Dollar Tree 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

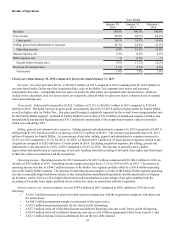

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

In Management’s Discussion and Analysis, we explain the general financial condition and the results of operations for our

company, including:

• what factors affect our business;

• what our net sales, earnings, gross margins and costs were in 2015, 2014 and 2013;

• why those net sales, earnings, gross margins and costs were different from the year before;

• how all of this affects our overall financial condition;

• what our expenditures for capital projects were in 2015 and 2014 and what we expect them to be in 2016; and

• where funds will come from to pay for future expenditures.

As you read Management’s Discussion and Analysis, please refer to our consolidated financial statements, included in

"Item 8. Financial Statements and Supplementary Data” of this Form 10-K, which present the results of operations for the fiscal

years ended January 30, 2016, January 31, 2015 and February 1, 2014. In Management’s Discussion and Analysis, we analyze

and explain the annual changes in some specific line items in the consolidated financial statements for fiscal year 2015

compared to fiscal year 2014 and for fiscal year 2014 compared to fiscal year 2013. We also provide information regarding the

performance of each of our operating segments. Unless otherwise indicated, references to "we," "our" or "us" refer to Dollar

Tree, Inc. and its direct and indirect subsidiaries on a consolidated basis.

Key Events and Recent Developments

Several key events have had or are expected to have a significant effect on our operations. You should keep in mind that:

• On July 6, 2015, we completed our acquisition of Family Dollar Stores, Inc. (the "Acquisition")

• On July 6, 2015, we repaid all amounts outstanding under our Senior Notes issued in 2013.

• On June 11, 2015, we amended the terms of the New Senior Secured Credit Facilities to refinance the existing

$3.95 billion Term Loan B tranche with $3.3 billion in aggregate principal amount of floating-rate Term B-1 Loans

and $650.0 million in aggregate principal amount of fixed-rate Term B-2 Loans.

• On March 9, 2015, we entered into a credit agreement and term loan facilities and received $3.95 billion under the

Term Loan B which we used in connection with our financing of the Acquisition.

• On February 23, 2015, we completed the offering of $3.25 billion of acquisition notes which we used in

connection with our financing of the Acquisition.

• In January 2015, we completed a 270,000 square foot expansion of our distribution center in Joliet, Illinois. The

Joliet distribution center is now a 1,470,000 square foot, fully automated facility.

• On July 27, 2014, we entered into an Agreement and Plan of Merger to acquire Family Dollar in a cash and stock

transaction.

• On September 17, 2013, we entered into agreements with JP Morgan Chase Bank to repurchase $1.0 billion of our

common stock under a variable maturity accelerated share repurchase program, 50% of which was collared and

50% of which was uncollared.

• On September 16, 2013, we completed a private placement with institutional investors of $750.0 million aggregate

principal amount of Senior Notes. The Senior Notes include three tranches with $300.0 million of 4.03% Senior

Notes due in September 2020, $350.0 million of 4.63% Senior Notes due in September 2023 and $100.0 million of

4.78% Senior Notes due in September 2025.

• On September 13, 2013, our Board of Directors authorized the repurchase of an additional $2.0 billion of our

common stock. This authorization replaced all previous authorizations. At January 30, 2016, we had $1.0 billion

remaining under Board repurchase authorization.

• In August 2013, we completed a 401,000 square foot expansion of our distribution center in Marietta, Oklahoma.

The Marietta distribution center is now a 1,004,000 square foot, fully automated facility.

• In June 2013, we completed construction on a new 1.0 million square foot distribution center in Windsor,

Connecticut.

• In March 2013, we leased an additional 0.4 million square feet at our distribution center in San Bernardino,

California. The San Bernardino distribution center is now an 802,000 square foot facility.