Dollar Tree 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

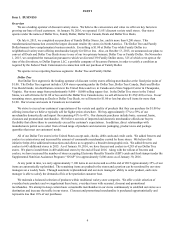

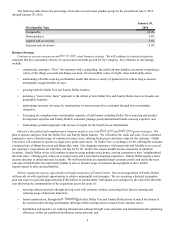

The following table shows the percentage of net sales of each major product group for the period from July 6, 2015

through January 30, 2016:

January 30,

Merchandise Type 2016

Consumable 68.4%

Home products 9.8%

Apparel and accessories 6.8%

Seasonal and electronics 15.0%

Business Strategy

Continue to execute our proven and retail business strategy. We will continue to execute our proven

strategies that have generated a history of success and consistent growth for the Company. Key elements of our strategy

include:

• continuously aiming to “Wow” the customer with a compelling, fun and fresh merchandise assortment comprising a

variety of the things you want and things you need, all at incredible values in bright, clean and friendly stores;

• maintaining a flexible sourcing merchandise model that allows a variety of products to be sold as long as desired

merchandise margin hurdles are met;

• growing both the Dollar Tree and Family Dollar banners;

• pursuing a “more, better, faster” approach to the rollout of new Dollar Tree and Family Dollar stores to broaden our

geographic footprint;

• maintaining customer relevance by ensuring that we reinvent ourselves constantly through new merchandise

categories;

• leveraging the complementary merchandise expertise of each banner including Dollar Tree's sourcing and product

development expertise and Family Dollar's consumer package goods and national brands sourcing expertise; and

• maintaining a prudent approach with our use of capital for the benefit of our shareholders.

Operate a diversified and complementary business model across both and point strategies. We

plan to operate and grow both the Dollar Tree and Family Dollar banners. We will utilize the reach and scale of our combined

company to serve a broader range of customers in more ways, offering better prices and more value for the customer. Dollar

Tree stores will continue to operate as single price point retail stores. At Dollar Tree, everything is $1.00, offering the customer

a balanced mix of things they need and things they want. Our shopping experience will remain fun and friendly as we exceed

our customers’ expectations for what they can buy for $1.00. Dollar Tree targets middle income customers in suburban

locations. Family Dollar stores will continue to operate using multiple price points, serving customers as their “neighborhood

discount store,” offering great values on everyday items and a convenient shopping experience. Family Dollar targets a lower

income customer in urban and rural locations. We will benefit from an expanded target customer profile and utilize the store

concepts of both Dollar Tree and Family Dollar to serve a broader range of customer demographics to drive further

improvements in sales and profitability.

Deliver significant synergy opportunities through integration of Family Dollar. Our recent acquisition of Family Dollar

will provide us with significant opportunities to achieve meaningful cost synergies. We are executing a detailed integration

plan and expect to generate approximately $300 million of estimated annual cost synergies by the end of the third full

year following the consummation of the acquisition across the areas of:

• sourcing and procurement, through driving scale with common vendors, increasing direct factory sourcing and

reducing usage of domestic importers;

• format optimization, through the of select Dollar Tree and Family Dollar stores to match the banner to

the customer and tailoring merchandise offerings within existing stores to match local customer tastes;

• distribution and logistics, by reducing inbound and outbound freight costs (domestic and international) and optimizing

efficiency within our combined distribution center network; and