Entergy 2003 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

ENTERGY CORPORATION AND SUBSIDIARIES 2003

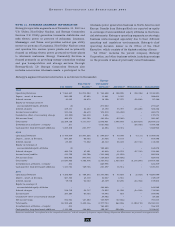

Equity Compensation Plan Information

Entergy has two plans that grant stock options, equity

awards, and incentive awards to key employees of the

Entergy subsidiaries. The Equity Ownership Plan is a

shareholder-approved stock-based compensation plan. The

Equity Awards Plan is a Board-approved stock-based com-

pensation plan. Stock options are granted at exercise prices

not less than market value on the date of grant. The majority

of options granted in 2003, 2002, and 2001 will become

exercisable in equal amounts on each of the first three

anniversaries of the date of grant. Options expire ten years

after the date of the grant if they are not exercised.

Beginning in 2001, Entergy began granting most of the

equity awards and incentive awards earned under its stock

benefit plans in the form of performance units, which are

equal to the cash value of shares of Entergy Corporation

common stock at the time of payment. In addition to the

potential for equivalent share appreciation or depreciation,

performance units will earn the cash equivalent of the

dividends paid during the performance period applicable to

each plan. The amount of performance units awarded will

not reduce the amount of securities remaining under the

current authorizations. The costs of equity and incentive

awards, given either as company stock or performance

units, are charged to income over the period of the grant or

restricted period, as appropriate. In 2003, 2002, and 2001,

$45 million, $28 million, and $14 million, respectively, was

charged to compensation expense.

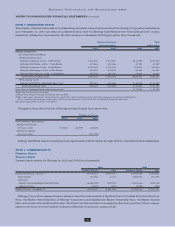

Entergy was assisted by external valuation firms to deter-

mine the fair value of the stock option grants made in 2003.

The fair value applied to the 2003 grants was an average of

two firms’ option valuations, which included adjustments

for factors such as lack of marketability, stock retention

requirements, and regulatory restrictions on exercisability.

In 2002 and 2001, the fair value of each option grant was

estimated on the date of grant using the Black-Scholes

option-pricing model, without any such adjustments. The

stock option weighted-average assumptions used in deter-

mining the fair values were as follows:

2003 2002 2001

Stock price volatility 26.3% 27.2% 26.3%

Expected term in years 6.2 5.0 5.0

Risk-free interest rate 3.3% 4.2% 4.9%

Dividend yield 3.3% 3.2% 3.4%

Dividend payment $1.40 $1.32 $1.26

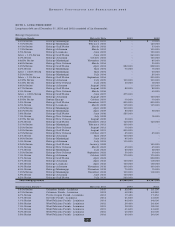

Stock option transactions are summarized as follows:

2003 2002 2001

Number Average Number Average Number Average

of Options Exercise Price of Options Exercise Price of Options Exercise Price

Beginning-of-year balance 19,943,114 $35.85 17,316,816 $31.06 11,468,316 $25.52

Options granted 2,936,236 44.98 8,168,025 41.72 8,602,300 36.96

Options exercised (6,927,000) 33.12 (4,877,688) 28.62 (2,407,783) 25.85

Options forfeited (522,967) 40.98 (664,039) 36.36 (346,017) 30.35

End-of-year balance 15,429,383 $38.64 19,943,114 $35.85 17,316,816 $31.06

Options exercisable at year-end 6,153,043 $34.82 4,837,511 $31.39 2,923,452 $27.35

Weighted-average fair value

of options at time of grant $6.86 $9.22 $8.14

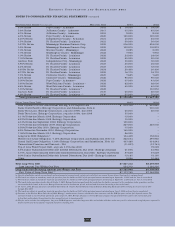

The following table summarizes information about stock options outstanding as of December 31, 2003:

Options Outstanding Options Exercisable

Weighted- Number

Range of As of Average Remaining Weighted-Average Exercisable Weighted-Average

Exercise Prices 12/31/2003 Contractual Life-Years Exercise Price at 12/31/03 Exercise Price

$18 - $30.99 2,310,500 5.9 $26.35 2,258,750 $26.30

$31 - $42.99 10,286,108 7.7 $39.65 2,048,780 $36.82

$43 - $55.99 2,832,775 8.8 $45.02 1,845,513 $43.04

$18 - $55.99 15,429,383 7.6 $38.64 6,153,043 $34.82