Entergy 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

Table of contents

-

Page 1

-

Page 2

... nuclear generator in the United States. Entergy delivers electricity to 2.6 million utility customers in Arkansas, Louisiana, Mississippi, and Texas. Through Entergy-Koch, LP, it is a leading provider of wholesale energy marketing and trading services, as well as an operator of natural gas pipeline...

-

Page 3

...performance at Entergy. In this report, we measure how Entergy performed in 2003 against the goals and aspirations advanced in last year's annual report. We also update our goals and outline steps we're taking to maintain a high standard of performance. For a company that calls New Orleans home, the...

-

Page 4

... lost-time accidents reached a new low in 2003, but we have suffered an employee fatality in each of the past two years. Entergy's balance sheet and cash flow continue to strengthen, but our credit rating lags both our performance and our industry peers. Entergy's stock price has reached a number of...

-

Page 5

... we did in our New Orleans rate case last year. Entergy New Orleans obtained a $30 million base rate increase, but the customers' retail bill was less as we implemented an innovative plan to acquire generation supplies at the lowest cost, replacing more expensive power purchases and less-reliable...

-

Page 6

... breakdowns don't occur in other areas.

"

Entergy CEO Wayne Leonard and Rev. Hezekiah Stewart, Founder and Executive Director of the Watershed Human and Community Development Agency in Little Rock, Arkansas, get together after Leonard's keynote address during a celebration of Watershed's 25th...

-

Page 7

...have not changed. They are: gas pipelines and gas storage; nuclear generating plants and fossil plants which can be used to meet the needs of our utility customers. We determine the optimal capital structure for Entergy to best manage financial risk, given the company's overall business risk. In our...

-

Page 8

... Cooper contract as a model for providing our expertise to other nuclear owners. With investments targeted to improve reliability nearly complete, system performance and reliability continued to improve in 2003 and reliability complaints to regulators hit new lows. But measures of customer service...

-

Page 9

...those who built a great company, and acknowledge the serious responsibility to maintain that legacy for investors, customers, and employees. And we thank you, our audience, for your attention and support.

"

ROBERT

V. D .

L U F T,

J . W AY N E L E O N A R D , CHIEF EXECUTIVE OFFICER

CHAIRMAN

7

-

Page 10

... Energy Awards in December 2003, Entergy was named the Global Energy Company of the Year and Wayne Leonard was recognized as the CEO of the Year.

Maintaining Financial Growth

In July 2003, Entergy's Board of Directors raised the dividend 29 percent to $1.80 per share on an annual basis. The higher...

-

Page 11

... by 2006. In December 2003, Entergy completed a Voluntary Severance Program, designed to achieve necessary staff reductions by offering enhanced severance benefits to eligible employees. A total of 1,100 employees participated. Entergy recorded a one-time after-tax charge of $123 million in...

-

Page 12

... in the transmission service index, a measure of grid reliability, since 1998.

In November 1925, the Louisiana Power Company - which had been formed to take advantage of abundant natural gas found in the state - opened the 30,000-kilowatt Sterlington Station, the largest power plant south of St...

-

Page 13

... acquired to meet customer needs - are offset by fuel savings, as we displace more expensive purchased power and generation from less efficient sources. Most notably, we reached agreement in January 2004 to acquire a natural gas-fired power plant in Perryville, Louisiana, from Cleco Corporation...

-

Page 14

... employees' health and safety, with the Pilgrim and Nelson plants added in 2003. For the fifth consecutive year, Entergy was named by the nation's retail chains for offering the best overall customer service in the Edison Electric Institute's annual Customer Service Awards. And in a 2003 survey...

-

Page 15

...

Once again in 2003 Entergy employees met the challenge of a major storm in our service area. In June, Tropical Storm Bill left nearly 150,000 Entergy customers without power, mostly in the New Orleans area. Entergy employees were also honored with EEI's Emergency Assistance Award for their efforts...

-

Page 16

... are ready.

In 1949, Middle South Utilities was formed as a holding company for Arkansas Power and Light, Louisiana Power and Light, Mississippi Power and Light, and New Orleans Public Service. In these last days of the golden age of radio, the Louisiana Hayride began broadcasting country music in...

-

Page 17

... opened up a new avenue of growth when the Nebraska Public Power District selected Entergy over other nuclear operating companies to provide management services to the Cooper Nuclear Station. Entergy began managing the 800 MW plant in October 2003. Providing management services to nuclear owners...

-

Page 18

... standards of safety for employees and the public.

In 1968, a construction permit was granted for Arkansas Nuclear One Unit 1, to be built near Russellville. In the next several years, the company announced plans for two more nuclear plants: Waterford 3 in Louisiana and Grand Gulf in Mississippi...

-

Page 19

...of Entergy-Koch, LP, a joint venture with Koch Industries. Since that time, EKLP has contributed $343 million to Entergy earnings, with profitability year after

year in its combined energy trading and gas pipeline operations. In 2003, Entergy-Koch's strong balance sheet began providing a new source...

-

Page 20

...assets - electric generation and gas storage and transportation - to reduce their

Entergy-Koch Trading balances point-ofview energy trading with more stable earnings from a growing physical optimization business that manages customerowned power plants and gas distribution systems. EKT has turned in...

-

Page 21

... systems in both the United Sta tes and Europe is a key initia tive for Enterg y-Koch.

Gulf South Focus on Productivity

Results at Gulf South Pipeline suffered from a 17 percent decline in throughput in 2003, as higher gas prices led industrial and power plant customers to switch to fuel...

-

Page 22

... two to three new nuclear services operating contracts with third-party nuclear owners by the end of 2006. 4. Improve results from Entergy-Koch. Goals include: doubling 2002 U.S. assets under management in EKT's physical optimization business by year-end 2005. growing European trading operations to...

-

Page 23

... and execute on a point of view regarding prices of electricity, natural gas, and other energyrelated commodities Entergy-Koch's profitability in trading physical and financial natural gas and power as well as other energy and weather-related contracts changes in the number of participants in the...

-

Page 24

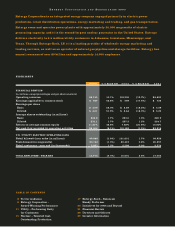

..., except percentages and per share amounts

2003

2002

2001

2000

1999

SELECTED FINANCIAL DATA AS REPORTED:

Operating revenues Income before cumulative effect of accounting changes Earnings per share before cumulative effect of accounting changes Basic Diluted Dividends declared per share Book...

-

Page 25

... the electric power produced by those plants to wholesale customers. This business also provides services to other nuclear power plant owners. E N E R G Y C O M M O D I T Y S E RV I C E S provides energy commodity trading and gas transportation and storage services through Entergy-Koch, LP. Energy...

-

Page 26

... agreement Volume/weather Fuel price System Energy refund in 2001 Other 2002 net revenue $3,873.1 180.7 155.7 94.3 (128.9) 34.7 $4,209.6

Base rates increased net revenue due to base rate increases at Entergy Mississippi and Entergy New Orleans that became effective in January 2003 and June 2003...

-

Page 27

... order addressing System Energy's rate proceeding; interest recognized in 2001 at Entergy Mississippi and Entergy New Orleans on the deferred System Energy costs related to its 1995 rate filing that were not being recovered through rates; and lower interest earned on declining deferred fuel balances...

-

Page 28

...effects of the final FERC order addressing System Energy's 1995 rate filing. The refund was made in December 2001.

E N E R G Y C O M M O D I T Y S E RV I C E S Earnings for Energy Commodity Services in 2003 were primarily driven by Entergy's investment in Entergy-Koch. Following are key performance...

-

Page 29

...of the Saltend plant in August 2001; and a decrease of $139.1 million in revenues and $133.5 million in purchased power expenses due to the contribution of substantially all of Entergy's power marketing and trading business to Entergy-Koch in February 2001. Earnings from Entergy-Koch are reported as...

-

Page 30

... nuclear fuel leases $165

2005

$142

2006

$6

Notes payable, which include borrowings outstanding on credit facilities with original maturities of less than one year, were less than $1 million as of December 31, 2003. Entergy Corporation, Entergy Arkansas, Entergy Louisiana, and Entergy Mississippi...

-

Page 31

... construction agreement with an Entergy subsidiary, Entergy Power Ventures, L.P. (EPV), and with Northeast Texas Electric Cooperative, Inc. (NTEC), providing for the construction by EntergyShaw of a 550 MW electric generating station to be located in Harrison County, Texas. Entergy has guaranteed...

-

Page 32

... Nuclear One Unit 2 (ANO 2) steam generators. The APSC found that the replacement is in the public interest in a declaratory order issued in May 2003. Purchase of the Perryville power plant in Louisiana. In January 2004, Entergy Louisiana signed an agreement to acquire the 718 MW Perryville power...

-

Page 33

... other agreements relating to the long-term debt and preferred stock of certain of Entergy Corporation's subsidiaries restrict the payment of cash dividends or other distributions on their common and preferred stock. As of December 31, 2003, Entergy Arkansas and Entergy Mississippi had restricted...

-

Page 34

...In 2001 Entergy Louisiana changed its method of accounting for tax purposes related to the contract to purchase power from the Vidalia project (the contract is discussed in Note 9 to the consolidated financial statements). The new tax accounting method has provided a cumulative cash flow benefit of...

-

Page 35

... Non-Utility Nuclear business purchased the Vermont Yankee nuclear power plant for $180 million in cash. In September 2001, Entergy's NonUtility Nuclear business purchased the Indian Point 2 nuclear power plant for $600 million in cash. The liabilities to decommission both plants, as well as related...

-

Page 36

... 2004.

Entergy New Orleans

10.25%-12.25%(3)

The City Council approved an agreement in May 2003 allowing for a $30.2 million increase in base rates effective June 1, 2003 and approved the implementation of formula rate plans for the electric and gas service that will be evaluated annually until...

-

Page 37

... and other aspects of Entergy System or domestic utility company contracts or assets that may not be subject to their respective jurisdictions. For instance, in its Order of Investigation, the APSC discusses aspects of Entergy Louisiana's power purchases from the Vidalia project, and the APSC has...

-

Page 38

... of electricity from the power generation plants owned by Entergy's Non-Utility Nuclear business and Energy Commodity Services, unless otherwise contracted, is subject to the fluctuation of market power prices. Entergy's Non-Utility Nuclear business has entered into power purchase agreements (PPAs...

-

Page 39

... with the policy approved by the trading committee of the governing board of Entergy-Koch. The trading portfolio consists of physical and financial natural gas and power as well as other energy and weather-related contracts. These contracts take many forms, including futures, forwards, swaps, and...

-

Page 40

... are exposed to fluctuations in equity prices and interest rates. The Nuclear Regulatory Commission (NRC) requires Entergy to maintain trusts to fund the costs of decommissioning ANO 1, ANO 2, River Bend, Waterford 3, Grand Gulf 1, Pilgrim, Indian Point 1 and 2, and Vermont Yankee (NYPA currently...

-

Page 41

... a number of other changes that may result from electric business competition and unbundling, including, but not limited to, changes to labor relations, management and staffing, structure of operations, environmental compliance responsibility, and other aspects of the utility business.

Transmission...

-

Page 42

... resources in its service territory, such as the pending purchase of the Perryville power plant by Entergy Louisiana.

"Entergy does not expect that retail open access is likely to begin for Entergy Gulf States before the first quarter of 2005."

INTERCONNECTION ORDERS

In January 2003, FERC...

-

Page 43

... domestic utility companies, System Energy, and NonUtility Nuclear subsidiaries own and operate ten nuclear power generating units and the shutdown Indian Point 1 nuclear reactor. Entergy is, therefore, subject to the risks related to owning and operating nuclear plants. These include risks from the...

-

Page 44

... have raised concerns about safety issues associated with Entergy's Indian Point power plants located in New York. They argue that Indian Point's security measures and emergency plans do not provide reasonable assurance to protect the public health and safety. The NRC has original jurisdiction over...

-

Page 45

... of these implications by business segment follow.

U.S. Utility

Entergy collects substantially all of the projected costs of decommissioning the nuclear facilities in its U.S. Utility business segment through rates charged to customers, except for portions of River Bend, which is discussed in...

-

Page 46

... a decrease in electric plant in service of $315 million, and an increase in earnings of approximately $155 million net-of-tax ($0.67 per share) as a result of the one-time cumulative effect of accounting change. Also, Entergy's 2003 earnings for the Non-Utility Nuclear business increased by...

-

Page 47

... Energy commodity inventories held by trading companies such as physical natural gas are accounted for at the lower of cost or market. The adoption of the consensus had minimal cumulative and ongoing earnings effects for Entergy's Energy Commodity Services business. As required by generally accepted...

-

Page 48

... BENEFITS Entergy sponsors defined benefit pension plans which cover substantially all employees. Additionally, Entergy provides postretirement health care and life insurance benefits for substantially all employees who reach retirement age while still working for Entergy. Entergy's reported...

-

Page 49

...and taxes. Net income for 2003 and 2002 were not affected. Total postretirement health care and life insurance benefit costs for Entergy in 2003 were $165 million, including a $64 million charge related to the voluntary severance program. In December 2003, the Medicare Prescription Drug, Improvement...

-

Page 50

... concluded

OTHER CONTINGENCIES Entergy, as a company with multi-state domestic utility operations, and which also had investments in international projects, is subject to a number of federal, state, and international laws and regulations and other factors and conditions in the areas in which it...

-

Page 51

... are carried out with a high standard of business conduct.

To the Board of Directors and Shareholders of Entergy Corporation:

J. WAYNE LEONARD Chief Executive Officer

LEO P. DENAULT Executive Vice President and Chief Financial Officer

We have audited the accompanying consolidated balance sheets...

-

Page 52

...Domestic electric Natural gas Competitive businesses Total

OPERATING EXPENSES:

Operating and maintenance: Fuel, fuel-related expenses, and gas purchased for resale Purchased power Nuclear refueling outage expenses Provision for turbine commitments, asset impairments, and restructuring charges Other...

-

Page 53

...accounting change regarding fair value of derivative instruments Net derivative instrument fair value changes arising during the period Foreign currency translation adjustments Minimum pension... - Beginning of period Add: Common stock issuances related to stock plans Paid-in Capital - End of period...

-

Page 54

...at cost (less accumulated depreciation) Other Total P R O P E R T Y, P L A N T A N D E Q U I P M E N T : Electric Property under capital lease Natural gas Construction work in progress Nuclear fuel under capital lease Nuclear fuel Total property, plant and equipment Less-accumulated depreciation and...

-

Page 55

... thousands, as of December 31,

2003

2002

LIABILITIES AND SHAREHOLDERS' EQUITY

CURRENT LIABILITIES: Currently maturing long-term debt Notes payable Accounts payable Customer deposits Taxes accrued Accumulated deferred income taxes Nuclear refueling outage costs Interest accrued Obligations under...

-

Page 56

... for equity funds used during construction Nuclear fuel purchases Proceeds from sale/leaseback of nuclear fuel Proceeds from sale of assets and businesses Investment in non-utility properties Decrease (increase) in other investments Changes in other temporary investments Decommissioning trust...

-

Page 57

... capitalized Income taxes Noncash investing and financing activities: Debt assumed by the Damhead Creek purchaser Decommissioning trust funds acquired in nuclear power plant acquisitions Long-term debt refunded with proceeds from long-term debt issued in prior period Proceeds from long-term debt...

-

Page 58

... FUEL COSTS The domestic utility companies generate, transmit, and distribute electric power primarily to retail customers in Arkansas, Louisiana, including the City of New Orleans, Mississippi, and Texas. Entergy Gulf States distributes gas to retail customers in and around Baton Rouge, Louisiana...

-

Page 59

... were as follows ($ in millions):

Total Megawatt Generating Stations Grand Gulf Unit 1 Independence Units 1 and 2 White Bluff Units 1 and 2 Roy S. Nelson Unit 6 Big Cajun 2 Unit 3 Harrison County Fuel-Type Nuclear Coal Coal Coal Coal Gas Capability(1) 1,207 1,630 1,635 550 575 550 Ownership 90...

-

Page 60

...and amortized over the period to the next outage. In accordance with the regulatory treatment of the River Bend plant, River Bend's costs are accrued in advance and included in the cost of service used to establish retail rates. Entergy Gulf States relieves the accrued liability when it incurs costs...

-

Page 61

... in accounting for those plans. No stockbased employee compensation expense is reflected in 2002 and 2001 net income as all options granted under those plans have an exercise price equal to the market value of the underlying common stock on the date of grant. Effective January 1, 2003, Entergy...

-

Page 62

... for under the equity method of accounting because Entergy's ownership level results in significant influence, but not control, over the investee and its operations. Entergy records its share of earnings or losses of the investee based on the change during the period in the estimated liquidation...

-

Page 63

...equity. Current exchange rates are used for U.S. dollar disclosures of future obligations denominated in foreign currencies. NEW ACCOUNTING PRONOUNCEMENTS During 2003, Entergy adopted the provisions of the following accounting standards: SFAS 143, "Accounting for Asset Retirement Obligations," which...

-

Page 64

... has deferred pursuing retail open access, pending developments at the federal level and in other states. Mississippi The Mississippi Public Service Commission (MPSC) has recommended not pursuing open access at this time. New Orleans The Council of the City of New Orleans, Louisiana (Council or City...

-

Page 65

... recovered or (refunded) through the fuel mechanisms of the domestic utility companies (in millions):

2003

Entergy Arkansas Entergy Gulf States Entergy Louisiana Entergy Mississippi Entergy New Orleans $ 10.6 $118.4 $ 30.6 $ 89.1 $ (2.7)

The domestic utility companies and System Energy are subject...

-

Page 66

...

ENTERGY LOUISIANA

The Louisiana jurisdiction of Entergy Gulf States and Entergy Louisiana recover electric fuel and purchased power costs for the upcoming month based upon the level of such costs from the prior month. Entergy Gulf States' gas rate schedules include estimates for the billing month...

-

Page 67

... for a base rate freeze that has remained in effect during the delay in implementation of retail open access in Entergy Gulf States' Texas service territory.

R E C O V E RY

OF

RIVER BEND COSTS

In March 1998, the PUCT disallowed recovery of $1.4 billion of company-wide abeyed River Bend plant costs...

-

Page 68

... Grand Gulf purchased power over the period October 1, 1998 through June 30, 2004. In May 2003, the MPSC authorized the cessation of the GGART effective July 1, 2003. Entergy

66

In April 1999, a group of ratepayers filed a complaint against Entergy New Orleans, Entergy Corporation, Entergy Services...

-

Page 69

...In 2001, Entergy Louisiana changed its method of accounting for tax purposes related to the contract to purchase power from the Vidalia project (the contract is discussed in Note 9 to the consolidated financial statements). The new tax accounting method has provided a cumulative cash flow benefit of...

-

Page 70

... as follows:

Expiration Company Entergy Arkansas Entergy Louisiana Entergy Mississippi Date April 2004 May 2004 May 2004 Amount of Facility $63 million $15 million $25 million Amount Drawn as of Dec. 31, 2003 - - -

The facilities have variable interest rates and the average commitment fee is 0.14...

-

Page 71

...Gulf States Entergy New Orleans Entergy Gulf States Entergy Arkansas System Energy Entergy Gulf States Entergy Louisiana Entergy Mississippi Entergy Mississippi Entergy Gulf States Entergy New Orleans Entergy New Orleans Entergy Gulf States Entergy Mississippi Entergy New Orleans Entergy Gulf States...

-

Page 72

... 1982, Entergy's nuclear owner/licensee subsidiaries have contracts with the DOE for spent nuclear fuel disposal service. The contracts include a one-time fee for generation prior to April 7, 1983. Entergy Arkansas is the only Entergy company that generated electric power with nuclear fuel prior to...

-

Page 73

...539 2008 $941,625

NOTE 6. COMPANY-OBLIGATED REDEEMABLE PREFERRED SECURITIES

In November 2000, Entergy's Non-Utility Nuclear business purchased the FitzPatrick and Indian Point 3 power plants in a seller-financed transaction. Entergy issued notes to New York Power Authority (NYPA) with seven annual...

-

Page 74

... Authorized and Outstanding 2003 Entergy Corporation U.S. Utility Preferred Stock: Without sinking fund Entergy Arkansas, 4.32% - 7.88% Series Entergy Gulf States, 4.20% - 7.56% Series Entergy Louisiana, 4.16% - 8.00% Series Entergy Mississippi, 4.36% - 8.36% Series Entergy New Orleans, 4.36% - 5.56...

-

Page 75

... not exercised. Beginning in 2001, Entergy began granting most of the equity awards and incentive awards earned under its stock benefit plans in the form of performance units, which are equal to the cash value of shares of Entergy Corporation common stock at the time of payment. In addition to the...

-

Page 76

... as of December 31, 2003. VIDALIA PURCHASED POWER AGREEMENT Entergy Louisiana has an agreement extending through the year 2031 to purchase energy generated by a hydroelectric facility known as the Vidalia project. Entergy Louisiana made payments under the contract of approximately $112.6 million...

-

Page 77

... (NEIL). As of December 31, 2003, Entergy was insured against such losses per the following structures:

U.S. UTILITY PLANTS (ANO 1 RIVER BEND,

AND AND

In addition, the Non-Utility Nuclear plants are also covered under NEIL's Accidental Outage Coverage program. This coverage provides certain fixed...

-

Page 78

... change. The cumulative decommissioning liabilities and expenses recorded in 2003 by Entergy were as follows (in millions):

Liabilities as of Dec. 31, 2002 SFAS 143 Adoption Liabilities as of Dec. 31, 2003

Accretion Spending

ANO 1 & ANO 2 River Bend Waterford 3 Grand Gulf 1 Pilgrim Indian Point...

-

Page 79

...nuclear power plants. The fair values of the decommissioning trust funds and asset retirement obligation-related regulatory assets of Entergy as of December 31, 2003 are as follows (in millions):

Decommissioning Trust Fair Values

ANO 1 & ANO 2 River Bend Waterford 3 Grand Gulf 1 Pilgrim Indian Point...

-

Page 80

... pension benefits that are based on employees' credited service and compensation during the final years before retirement. The Entergy Corporation Retirement Plan III includes a mandatory employee contribution of 3% of earnings during the first 10 years of plan participation, and allows voluntary...

-

Page 81

... health care and life insurance benefits for retired employees. Substantially all domestic employees may become eligible for these benefits if they reach retirement age while still working for Entergy. Entergy uses a December 31 measurement date for its postretirement benefit plans. Effective...

-

Page 82

...'s pension plans was $2.1 billion and $1.7 billion at December 31, 2003 and 2002, respectively.

Entergy's trust asset investment strategy is to invest the assets in a manner whereby long-term earnings on the assets (plus cash contributions) provide adequate funding for retiree benefit payments...

-

Page 83

... During 2003, Entergy offered a voluntary severance program to certain groups of employees. As a result of this program, Entergy recorded additional pension and postretirement costs (including amounts capitalized) of $110.3 million for special termination benefits and plan curtailment charges. These...

-

Page 84

... to the Savings Plan in an amount equal to 75% of the participants' basic contributions, up to 6% of their eligible earnings, in shares of Entergy Corporation common stock if the employees direct their company-matching contribution to the purchase of Entergy Corporation's common stock; or make...

-

Page 85

...

Entergy's reportable segments as of December 31, 2003 are U.S. Utility, Non-Utility Nuclear, and Energy Commodity Services. U.S. Utility generates, transmits, distributes, and sells electric power in portions of Arkansas, Louisiana, Mississippi, and Texas, and provides natural gas utility service...

-

Page 86

...

As of December 31, 2003, Entergy owns material investments in the following companies that it accounts for under the equity method of accounting:

Company Entergy-Koch, LP Ownership interest Description businesses: energy commodity trading, which includes power, gas, weather derivatives, emissions...

-

Page 87

... natural gas and risk management services for electricity and natural gas. The total cost of such services in 2003, 2002, and 2001 was approximately $15.9 million, $11.2 million, and $7.8 million, respectively. In 2003, Entergy Louisiana and Entergy New Orleans entered purchase power agreements with...

-

Page 88

... arrangements and derivatives. Contractual risk management tools include long-term power and fuel purchase agreements, capacity contracts, and tolling agreements. Entergy also uses a variety of commodity and financial derivatives, including natural gas and electricity futures, forwards, swaps, and...

-

Page 89

... common share before the cumulative effect of accounting change for the first quarter of 2003 were $1.13 and $1.10, respectively.

FINANCIAL INSTRUMENTS

The estimated fair value of Entergy's financial instruments is determined using bid prices reported by dealer markets and by nationally recognized...

-

Page 90

... Board in October 2003. Age, 62

W. Frank Blount

Chairman and Chief Executive Officer, JI Ventures, Inc., Atlanta, Georgia. An Entergy director since 1987. Age, 65

OFFICERS

J. Wayne Leonard

Chief Executive Officer. Joined Entergy in 1998 as President and Chief Operating Officer; appointed CEO...

-

Page 91

... the company, will be offered by broker dealers at the time an investor purchases shares and requests that they be registered. An additional feature of DRS enables existing registered holders to deposit physical shares into a book account. ENTERGY COMMON STOCK PRICES The high and low trading prices...

-

Page 92

E N T E R G Y POST NEW

C O R P O R AT I O N BOX LA 61000 70161

OFFICE

ORLEANS,

W W W. E N T E R G Y. C O M