Dollar Tree 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

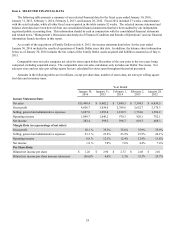

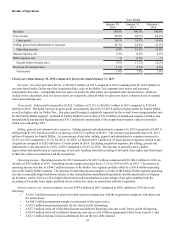

Fiscal 2015, fiscal 2014 and fiscal 2013 which ended on January 30, 2016, January 31, 2015 and February 1, 2014,

respectively, each included 52 weeks.

In fiscal 2015, comparable store net sales increased by 2.1%. The comparable store net sales increase was the result of a

1.4% increase in the number of transactions and a 0.8% increase in average ticket. We believe comparable store net sales

continued to be positively affected by a number of our Dollar Tree initiatives, as debit and credit card penetration continued to

increase in 2015, and we continued the rollout of frozen and refrigerated merchandise to more of our Dollar Tree stores. At

January 30, 2016, the Dollar Tree segment had frozen and refrigerated merchandise in approximately 4,285 stores, which

includes rebannered stores, compared to approximately 3,620 stores at January 31, 2015. We believe that the addition of frozen

and refrigerated product enables us to increase sales and earnings by increasing the number of shopping trips made by our

customers. In addition, the Dollar Tree segment accepts food stamps (under the Supplemental Nutrition Assistance Program

(“SNAP”)) in approximately 5,600 qualified stores compared to 5,000 at the end of 2014.

Our point-of-sale technology provides us with valuable sales and inventory information to assist our buyers and improve

our merchandise allocation to our stores. We believe that this has enabled us to better manage our inventory flow in our stores

resulting in more efficient distribution and store operations.

We must continue to control our merchandise costs, inventory levels and our general and administrative expenses as

increases in these items could negatively impact our operating results.

We previously announced that we will rebanner our Deals stores in 2015 and 2016. The majority of the Deals stores will

be rebannered as Dollar Tree stores and the remaining stores will be rebannered as Family Dollar Stores. In 2015, 52 stores

were rebannered and we recorded $15.5 million in expenses in connection with the rebannering in fiscal 2015.

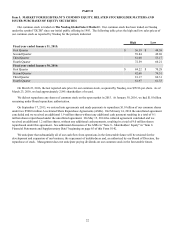

Acquisition

On July 27, 2014, we executed an Agreement and Plan of Merger to acquire Family Dollar in a cash and stock transaction.

On July 6, 2015 (the "Acquisition Date") we completed the Acquisition and Family Dollar became a direct, wholly-owned

subsidiary. Under the Acquisition, the Family Dollar shareholders received $59.60 in cash and 0.2484 shares of our common

stock for each share of Family Dollar common stock they owned, plus cash in lieu of fractional shares (the "Merger

Consideration").

As of the Acquisition Date, each outstanding performance share right of Family Dollar common stock was canceled in

exchange for the right of the holder to receive the Merger Consideration (the "PSR Payment"). The aggregate amount we paid

for the Merger Consideration and PSR Payment was $6.8 billion in cash and we issued 28.5 million shares of our common

stock, valued at $2.3 billion based on the closing price of our common stock on July 2, 2015.

For a complete description of the Acquisition refer to our Current Report on Form 8-K filed with the SEC on July 8, 2015.

We incurred $39.2 million and $28.5 million in acquisition-related expenses in 2015 and 2014, respectively, excluding

acquisition-related interest expense. We also expended approximately $165.7 million in capitalizable debt issuance costs

related to the financing of the Acquisition and $129.8 million of debt-issuance costs was included as a reduction in "Long-term

debt, net, excluding current portion" at January 30, 2016.

We expect to achieve approximately $300 million in annual cost savings synergies by the end of the third year after

closing, and that we will incur $300 million in one-time costs to achieve these synergies. We project that the Acquisition will

be dilutive to earnings per share in the first twelve months following closing on a GAAP basis; however, we expect it will be

accretive excluding the one-time costs to achieve synergies.

In 2015, we completed the offering of $3.25 billion of senior notes and entered into a credit facility and term loan

providing for $6.2 billion in senior secured credit facilities. See "Liquidity and Capital Resources" for a further discussion of

these transactions.

In connection with the Acquisition, we agreed to divest 330 Family Dollar stores to settle Federal Trade Commission

charges that the Acquisition would be anticompetitive in certain local markets. The 330 Family Dollar stores represent

approximately $45.5 million of annual operating income. In accordance with purchase accounting, the net effect of the

divestiture on our assets and liabilities is fully reflected in the table summarizing the preliminary estimates of fair value set

forth in "Note 2 - Acquisition" and the Consolidated Balance Sheet of Dollar Tree, Inc. as of January 30, 2016 included in

"Item 8. Financial Statements and Supplementary Data” of this Form 10-K. The divestiture was completed on November 1,

2015 and the primary expected future effect of the sale on the Consolidated Income Statements of Dollar Tree, Inc. will be that

we will lose the operating income associated with the divested stores and will incur approximately $5.0 million to $10.0 million

in closing costs and set-up costs for transition services. Over a period expected to be no more than 24 months, we will provide

certain transition services to the buyer for which we expect to be reimbursed by the buyer at our direct operating costs for those

services.