Dollar Tree 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

If we are unable to secure our customers’ credit card and confidential information, or other private data relating to our

associates, suppliers or our business, we could be subject to negative publicity, costly government enforcement actions

or private litigation, which could damage our business reputation and adversely affect our results of operation or

business.

We have procedures and technology in place to safeguard our customers’ debit and credit card information, our associates’

private data, suppliers’ data, and our business records and intellectual property. Despite these measures, criminals are

constantly devising schemes to circumvent safeguards and we may be vulnerable to, and unable to detect and appropriately

respond to, data security breaches and data loss, including cyber-security attacks. Other sophisticated retailers have recently

suffered serious security breaches. If we experience a data security breach, we could be exposed to negative publicity,

government enforcement actions, private litigation, or costly response measures. In addition, our reputation within the business

community and with our customers may be affected, which could result in our customers discontinuing the use of debit or

credit cards in our stores or not shopping in our stores altogether. This could have an adverse effect on our results of operation

or business.

Our growth is dependent on our ability to increase sales in existing stores and to expand our square footage profitably.

Existing store sales growth is critical to good operating results and is dependent on a variety of factors including

merchandise quality, relevance and availability, store operations and customer satisfaction. In addition, increased competition

could adversely affect our sales. Our highest sales periods are during the Christmas and Easter seasons, and we generally

realize a disproportionate amount of our net sales and our operating and net income during the fourth quarter. In anticipation,

we stock extra inventory and hire many temporary employees to prepare our stores. A reduction in sales during these periods

could adversely affect our operating results, particularly operating and net income, to a greater extent than if a reduction

occurred at other times of the year. Untimely merchandise delays due to receiving or distribution problems could have a similar

effect. When Easter is observed earlier in the year, the selling season is shorter and, as a result, our sales could be adversely

affected. Easter was observed on April 20, 2014, April 5, 2015, and will be observed on March 27, 2016.

Expanding our square footage profitably depends on a number of uncertainties, including our ability to locate, lease, build

out and open or expand stores in suitable locations on a timely basis under favorable economic terms. Obtaining an increasing

number of profitable stores is an ever increasing challenge. In addition, our expansion is dependent upon third-party

developers’ abilities to acquire land, obtain financing, and secure necessary permits and approvals. It remains difficult for third

party developers to obtain financing for new projects due to the recent turmoil in the financial markets. We also open or expand

stores within our established geographic markets, where new or expanded stores may draw sales away from our existing stores.

We may not manage our expansion effectively, and our failure to achieve our expansion plans could materially and adversely

affect our business, financial condition and results of operations.

Risks associated with our domestic and foreign suppliers from whom our products are sourced could affect our financial

performance.

We are dependent on our vendors to supply merchandise in a timely and efficient manner. If a vendor fails to deliver on its

commitments due to financial or other difficulties, we could experience merchandise shortages which could lead to lost sales or

increased merchandise costs if alternative sources must be used.

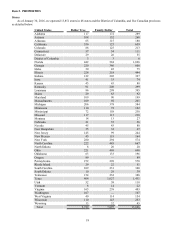

Merchandise imported directly accounts for approximately 41% to 43% of our Dollar Tree segment's total retail value

purchases and 22% to 24% of our Family Dollar segment's total retail value purchases. In addition, we believe that a portion of

our goods purchased from domestic vendors is imported. China is the source of a substantial majority of our imports. Imported

goods are generally less expensive than domestic goods and increase our profit margins. A disruption in the flow of our

imported merchandise or an increase in the cost of those goods may significantly decrease our profits. Risks associated with

our reliance on imported goods may include disruptions in the flow of or increases in the cost of imported goods because of

factors such as:

• raw material shortages, work stoppages, strikes and political unrest;

• an increase in duties or tariffs;

• economic crises and international disputes;

• changes in currency exchange rates or policies and local economic conditions, including inflation in the country of

origin; and

• failure of the United States to maintain normal trade relations with China.