Dollar Tree 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

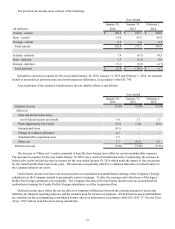

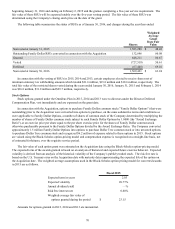

Contributions to and reimbursements by the Company of expenses of the plan included in "Selling, general and

administrative expenses" in the accompanying consolidated income statements were as follows:

Year ended January 30, 2016 $36.6 million

Year ended January 31, 2015 $41.1 million

Year ended February 1, 2014 $35.8 million

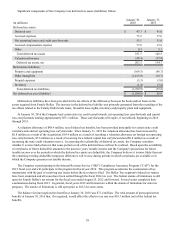

Eligible employees vest in the Company’s profit sharing contributions based on the following schedule:

20% after two years of service

40% after three years of service

60% after four years of service

100% after five years of service

All eligible employees are immediately vested in any Company match contributions under the 401(k) portion of the plan.

Family Dollar 401(k) Retirement Plan

The Company maintains a defined contribution 401(k) plan which is available to all eligible Family Dollar employees. The

Company may make contributions at its discretion. Contributions to and reimbursements by the Company of expenses of the

plan included in "Selling, general and administrative expenses" in the accompanying consolidated income statements were $6.2

million for the year ended January 30, 2016.

Dollar Tree Deferred Compensation Plan

The Company has a deferred compensation plan which provides certain Dollar Tree officers and executives the ability to

defer a portion of their base compensation and bonuses and invest their deferred amounts. The plan is a nonqualified plan and

the Company may make discretionary contributions. The deferred amounts and earnings thereon are payable to participants, or

designated beneficiaries, at specified future dates, or upon retirement or death. Total cumulative participant deferrals and

earnings were approximately $5.2 million and $5.5 million, respectively, at January 30, 2016 and January 31, 2015, and are

included in "Other liabilities" on the accompanying consolidated balance sheets. The related assets are included in "Other

assets" on the accompanying consolidated balance sheets. The Company did not make any discretionary contributions in the

years ended January 30, 2016, January 31, 2015, or February 1, 2014.

Family Dollar Deferred Compensation Plan

The Company has a deferred compensation plan which provides certain Family Dollar officers and executives the ability to

defer a portion of their base compensation and bonuses and invest their deferred amounts. The plan is a nonqualified plan and

the Company does not make contributions to this plan or guarantee earnings. The deferred amounts and earnings thereon are

payable to participants, or designated beneficiaries, at either specified future dates, or upon separation of service or death. Total

cumulative participant deferrals and earnings were approximately $15.9 million at January 30, 2016.

NOTE 10 - STOCK-BASED COMPENSATION PLANS

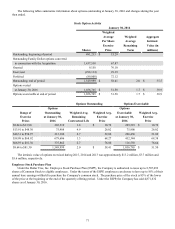

Fixed Stock Option Compensation Plans

Under the Equity Incentive Plan (EIP), the Company granted up to 18.0 million shares of its Common Stock, plus any

shares available for future awards under the 1995 Stock Incentive Plan, to the Company’s employees, including executive

officers and independent contractors. The EIP permitted the Company to grant equity awards in the form of stock options,

stock appreciation rights and restricted stock. The exercise price of each stock option granted equaled the market price of the

Company’s stock at the date of grant. The options generally vested over a three-year period and have a maximum term of 10

years. This plan was terminated on June 16, 2011 and replaced with the Company’s Omnibus Incentive Plan (Omnibus Plan).

The Executive Officer Equity Incentive Plan (EOEP) was available only to the Chief Executive Officer and certain other

executive officers. These officers no longer received awards under the EIP. The EOEP allowed the Company to grant the same

types of equity awards as the EIP. These awards generally vested over a three-year period, with a maximum term of 10 years

for stock options. This plan was terminated on June 16, 2011 and replaced with the Omnibus Plan.

Stock appreciation rights may be awarded alone or in tandem with stock options. When the stock appreciation rights are

exercisable, the holder may surrender all or a portion of the unexercised stock appreciation right and receive in exchange an

amount equal to the excess of the fair market value at the date of exercise over the fair market value at the date of the grant. No

stock appreciation rights have been granted to date.