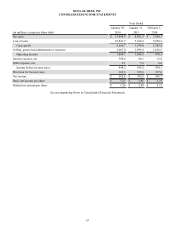

Dollar Tree 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

allocation for the Acquisition, the Company engaged a third-party appraisal firm. See Note 2 for more information regarding

the Acquisition.

During 2015, the Company adopted Accounting Standards Update ("ASU") No. 2015-16, "Business Combinations (Topic

805)." This update requires that an acquirer in a business combination recognize adjustments to provisional amounts that are

identified during the measurement period in the reporting period in which the adjustment amounts are determined. The effect

on earnings of any changes in the provisional amounts must be calculated as if they occurred as of the acquisition date. The

update also requires the acquirer to disclose the portion of the effect on earnings that would have been recorded in previous

reporting periods if the adjustments to the provisional amounts had been recognized as of the acquisition date. This update

must be adopted prospectively and may be early adopted for financial statements that had not been issued before the update's

issuance date. The adoption of the update did not have a material effect on the consolidated income statements.

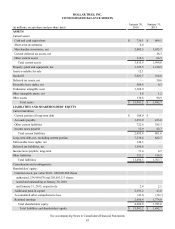

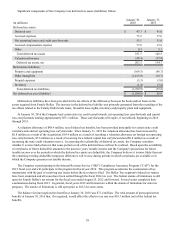

Cash and Cash Equivalents

Cash and cash equivalents at January 30, 2016 and January 31, 2015 includes $462.9 million and $788.6 million,

respectively, of investments primarily in money market securities which are valued at cost, which approximates fair value. For

purposes of the consolidated statements of cash flows, the Company considers all highly-liquid debt instruments with original

maturities of 3 months or less to be cash equivalents. The majority of payments due from financial institutions for the

settlement of debit card and credit card transactions process within 3 business days, and therefore are classified as cash and

cash equivalents.

Merchandise Inventories

Merchandise inventories at the Company’s distribution centers are stated at the lower of cost or market, determined on a

weighted-average cost basis. Cost is assigned to store inventories using the retail inventory method on a weighted-average

basis. Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are computed by

applying a calculated cost-to-retail ratio to the retail value of inventories.

Costs directly associated with warehousing and distribution are capitalized as merchandise inventories. Total warehousing

and distribution costs capitalized into inventory amounted to $114.0 million and $44.3 million at January 30, 2016 and

January 31, 2015, respectively.

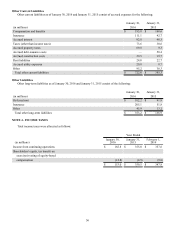

Property, Plant and Equipment

Property, plant and equipment are stated at cost and depreciated using the straight-line method over the estimated useful

lives of the respective assets as follows:

Buildings 39 to 40 years

Furniture, fixtures and equipment 3 to 15 years

Leasehold improvements and assets held under capital leases are amortized over the estimated useful lives of the respective

assets or the committed terms of the related leases, whichever is shorter. Amortization is included in "Selling, general and

administrative expenses" in the accompanying consolidated income statements.

Costs incurred related to software developed for internal use are capitalized and amortized, generally over three years.

Capitalized Interest

The Company capitalizes interest on borrowed funds during the construction of certain property and equipment. The

Company capitalized $1.3 million of interest costs in the year ended January 30, 2016. No interest costs were capitalized in the

years ended January 31, 2015 and February 1, 2014.

Goodwill and Nonamortizing Intangible Assets

Goodwill and nonamortizing intangible assets are not amortized, but rather tested for impairment at least annually. In

addition, goodwill and nonamortizing intangible assets will be tested on an interim basis if an event or circumstance indicates

that it is more likely than not that an impairment loss has been incurred. The Company performed its annual impairment testing

in November 2015 and determined that no impairment existed.

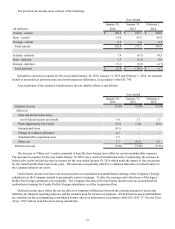

Other Assets, Net

Other assets, net consists primarily of restricted investments and deferred compensation plan assets. Restricted

investments were $82.0 million and $78.9 million at January 30, 2016 and January 31, 2015, respectively and were purchased

to collateralize long-term insurance obligations. These investments are primarily in tax-exempt money market funds that invest

in short-term municipal obligations. These investments are classified as available-for-sale and are recorded at fair value, which

approximates cost. Deferred compensation plan assets were $21.1 million and $5.5 million at January 30, 2016 and

January 31, 2015, respectively, and are recorded at fair value.