Dollar Tree 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

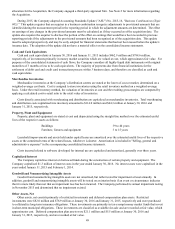

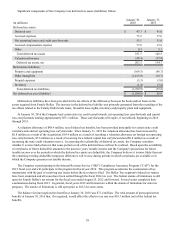

Vendor Allowances

The Company receives vendor support in the form of cash payments or allowances through a variety of reimbursements

such as purchase discounts, cooperative advertising, markdowns, scandowns and volume rebates. The Company has

agreements with vendors setting forth the specific conditions for each allowance or payment. The Company either recognizes

the allowance as a reduction of current costs or defers the payment over the period the related merchandise is sold. If the

payment is a reimbursement for costs incurred, it is offset against those related costs; otherwise, it is treated as a reduction to

the cost of merchandise.

Pre-Opening Costs

The Company expenses pre-opening costs for new, expanded, relocated and rebannered stores, as incurred.

Advertising Costs

The Company expenses advertising costs as they are incurred and they are included in "Selling, general and administrative

expenses" on the accompanying consolidated income statements. Advertising costs, net of co-op recoveries from vendors,

approximated $32.5 million, $18.1 million and $14.9 million for the years ended January 30, 2016, January 31, 2015, and

February 1, 2014, respectively.

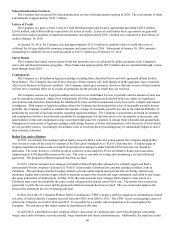

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for

the future tax consequences attributable to differences between financial statement carrying amounts of existing assets and

liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to

apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect

on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment

date of such change.

The Company recognizes a financial statement benefit for a tax position if it determines that it is more likely than not that

the position will be sustained upon examination.

The Company includes interest and penalties in the provision for income tax expense and income taxes payable. The

Company does not provide for any penalties associated with tax contingencies unless they are considered probable of

assessment.

During 2015, the Company adopted ASU No. 2015-17, "Income Taxes (Topic 740)." This update requires that deferred tax

liabilities and assets be classified as noncurrent in a classified balance sheet. The requirement that deferred tax liabilities and

assets of a tax-paying component of an entity be offset and presented as a single amount is not affected by the amendments in

the update. The update has been adopted prospectively to all deferred tax liabilities and assets and prior periods have not been

retrospectively adjusted.

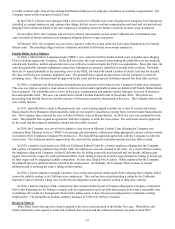

Stock-Based Compensation

The Company recognizes expense for all share-based payments to employees based on their fair values. Total stock-based

compensation expense for 2015, 2014 and 2013 was $52.3 million, $37.4 million and $36.2 million, respectively.

The Company recognizes expense related to the fair value of restricted stock units (RSUs) and stock options over the

requisite service period on a straight-line basis or a shorter period based on the retirement eligibility of the grantee. The fair

value is determined using the closing price of the Company’s common stock on the date of grant.

During 2015, the Company adopted Accounting Standards Update No. 2014-12, "Compensation-Stock Compensation

(Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could be

Achieved after the Requisite Service Period." This update provides explicit accounting treatment with respect to share-based

awards with specific performance targets for employees who are eligible to vest in the award regardless of whether the

employee is rendering service on the date the performance target is achieved. This update has been adopted by the Company

on a prospective basis for all awards granted or modified on or after February 1, 2015. There was no impact upon the adoption

of the update.

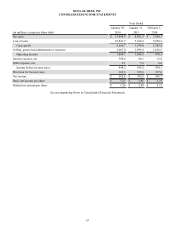

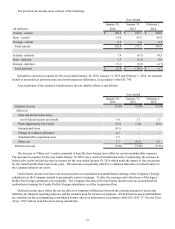

Net Income Per Share

Basic net income per share has been computed by dividing net income by the weighted average number of shares

outstanding. Diluted net income per share reflects the potential dilution that could occur assuming the inclusion of dilutive

potential shares and has been computed by dividing net income by the weighted average number of shares and dilutive

potential shares outstanding. Dilutive potential shares include all outstanding stock options and unvested RSUs after applying

the treasury stock method.