Dollar Tree 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

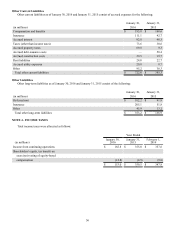

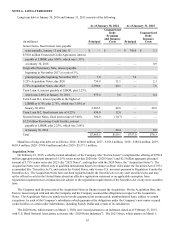

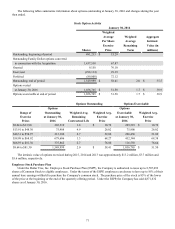

Net Income Per Share

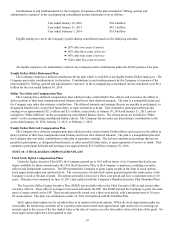

The following table sets forth the calculation of basic and diluted net income per share:

Year Ended

January 30, January 31, February 1,

(in millions, except per share data) 2016 2015 2014

Basic net income per share:

Net income $ 282.4 $ 599.2 $ 596.7

Weighted average number of shares outstanding 222.5 206.0 218.1

Basic net income per share $ 1.27 $ 2.91 $ 2.74

Diluted net income per share:

Net income $ 282.4 $ 599.2 $ 596.7

Weighted average number of shares outstanding 222.5 206.0 218.1

Dilutive effect of stock options and

restricted stock (as determined by

applying the treasury stock method) 1.0 1.0 1.0

Weighted average number of shares and

dilutive potential shares outstanding 223.5 207.0 219.1

Diluted net income per share $ 1.26 $ 2.90 $ 2.72

At January 30, 2016, January 31, 2015 and February 1, 2014, substantially all of the stock options outstanding were

included in the calculation of the weighted average number of shares and dilutive potential shares outstanding.

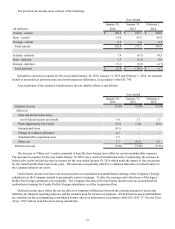

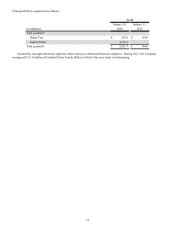

Share Repurchase Programs

The Company repurchases shares on the open market and under Accelerated Share Repurchase agreements.

On September 17, 2013, the Company entered into two $500.0 million variable maturity accelerated share repurchase

agreements to repurchase $1.0 billion of the Company’s common shares in the aggregate. One agreement was collared and the

other was uncollared.

The number of shares to be received by the Company under the collared agreement was determined based on the weighted

average market price of the Company’s common stock, less a discount, during a calculation period ending on or before June

2014, subject to a minimum and maximum number of shares. Under this agreement, the Company received 7.8 million shares

during the year ended February 1, 2014. This represents the minimum number of shares to be received based on a calculation

using the "cap" or high-end of the price range of the "collar". On May 15, 2014, the collared agreement concluded and the

Company received an additional 1.2 million shares resulting in a total of 9.0 million shares repurchased under this agreement.

The number of shares to be received by the Company under the uncollared agreement was determined based on the

weighted average market price of the Company's common stock, less a discount, during a calculation period ending on or before

June 2014. The Company received an initial delivery of 7.2 million shares during the year ended February 1, 2014. On

February 14, 2014, the uncollared agreement concluded and the Company received an additional 1.9 million shares resulting in a

total of 9.1 million shares repurchased under this agreement.

The Company did not repurchase any shares of common stock on the open market in fiscal 2015 or fiscal 2014. The

Company repurchased 2.4 million shares for $112.1 million on the open market in fiscal 2013. At January 30, 2016, the

Company had $1.0 billion remaining under Board repurchase authorization.

NOTE 9 – EMPLOYEE BENEFIT PLANS

Dollar Tree Profit Sharing and 401(k) Retirement Plan

The Company maintains a defined contribution profit sharing and 401(k) plan which is available to all United States-based

Dollar Tree employees over 21 years of age who have completed one year of service in which they have worked at least 1,000

hours. Eligible employees may make elective salary deferrals. The Company may make contributions at its discretion.