Dollar Tree 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

Any restricted stock or RSUs awarded are subject to certain general restrictions. The restricted stock shares or units may

not be sold, transferred, pledged or disposed of until the restrictions on the shares or units have lapsed or have been removed

under the provisions of the plan. In addition, if a holder of restricted shares or units ceases to be employed by the Company,

any shares or units in which the restrictions have not lapsed will be forfeited.

The 2003 Non-Employee Director Stock Option Plan (NEDP) provided non-qualified stock options to non-employee

members of the Company's Board of Directors. The stock options were functionally equivalent to the options issued under the

EIP discussed above. The exercise price of each stock option granted equaled the closing market price of the Company’s stock

on the date of grant. The options generally vested immediately. This plan was terminated on June 16, 2011 and replaced with

the Omnibus Plan.

The 2003 Director Deferred Compensation Plan permits any of the Company's directors who receive a retainer or other

fees for Board or Board committee service to defer all or a portion of such fees until a future date, at which time they may be

paid in cash or shares of the Company's common stock, or receive all or a portion of such fees in non-statutory stock

options. Deferred fees that are paid out in cash will earn interest at the 30-year Treasury Bond Rate. If a director elects to be

paid in common stock, the number of shares will be determined by dividing the deferred fee amount by the closing market

price of a share of the Company's common stock on the date of deferral. The number of options issued to a director will equal

the deferred fee amount divided by 33% of the price of a share of the Company's common stock. The exercise price will equal

the fair market value of the Company's common stock at the date the option is issued. The options are fully vested when issued

and have a term of 10 years.

Under the Omnibus Plan, the Company may grant up to 4.0 million shares of its Common Stock, plus any shares available

for future awards under the EIP, EOEP, or NEDP plans, to the Company’s employees, including executive officers and

independent contractors. The Omnibus Plan permits the Company to grant equity awards in the form of incentive stock

options, non-qualified stock options, stock appreciation rights, restricted stock awards, restricted stock units, performance

bonuses, performance units, non-employee director stock options and other equity-related awards. These awards generally vest

over a three-year period with a maximum term of 10 years.

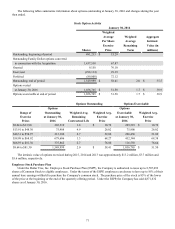

In conjunction with the Acquisition, the Company assumed the Family Dollar Stores, Inc. 2006 Incentive Plan (the "2006

Plan"). The 2006 Plan permits the granting of a variety of compensatory award types, including stock options and performance

share rights.

Restricted Stock

In connection with the Acquisition, unvested Family Dollar RSUs that were outstanding prior to the Acquisition were

converted into unvested Dollar Tree RSUs with the same substantive terms and conditions as were applicable to the Family

Dollar RSUs, in respect of a number of shares of common stock of the Company determined by multiplying the number of

shares of Family Dollar RSUs by 1.0000 (the "Award Exchange Ratio"). The Company converted approximately 0.1 million

unvested Family Dollar RSUs into unvested Dollar Tree RSUs and recognized $2.8 million of expense related to these RSUs in

2015.

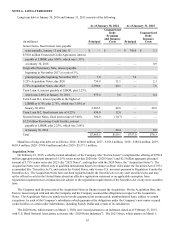

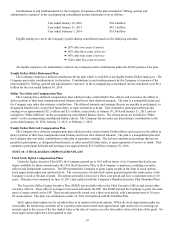

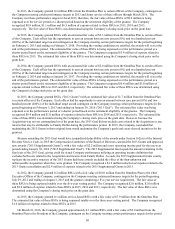

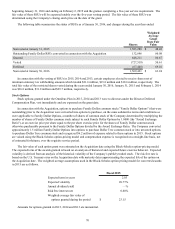

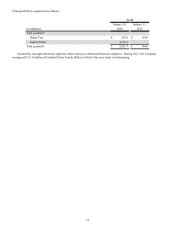

The Company granted 0.3 million, 0.5 million and 0.5 million service-based RSUs, net of forfeitures in 2015, 2014 and

2013, respectively, from the Omnibus Plan to the Company’s employees and officers. The fair value of all of these RSUs is

being expensed ratably over the three-year vesting periods, or shorter periods based on the retirement eligibility of certain

grantees. The fair value was determined using the Company’s closing stock price on the date of grant. The Company

recognized $22.6 million, $22.2 million and $21.1 million of expense related to service-based RSUs during 2015, 2014 and

2013, respectively. As of January 30, 2016, there was approximately $24.1 million of total unrecognized compensation

expense related to these RSUs which is expected to be recognized over a weighted-average period of 22 months.

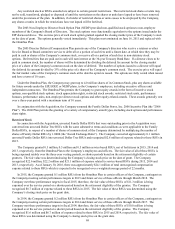

In 2015, the Company granted 0.1 million RSUs from the Omnibus Plan to certain officers of the Company, contingent on

the Company meeting certain performance targets in 2015 and future service of these officers through March 2018. The

Company met these performance targets in fiscal 2015; therefore, the fair value of these RSUs of $11.3 million is being

expensed over the service period or a shorter period based on the retirement eligibility of the grantee. The Company

recognized $8.7 million of expense related to these RSUs in 2015. The fair value of these RSUs was determined using the

Company’s closing stock price on the grant date.

In 2014, the Company granted 0.2 million RSUs from the Omnibus Plan to certain officers of the Company, contingent on

the Company meeting certain performance targets in 2014 and future service of these officers through March 2017. The

Company met these performance targets in fiscal 2014; therefore, the fair value of these RSUs of $10.0 million is being

expensed over the service period or a shorter period based on the retirement eligibility of the grantee. The Company

recognized $1.6 million and $6.7 million of expense related to these RSUs in 2015 and 2014, respectively. The fair value of

these RSUs was determined using the Company’s closing stock price on the grant date.