Dollar Tree 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

PART II

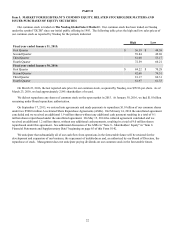

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

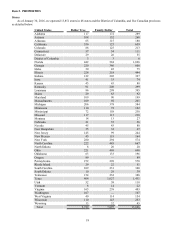

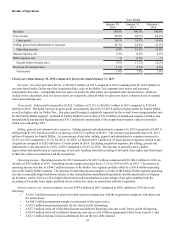

Our common stock is traded on The Nasdaq Global Select Market®. Our common stock has been traded on Nasdaq

under the symbol "DLTR" since our initial public offering in 1995. The following table gives the high and low sales prices of

our common stock as reported by Nasdaq for the periods indicated.

High Low

Fiscal year ended January 31, 2015:

First Quarter $ 56.39 $ 49.59

Second Quarter 59.84 49.69

Third Quarter 61.00 53.17

Fourth Quarter 72.59 60.21

Fiscal year ended January 30, 2016:

First Quarter $ 84.22 $ 70.28

Second Quarter 82.68 74.51

Third Quarter 81.17 60.31

Fourth Quarter 81.97 61.33

On March 23, 2016, the last reported sale price for our common stock, as quoted by Nasdaq, was $78.96 per share. As of

March 23, 2016, we had approximately 2,841 shareholders of record.

We did not repurchase any shares of common stock on the open market in 2015. At January 30, 2016, we had $1.0 billion

remaining under Board repurchase authorization.

On September 17, 2013, we entered into agreements and made payments to repurchase $1.0 billion of our common shares

under two $500.0 million Accelerated Share Repurchase Agreements (ASRs). On February 14, 2014 the uncollared agreement

concluded and we received an additional 1.9 million shares without any additional cash payment resulting in a total of 9.1

million shares repurchased under the uncollared agreement. On May 15, 2014 the collared agreement concluded and we

received an additional 1.2 million shares, without any additional cash payments, resulting in a total of 9.0 million shares

repurchased under this agreement. See additional discussion of the ASRs in "Note 8 - Shareholders' Equity" in "Item 8.

Financial Statements and Supplementary Data” beginning on page 65 of this Form 10-K.

We anticipate that substantially all of our cash flow from operations in the foreseeable future will be retained for the

development and expansion of our business, the repayment of indebtedness and, as authorized by our Board of Directors, the

repurchase of stock. Management does not anticipate paying dividends on our common stock in the foreseeable future.