Dollar Tree 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

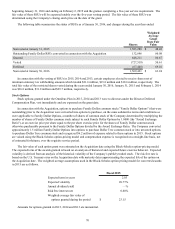

In 2013, the Company granted 0.2 million RSUs from the Omnibus Plan to certain officers of the Company, contingent on

the Company meeting certain performance targets in 2013 and future service of these officers through March 2016. The

Company met these performance targets in fiscal 2013; therefore, the fair value of these RSUs of $9.9 million is being

expensed over the service period or a shorter period based on the retirement eligibility of the grantee. The Company

recognized $0.9 million, $1.1 million and $6.5 million of expense related to these RSUs in 2015, 2014 and 2013,

respectively. The fair value of these RSUs was determined using the Company’s closing stock price on the grant date.

In 2015, the Company granted RSUs with an estimated fair value of $2.3 million from the Omnibus Plan to certain officers

of the Company. Each officer has the opportunity to earn an amount between zero percent (0%) and two hundred percent

(200%) of the individual target award contingent on the Company meeting certain performance targets for the period beginning

on February 1, 2015 and ending on February 3, 2018. Providing the vesting conditions are satisfied, the awards will vest at the

end of the performance period. The estimated fair value of these RSUs is being expensed over the performance period or a

shorter period based on the retirement eligibility of the grantee. The Company recognized $1.4 million of expense related to

these RSUs in 2015. The estimated fair value of these RSUs was determined using the Company's closing stock price on the

grant date.

In 2014, the Company granted RSUs with an estimated fair value of $2.0 million from the Omnibus Plan to certain officers

of the Company. Each officer has the opportunity to earn an amount between zero percent (0%) and two hundred percent

(200%) of the individual target award contingent on the Company meeting certain performance targets for the period beginning

on February 2, 2014 and ending on January 28, 2017. Providing the vesting conditions are satisfied, the awards will vest at the

end of the performance period. The estimated fair value of these RSUs is being expensed over the performance period or a

shorter period based on the retirement eligibility of the grantee. The Company recognized $0.4 million and $1.0 million of

expense related to these RSUs in 2015 and 2014, respectively. The estimated fair value of these RSUs was determined using

the Company's closing stock price on the grant date.

In 2013, the Company granted RSUs ("2013 Grants") with an estimated fair value of $1.7 million from the Omnibus Plan

to certain officers of the Company. Each officer had the opportunity to earn an amount between zero percent (0%) and two

hundred percent (200%) of the individual target award contingent on the Company meeting certain performance targets for the

period beginning on February 3, 2013 and ending on January 30, 2016 ("2013 Goal"). The estimated fair value was being

expensed over the performance period or a shorter period based on the retirement eligibility of the grantee. The Company

recognized $0.4 million and $1.0 million of expense related to these RSUs in 2014 and 2013, respectively. The estimated fair

value of these RSUs was determined using the Company's closing stock price on the grant date. However, because the

Acquisition was not yet contemplated as of the grant date, the 2013 Goal did not exclude costs related to the Acquisition or any

income that may be attributable to Family Dollar during the performance period. In 2015, the Company concluded that

maintaining the 2013 Grants in their original form would undermine the Company's goals and create skewed incentives for the

grantees.

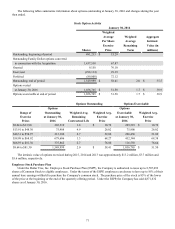

Because amending the 2013 Goal would have jeopardized deductibility of the awards under Section 162(m) of the Internal

Revenue Service Code, in 2015 the Compensation Committee of the Board of Directors canceled the 2013 Grants and approved

new awards ("2015 Supplemental Grants"), with a fair value of $2.2 million and a new operating income goal for the one-year

period ending January 30, 2016 ("2015 Supplemental Goal"). The 2015 Supplemental Goal equals the amount remaining in the

final year of the 2013 Goal, giving credit for actual Company performance utilizing an operating income definition that

excludes both costs related to the Acquisition and income from Family Dollar. As such, the 2015 Supplemental Grants exactly

replicate the incentive structure of the 2013 Grants had those awards excluded the effect of the then-unknown and

unforeseeable Acquisition when they were granted. The Company recognized a $1.2 million reduction of expense related to the

2013 Grants cancellation and $2.4 million of expense related to the 2015 Supplemental Grants in 2015.

In 2012, the Company granted 0.2 million RSUs with a fair value of $10.0 million from the Omnibus Plan to the Chief

Executive Officer of the Company, contingent on the Company meeting certain performance targets for the period beginning

July 29, 2012 and ending on August 3, 2013 and the grantee completing a five-year service requirement. The fair value of

these RSUs is being expensed ratably over the five-year vesting period. The Company recognized $2.0 million, $2.0 million

and $2.0 million of expense related to these RSUs in 2015, 2014 and 2013, respectively. The fair value of these RSUs was

determined using the Company's closing stock price on the grant date.

In 2015, the Company granted 0.1 million service-based RSUs with a fair value of $7.9 million from the Omnibus Plan.

The estimated fair value of these RSUs is being expensed ratably over the three-year vesting period. The Company recognized

$1.0 million of expense related to these RSUs in 2015.

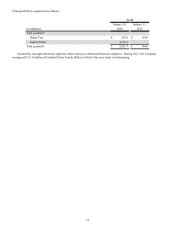

On March 18, 2016, the Company granted approximately 0.1 million RSUs with a fair value of $5.0 million from the

Omnibus Plan to the President of the Company, contingent on the Company meeting certain performance targets for the period