Dollar Tree 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

DOLLAR TREE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business

Dollar Tree, Inc. (the Company) is a leading operator of discount retail stores in the United States and Canada. Below are

those accounting policies considered by the Company to be significant.

Acquisition

On July 6, 2015, the Company acquired Family Dollar Stores, Inc. ("Family Dollar") for cash consideration of $6.8 billion

and the issuance of 28.5 million shares of the Company's common stock valued at $2.3 billion based on the closing price of the

Company's common stock on July 2, 2015 (the "Acquisition"). The results of operations of Family Dollar are included in the

Company's results of operations beginning on July 6, 2015.

Principles of Consolidation

The consolidated financial statements include the financial statements of Dollar Tree, Inc., and its wholly-owned

subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Segment Information

At January 30, 2016, the Company operates more than 13,800 discount retail stores in 48 states and five Canadian

provinces. The Company's operations are conducted in two reporting business segments: Dollar Tree and Family Dollar. The

Company defines its segments as those operations whose results its chief operating decision maker ("CODM") regularly

reviews to analyze performance and allocate resources. The results of operations of Family Dollar are included in the

Company's results of operations beginning on July 6, 2015.

The Dollar Tree segment is the leading operator of discount variety stores offering merchandise at the fixed price of $1.00.

The Dollar Tree segment includes the Company's operations under the "Dollar Tree," "Dollar Tree Canada," "Deals" and

"Dollar Tree Deals" brands, ten distribution centers in the United States, two distribution centers in Canada and a Store Support

Center in Chesapeake, Virginia.

The Family Dollar segment operates a chain of general merchandise discount retail stores providing consumers with a

selection of competitively priced merchandise in convenient neighborhood stores. The Family Dollar segment consists of the

Company's operations under the "Family Dollar" brand, eleven distribution centers and a Store Support Center in Matthews,

North Carolina.

Foreign Currency

The functional currencies of certain of the Company’s international subsidiaries are the local currencies of the countries in

which the subsidiaries are located. Foreign currency denominated assets and liabilities are translated into U.S. dollars using the

exchange rates in effect at the consolidated balance sheet date. Results of operations and cash flows are translated using the

average exchange rates throughout the period. The effect of exchange rate fluctuations on translation of assets and liabilities is

included as a component of shareholders’ equity in accumulated other comprehensive loss. Gains and losses from foreign

currency transactions, which are included in "Other expense, net" have not been significant.

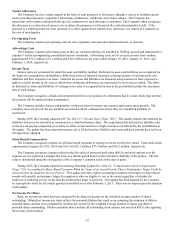

Fiscal Year

The Company's fiscal year ends on the Saturday closest to January 31. Any reference herein to "2015" or "Fiscal 2015,"

“2014” or “Fiscal 2014,” and “2013” or “Fiscal 2013,” relates to as of or for the years ended January 30, 2016, January 31,

2015, and February 1, 2014, respectively. Each fiscal year included 52 weeks.

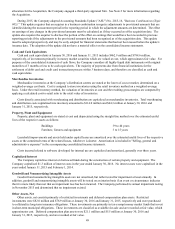

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from those estimates.

Purchase Price Allocation

Determining the fair value of certain assets and liabilities acquired is subjective in nature and often involves the use of

significant estimates and assumptions, which are inherently uncertain. Many of the estimates and assumptions used to

determine fair values, such as those used for intangible assets, are made based on forecasted information and discount rates. In

addition, the judgments made in determining the estimated fair value assigned to each class of assets acquired and liabilities

assumed, as well as asset lives, can materially impact the Company's results of operations. To assist in the purchase price