Dollar Tree 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

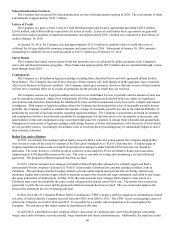

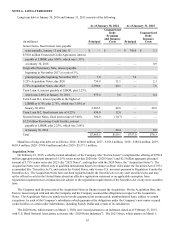

On January 26, 2016, the Company prepaid $1.0 billion of its $3.3 billion Term Loan B-1 Loan. The prepayment resulted

in an acceleration of the amortization of debt issuance costs of $19.0 million.

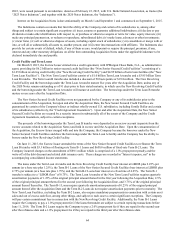

The New Senior Secured Credit Facilities contain representations and warranties, events of default and affirmative and

negative covenants. These include, among other things and subject to certain significant exceptions, restrictions on the

Company's ability to declare or pay dividends, repay the Acquisition Notes, create liens, incur additional indebtedness, make

investments, dispose of assets and merge or consolidate with any other person. In addition, a financial maintenance covenant

based on the Company’s consolidated first lien secured net leverage ratio applies to the New Revolving Credit Facility and the

Term Loan A tranche of the New Term Loan Facilities.

Secured Senior Notes

As a result of the Acquisition, the Company assumed the liability for $300.0 million of 5.0% unsecured senior notes due

February 1, 2021 which were issued by Family Dollar on January 28, 2011 through a public offering. These notes became

equally and ratably secured on the Acquisition Date.

Forgivable Promissory Note

In 2012, the Company entered into a promissory note with the state of Connecticut under which the state loaned the

Company $7.0 million in connection with the Company's acquisition, construction and installation of land, building, machinery

and equipment for the Company's distribution facility in Windsor, Connecticut. If certain performance targets are met, the loan

and any accrued interest will be forgiven in fiscal 2017. If the performance targets are not met, the loan and accrued interest

must be repaid over a five-year period beginning in fiscal 2017.

Senior Notes

On the Acquisition Date, the Company prepaid in full $750.0 million in Senior Notes comprised of (i) $300.0 million in

aggregate principal amount of 4.03% Series A Senior Notes due September 16, 2020, (ii) $350.0 million in aggregate principal

amount of 4.63% Series B Senior Notes due September 16, 2023 and (iii) $100.0 million in aggregate principal amount of

4.78% Series C Senior Notes due September 16, 2025, issued pursuant to that certain Note Purchase Agreement, dated as of

September 16, 2013 (as amended on January 20, 2015, the “Dollar Tree NPA”) among the Company, Dollar Tree Stores, Inc.,

and the Purchasers party thereto, plus accrued and unpaid interest thereon and a make-whole premium of approximately $89.5

million determined in accordance with the provisions of the Dollar Tree NPA plus additional interest in accordance with the

provisions of the first amendment to the Dollar Tree NPA.

Unsecured Credit Agreement

On the Acquisition Date, the Company paid in full all amounts under the Unsecured Credit Agreement, dated as of June 6,

2012, and terminated all commitments to extend further credit.

Debt Covenants

As of January 30, 2016, the Company was in compliance with its debt covenants.

NOTE 7 – DERIVATIVE FINANCIAL INSTRUMENTS

Hedging Derivatives

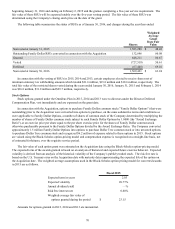

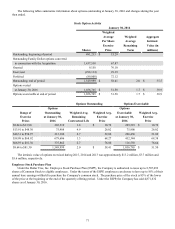

In order to manage fluctuations in cash flows resulting from changes in diesel fuel costs, the Company entered into fuel

derivative contracts with third parties. The Company hedged 6.6 million, 1.6 million and 2.8 million gallons of diesel fuel in

2015, 2014 and 2013, respectively. These hedges represented approximately 36%, 10% and 20% of the Dollar Tree segment's

total domestic truckload fuel needs in 2015, 2014 and 2013, respectively. Under these contracts, the Company pays the third

party a fixed price for diesel fuel and receives variable diesel fuel prices at amounts approximating current diesel fuel costs,

thereby creating the economic equivalent of a fixed-rate obligation. These derivative contracts do not qualify for hedge

accounting and therefore all changes in fair value for these derivatives are included in "Other expense, net" on the

accompanying consolidated income statements. The fair value of these contracts at January 30, 2016 was a liability of $0.8

million.

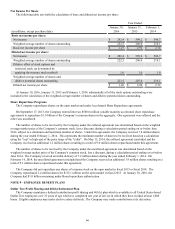

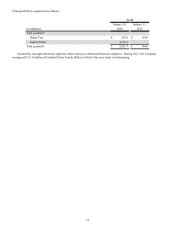

NOTE 8 - SHAREHOLDERS' EQUITY

Preferred Stock

The Company is authorized to issue 10,000,000 shares of Preferred Stock, $0.01 par value per share. No preferred shares

are issued and outstanding at January 30, 2016 and January 31, 2015.