting,

among other things, that Entergy New Orleans and other

defendants have engaged in fuel procurement and power

purchasing practices and included costs in Entergy New

Orleans’ fuel adjustment that could have resulted in

New Orleans customers being overcharged by more than

$100 million over a period of years. Hearings were held in

February and March 2002. In February 2004, the City

Council approved a resolution that results in a refund to

customers of $11.3 million, including interest, during the

months of June through September 2004. Entergy New

Orleans has accrued for this liability as of December 31,

2003. The resolution concludes, among other things, that

the record does not support an allegation that Entergy New

Orleans’ actions or inactions, either alone or in concert with

Entergy or any of its affiliates, constituted a misrepresentation

or a suppression of the truth made in order to obtain an

unjust advantage of Entergy New Orleans, or to cause loss,

inconvenience, or harm to its ratepayers. The plaintiffs

have appealed the City Council resolution to the state court

in Orleans Parish.

SYSTEM ENERGY’S1995 RATE PROCEEDING

System Energy applied to FERC in May 1995 for a rate

increase, and implemented the increase in December 1995.

The request sought changes to System Energy’s rate schedule,

including increases in the revenue requirement associated

with decommissioning costs, the depreciation rate, and the

rate of return on common equity. The request proposed a

13% return on common equity. In July 2000, FERC

approved a rate of return of 10.58% for the period December

1995 to the date of FERC’s decision, and prospectively

adjusted the rate of return to 10.94% from the date of FERC’s

decision. FERC’s decision also changed other aspects of

System Energy’s proposed rate schedule, including the

depreciation rate and decommissioning costs and their

methodology. FERC accepted System Energy’s compliance

tariff in November 2001. System Energy made refunds to

the domestic utility companies in December 2001.

In accordance with regulatory accounting principles,

during the pendency of the case, System Energy recorded

reserves for potential refunds against its revenues. Upon

the order becoming final, Entergy Arkansas, Entergy

Louisiana, Entergy Mississippi, Entergy New Orleans, and

System Energy recorded entries to spread the impacts of

FERC’s order to the various revenue, expense, asset, and

liability accounts affected, as if the order had been in place

since commencement of the case in 1995. System Energy

also recorded an additional reserve amount against its

revenue, to adjust its estimate of the impact of the order,

and recorded additional interest expense on that reserve.

System Energy also recorded reductions in its depreciation

and its decommissioning expenses to reflect the lower levels

in FERC’s order, and reduced tax expense affected by the order.

FERC SETTLEMENT

In November 1994, FERC approved an agreement settling

a long-standing dispute involving income tax allocation

procedures of System Energy. In accordance with the

agreement, System Energy has been refunding a total of

approximately $62 million, plus interest, to Entergy

Arkansas, Entergy Louisiana, Entergy Mississippi, and

Entergy New Orleans through June 2004. System Energy

also reclassified from utility plant to other deferred debits

approximately $81 million of other Grand Gulf 1 costs.

Although such costs are excluded from rate base, System

Energy is amortizing and recovering these costs over a

10-year period. Interest on the $62 million refund and the

loss of the return on the $81 million of other Grand Gulf 1

costs is reducing Entergy’s and System Energy’s net

income by approximately $10 million annually.

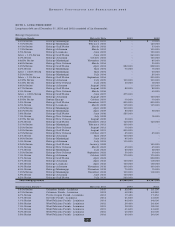

NOTE 3. INCOME TAXES

Income tax expenses for 2003, 2002, and 2001 consist of the

following (in thousands):

2003 2002 2001

Current

Federal (a) $ (731,129) $ 510,109 $321,085

Foreign 8,284 (3,295) 3,355

State (a) 23,396 43,788 53,565

Total (a) (699,449) 550,602 378,005

Deferred - net 1,307,092 (233,532) 110,944

Investment tax credit

adjustments - net (27,644) (23,132) (23,192)

Recorded income tax expense $ 579,999 $ 293,938 $465,757

(a) The actual cash taxes paid/(received) were $188,709 in 2003, $57,856 in 2002, and

($113,466) in 2001. Entergy Louisiana’s mark-to-market tax accounting election

significantly reduced taxes paid in 2001 and 2002. In 2001, Entergy Louisiana

changed its method of accounting for tax purposes related to the contract to

purchase power from the Vidalia project (the contract is discussed in Note 9 to the

consolidated financial statements). The new tax accounting method has provided a

cumulative cash flow benefit of approximately $805 million through 2003, which is

expected to reverse in the years 2005 through 2031. The election did not reduce book

income tax expense. The timing of the reversal of this benefit depends on several

variables, including the price of power. Approximately half of the consolidated cash

flow benefit of the election occurred in 2001 and the remainder occurred in 2002.

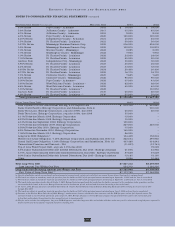

Total income taxes differ from the amounts computed by

applying the statutory income tax rate to income before

taxes. The reasons for the differences for the years 2003,

2002, and 2001 are (in thousands):

2003 2002 2001

Computed at statutory rate (35%) $535,663 $320,954 $425,692

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 54,024 44,835 45,124

Regulatory differences-

utility plant items 52,638 29,774 11,890

Amortization of investment

tax credits (24,364) (22,294) (22,488)

Flow-through/permanent

differences (30,221) (38,197) (20,698)

U.S. tax on foreign income 7,888 (28,416) 21,422

Other - net (15,629) (12,718) 4,815

Total income taxes $579,999 $293,938 $465,757

Effective income tax rate 37.9% 32.1% 38.3%