Dollar Tree 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Overview

We are a leading operator of more than 13,800 discount retail stores and we conduct our operations in two reporting

segments. Our Dollar Tree segment is the leading operator of discount variety stores offering merchandise at the fixed price

point of $1.00. Our Family Dollar segment operates general merchandise discount retail stores providing consumers with a

selection of competitively-priced merchandise in convenient neighborhood stores.

Our net sales are derived from the sale of merchandise. Two major factors tend to affect our net sales trends. First is our

success at opening new stores or adding new stores through mergers or acquisitions. Second is the performance of our stores

once they are open. Sales vary at our existing stores from one year to the next. We refer to this change as a change in

comparable store net sales, because we compare only those stores that are open throughout both of the periods being compared,

beginning after the first fifteen months of operation. We include sales from stores expanded during the year in the calculation

of comparable store net sales, which has the effect of increasing our comparable store net sales. The term 'expanded' also

includes stores that are relocated. Our comparable store net sales calculation only includes our Dollar Tree stores as our Family

Dollar stores were acquired on July 6, 2015. Stores that have been rebannered are considered to be new stores and are not

included in the calculation of comparable store net sales until after the first fifteen months of operation under the new banner.

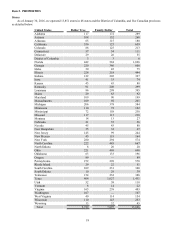

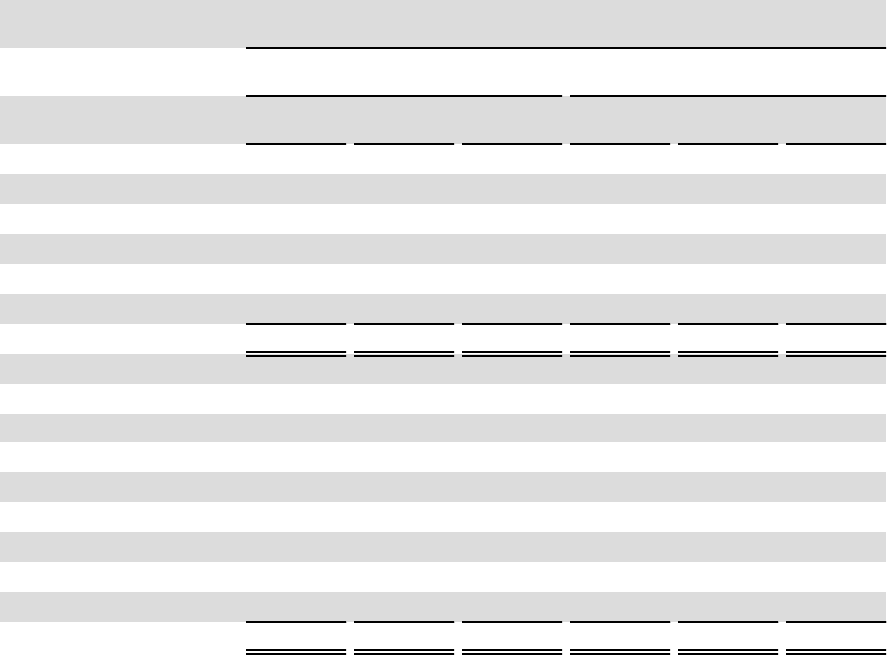

At January 30, 2016, we operated stores in 48 states and the District of Columbia, as well as stores in five Canadian

provinces. A breakdown of store counts and square footage by segment for the years ended January 30, 2016 and January 31,

2015, respectively, are as follows (Family Dollar's beginning amounts are as of the July 6, 2015 Acquisition Date):

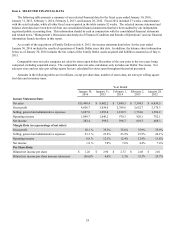

Year Ended

January 30, 2016 January 31, 2015

Dollar

Tree Family

Dollar Total Dollar

Tree Family

Dollar Total

Store Count:

Beginning 5,367 8,284 13,651 4,992 — 4,992

New stores 400 166 566 391 — 391

Rebannered stores 205 (205) — — — —

Closings (18) (23) (41)(16) — (16)

Divestitures — (325) (325) — — —

Ending 5,954 7,897 13,851 5,367 — 5,367

Relocations 64 102 166 72 — 72

Selling Square Feet (in millions):

Beginning 46.5 59.9 106.4 43.2 — 43.2

New stores 3.2 1.2 4.4 3.2 — 3.2

Rebannered stores 1.5 (1.5) — — — —

Closings (0.1) (0.1) (0.2)(0.1) — (0.1)

Divestitures — (2.4) (2.4) — — —

Relocations 0.2 — 0.2 0.2 — 0.2

Ending 51.3 57.1 108.4 46.5 — 46.5

Stores are included as rebanners when they close or open, respectively. Comparable store net sales for Dollar Tree may be

negatively affected when a Family Dollar store is rebannered near an existing Dollar Tree store. The average size of stores

opened in 2015 was approximately 8,030 selling square feet (or about 10,000 gross square feet) for the Dollar Tree segment

and 7,000 selling square feet (or about 8,200 gross square feet) for the Family Dollar segment. For 2016, we continue to plan

to open stores that are approximately 8,000 - 10,000 selling square feet (or about 10,000 - 12,000 gross square feet) for the

Dollar Tree segment and approximately 6,000 - 8,000 selling square feet (or about 7,000 - 9,000 gross square feet) for the

Family Dollar segment. We believe that these size stores are in the ranges of our optimal sizes operationally and give our

customers a shopping environment which invites them to shop longer, buy more and make return visits, which increases our

customer traffic.