Entergy 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

ENTERGY CORPORATION AND SUBSIDIARIES 2003

Lease payments are based on nuclear fuel use. The total

nuclear fuel lease payments (principal and interest) as well

as the separate interest component charged to operations

by the domestic utility companies and System Energy

were $142.0 million (including interest of $11.8 million) in

2003, $137.8 million (including interest of $11.3 million) in

2002, and $149.3 million (including interest of $17.2 million)

in 2001.

SALE AND LEASEBACK TRANSACTIONS

In 1988 and 1989, System Energy and Entergy Louisiana,

respectively, sold and leased back portions of their owner-

ship interests in Grand Gulf 1 and Waterford 3 for 26 1/2-

year and 28-year lease terms, respectively. Both companies

have options to terminate the leases, to repurchase the sold

interests, or to renew the leases at the end of their terms.

Under System Energy’s sale and leaseback arrange-

ments, letters of credit are required to be maintained to

secure certain amounts payable for the benefit of the equi-

ty investors by System Energy under the leases. The cur-

rent letters of credit are effective until March 20, 2003.

Entergy Louisiana did not exercise its option to repur-

chase the undivided interests in Waterford 3 in September

1994. As a result, Entergy Louisiana was required to provide

collateral for the equity portion of certain amounts payable

by Entergy Louisiana under the leases. Such collateral was

in the form of a new series of non-interest bearing first mort-

gage bonds in the aggregate principal amount of $208.2 mil-

lion issued by Entergy Louisiana in September 1994.

In July 1997, Entergy Louisiana caused the Waterford 3

lessors to issue $307.6 aggregate principal amount of

Waterford 3 Secured Lease Obligation Bonds, 8.09% Series

due 2017, to refinance the outstanding bonds originally

issued to finance the purchase of the undivided interests by

the lessors. The lease payments have been reduced to reflect

the lower interest costs.

As of December 31, 2003, System Energy and Entergy

Louisiana had future minimum lease payments, recorded

as long-term debt (reflecting an overall implicit rate of

7.02% and 7.45%, respectively) as follows (in thousands):

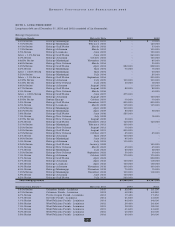

Entergy System

Louisiana Energy

2004 $ 31,739 $ 36,133

2005 14,554 52,253

2006 18,262 52,253

2007 18,754 52,253

2008 22,606 52,253

Years thereafter 366,514 365,176

Total $472,429 $610,321

Less: Amount representing interest 209,895 206,853

Present value of net

minimum lease payments $262,534 $403,468

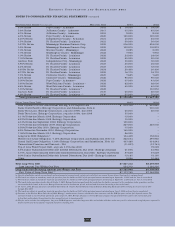

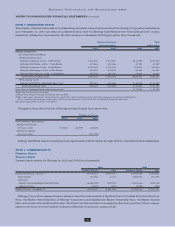

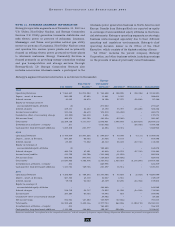

NOTE 11. RETIREMENT, OTHER

POSTRETIREMENT BENEFITS, AND

DEFINED CONTRIBUTION PLANS

PENSION PLANS

Entergy has seven pension plans covering substantially all

of its employees: “Entergy Corporation Retirement Plan

for Non-Bargaining Employees,” “Entergy Corporation

Retirement Plan for Bargaining Employees,” “Entergy

Corporation Retirement Plan II for Non-Bargaining

Employees,” “Entergy Corporation Retirement Plan II for

Bargaining Employees,” “Entergy Corporation Retirement

Plan III,” “Entergy Corporation Retirement Plan IV for

Non-Bargaining Employees,” and “Entergy Corporation

Retirement Plan IV for Bargaining Employees.” Except for

the Entergy Corporation Retirement Plan III, the pension

plans are noncontributory and provide pension benefits that

are based on employees’ credited service and compensation

during the final years before retirement. The Entergy

Corporation Retirement Plan III includes a mandatory

employee contribution of 3% of earnings during the first 10

years of plan participation, and allows voluntary contribu-

tions from 1% to 10% of earnings for a limited group of

employees. Entergy Corporation and its subsidiaries fund

pension costs in accordance with contribution guidelines

established by the Employee Retirement Income Security Act

of 1974, as amended, and the Internal Revenue Code of 1986,

as amended. The assets of the plans include common and

preferred stocks, fixed-income securities, interest in a money

market fund, and insurance contracts. As of December 31,

2003 and December 31, 2002, Entergy recognized an

additional minimum pension liability for the excess of the

accumulated benefit obligation over the fair market value

of plan assets. In accordance with FASB 87, an offsetting

intangible asset, up to the amount of any unrecognized prior

service cost, was also recorded, with the remaining offset to

the liability recorded as a regulatory asset reflective of the

recovery mechanism for pension costs in Entergy’s jurisdic-

tions. Entergy’s domestic utility companies’ and System

Energy’s pension costs are recovered from customers as a

component of cost of service in each of its jurisdictions.

Entergy uses a December 31 measurement date for its

pension plans.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

continued