Dollar Tree 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

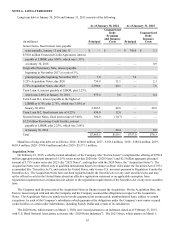

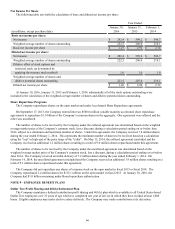

NOTE 6 - LONG-TERM DEBT

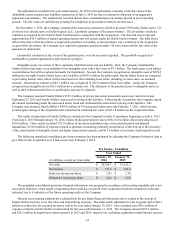

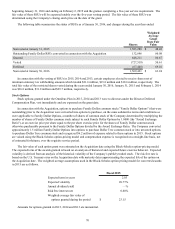

Long-term debt at January 30, 2016 and January 31, 2015 consists of the following:

As of January 30, 2016 As of January 31, 2015

(in millions) Principal

Unamortized

Debt

Premium

and Issuance

Costs Principal

Unamortized

Debt

Issuance

Costs

Senior Notes, fixed interest rates payable

semi-annually, January 15 and July 15 $ — $ — $ 750.0 $ 3.3

$750.0 million Unsecured Credit Agreement, interest

payable at LIBOR, plus 0.90%, which was 1.33%

at January 30, 2016 — — — 0.9

Forgivable Promissory Note, interest payable

beginning in November 2017 at a rate of 1%,

principal payable beginning November 2017 7.0 — 7.0 —

5.25% Acquisition Notes, due 2020 750.0 11.1 — 2.3

5.75% Acquisition Notes, due 2023 2,500.0 40.1 — 7.8

Term Loan A, interest payable at LIBOR, plus 2.25%,

which was 2.68% at January 30, 2016 975.0 3.6 — 0.4

Term Loan B-1, interest payable at the higher of

LIBOR or 0.75% plus 2.75%, which was 3.50% at

January 30, 2016 2,283.5 42.6 — 49.8

Term Loan B-2, fixed interest rate of 4.25% 650.0 12.0 — —

Secured Senior Notes, fixed interest rate of 5.00% 300.0 (10.7) — —

$1.25 billion Revolving Credit Facility, interest

payable at LIBOR, plus 2.25%, which was 2.68%

at January 30, 2016 — 20.4 — 9.8

Total $7,465.5 $119.1 $757.0 $74.3

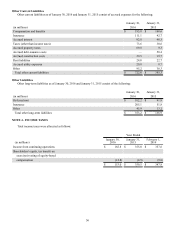

Maturities of long-term debt are as follows: 2016 - $108.0 million, 2017 - $158.2 million, 2018 - $184.4 million, 2019 -

$659.4 million, 2020 - $784.4 million and after 2020 - $5,571.1 million.

Acquisition Notes

On February 23, 2015, a wholly-owned subsidiary of the Company (the "Escrow Issuer") completed the offering of $750.0

million aggregate principal amount of 5.25% senior notes due 2020 (the “2020 Notes”) and $2.5 billion aggregate principal

amount of 5.75% senior notes due 2023 (the “2023 Notes”, and together with the 2020 Notes, the “Acquisition Notes”). The

Acquisition Notes were offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933,

as amended (the “Securities Act”), and outside the United States, only to non-U.S. investors pursuant to Regulation S under the

Securities Act. The Acquisition Notes have not been registered under the Securities Act or any state securities laws and may

not be offered or sold in the United States absent an effective registration statement or an applicable exemption from

registration requirements or a transaction not subject to the registration requirements of the Securities Act or any state securities

laws.

The Company used the proceeds of the Acquisition Notes to finance in part the Acquisition. On the Acquisition Date, the

Escrow Issuer merged with and into the Company and the Company assumed the obligations in respect of the Acquisition

Notes. The Acquisition Notes are jointly and severally guaranteed on an unsecured, unsubordinated basis, subject to certain

exceptions, by each of the Company’s subsidiaries which guarantees the obligations under the Company’s new senior secured

credit facilities or certain other indebtedness, including Family Dollar and certain of its subsidiaries.

The 2020 Notes, which mature on March 1, 2020, were issued pursuant to an indenture, dated as of February 23, 2015,

with U.S. Bank National Association, as trustee (the “2020 Notes Indenture”). The 2023 Notes, which mature on March 1,