Dollar Tree 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

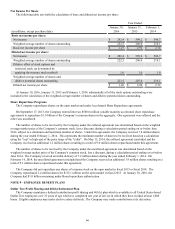

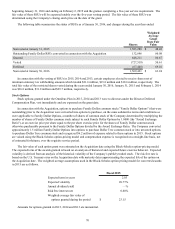

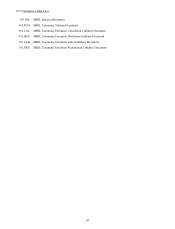

NOTE 12 - QUARTERLY FINANCIAL INFORMATION (Unaudited)

The following table sets forth certain items from the Company's unaudited consolidated income statements for each quarter

of fiscal year 2015 and 2014. The unaudited information has been prepared on the same basis as the audited consolidated

financial statements appearing elsewhere in this report and includes all adjustments, consisting only of normal recurring

adjustments, which management considers necessary for a fair presentation of the financial data shown. On July 6, 2015, the

Company acquired Family Dollar and the results of operations of Family Dollar are included beginning on that date. The

operating results for any quarter are not necessarily indicative of results for a full year or for any future period.

(dollars in millions, except diluted net income per share data) First

Quarter (1) Second

Quarter (4) Third

Quarter Fourth

Quarter

Fiscal 2015:

Net sales $ 2,176.7 $ 3,011.2 $ 4,945.2 $ 5,365.3

Gross profit $ 748.9 $ 855.2 $ 1,400.0 $ 1,652.6

Operating income (2) $ 232.8 $ 123.4 $ 223.7 $ 469.7

Net income (loss) (3) $ 69.5 $ (98.0) $ 81.9 $ 229.0

Diluted net income (loss) per share (3) $ 0.34 $ (0.46) $ 0.35 $ 0.97

Stores open at end of quarter 5,454 13,864 14,038 13,851

Comparable store net sales change 3.1% 2.4% 1.7% 1.3%

Fiscal 2014:

Net sales $ 2,000.3 $ 2,031.1 $ 2,095.2 $ 2,475.6

Gross profit $ 696.6 $ 694.1 $ 725.3 $ 918.1

Operating income (2) $ 231.9 $ 205.0 $ 219.7 $ 383.6

Net income (3) $ 138.3 $ 121.5 $ 133.0 $ 206.6

Diluted net income per share (3) $ 0.67 $ 0.59 $ 0.64 $ 1.00

Stores open at end of quarter 5,080 5,166 5,282 5,367

Comparable store net sales change 1.9% 4.4% 5.9% 5.5%

(1) Easter was observed on April 5, 2015 and April 20, 2014.

(2) In the first, second and third quarters of 2015, the Company incurred $10.4 million, $17.7 million and $11.8 million, respectively, in

selling, general and administrative expenses related to the Acquisition. In the second, third and fourth quarters of 2014, the Company

incurred $7.5 million, $14.3 million and $6.7 million, respectively, related to the Acquisition.

(3) In the first, second and third quarters of 2015, net income (loss) and diluted net income (loss) per share were reduced by the costs related

to the Acquisition noted in (2) above and interest expense related to the debt issued and retired in connection with the Acquisition, each of

which was tax-effected, in the amounts of $76.8 million and $0.37 per share; $151.5 million and $0.70 per share; and $7.3 million and $0.03

per share, respectively. In the second, third and fourth quarters of 2014, net income and diluted net income per share were reduced by the

costs related to the Acquisition noted in (2) above and interest expense related to the debt issued and retired in connection with the

Acquisition, each of which was tax-effected, in the amounts of $4.6 million and $0.02 per share; $9.4 million and $0.05 per share; and $32.4

million or $0.16 per share, respectively.

(4) In addition to the costs noted in (2) and (3) above, gross profit in the second quarter of 2015 was reduced by $60.0 million of markdown

expense related to sku rationalization and planned liquidations and $11.1 million related to the amortization of the stepped-up inventory sold

in the quarter.