Dollar Tree 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

beginning January 31, 2016 and ending on February 2, 2019 and the grantee completing a five-year service requirement. The

fair value of these RSUs will be expensed ratably over the five-year vesting period. The fair value of these RSUs was

determined using the Company's closing stock price on the date of the grant.

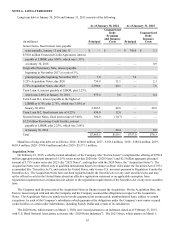

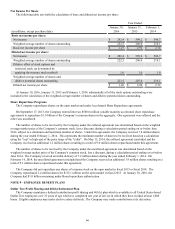

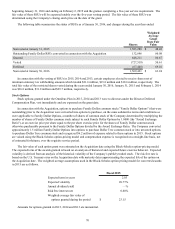

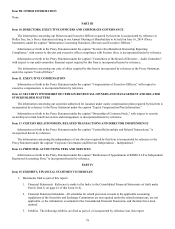

The following table summarizes the status of RSUs as of January 30, 2016, and changes during the year then ended:

Shares

Weighted

Average

Grant

Date Fair

Value

Nonvested at January 31, 2015 1,583,280 $ 48.48

Outstanding Family Dollar RSUs converted in connection with the Acquisition 132,896 80.08

Granted 648,211 80.67

Vested (727,518) 50.61

Forfeited (67,448) 69.10

Nonvested at January 30, 2016 1,569,421 $ 63.24

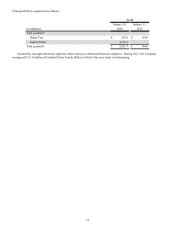

In connection with the vesting of RSUs in 2015, 2014 and 2013, certain employees elected to receive shares net of

minimum statutory tax withholding amounts which totaled $21.6 million, $15.8 million and $18.6 million, respectively. The

total fair value of the restricted shares vested during the years ended January 30, 2016, January 31, 2015 and February 1, 2014

was $36.8 million, $31.8 million and $29.7 million, respectively.

Stock Options

Stock options granted under the Omnibus Plan in 2015, 2014 and 2013 were to directors under the Director Deferred

Compensation Plan, vest immediately and are expensed on the grant date.

In connection with the Acquisition, options to purchase Family Dollar common stock ("Family Dollar Options") that were

outstanding prior to the Acquisition were converted into options to purchase, on the same substantive terms and conditions as

were applicable to Family Dollar Options, a number of shares of common stock of the Company determined by multiplying the

number of shares of Family Dollar common stock subject to such Family Dollar Options by 1.0000 (the "Award Exchange

Ratio"), at an exercise price per share equal to the per share exercise price for the shares of Family Dollar common stock

otherwise purchasable pursuant to the Family Dollar Options divided by the Award Exchange Ratio. The Company converted

approximately 1.5 million Family Dollar Options into options to purchase Dollar Tree common stock or into unvested options

to purchase Dollar Tree common stock and recognized $6.2 million of expense related to these options in 2015. Stock options

are valued using the Black-Scholes option-pricing model and compensation expense is recognized on a straight-line basis, net

of estimated forfeitures, over the requisite service period.

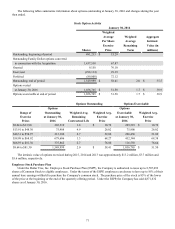

The fair value of each option grant was estimated on the Acquisition date using the Black-Scholes option-pricing model.

The expected term of the awards granted is based on an analysis of historical and expected future exercise behavior. Expected

volatility is derived from an analysis of the historical volatility of the Company’s publicly traded stock. The risk free rate is

based on the U.S. Treasury rates on the Acquisition date with maturity dates approximating the expected life of the option on

the Acquisition date. The weighted average assumptions used in the Black-Scholes option pricing model for converted awards

in 2015 are as follows.

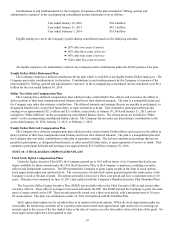

Fiscal 2015

Expected term in years 2.03

Expected volatility 20.77%

Annual dividend yield —%

Risk free interest rate 0.60%

Weighted-average fair value of

options granted during the period $ 23.15

Amounts for options granted in 2015, 2014 and 2013 are immaterial.