Dollar Tree 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

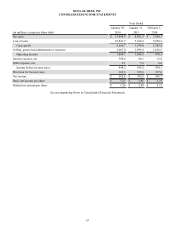

53

NOTE 2 - ACQUISITION

On July 27, 2014, the Company executed an Agreement and Plan of Merger to acquire Family Dollar in a cash and stock

transaction. On July 6, 2015 (the "Acquisition Date"), the Company completed the Acquisition and Family Dollar became a

direct, wholly-owned subsidiary of the Company. Under the Acquisition, the Family Dollar shareholders received $59.60 in

cash and 0.2484 shares of the Company's common stock for each share of Family Dollar common stock they owned, plus cash

in lieu of fractional shares (the "Merger Consideration").

As of the Acquisition Date, each outstanding performance share right of Family Dollar common stock was canceled in

exchange for the right of the holder to receive the Merger Consideration (the "PSR Payment"). The aggregate amount paid by

the Company for the Merger Consideration and PSR Payment was $6.8 billion in cash and the Company issued 28.5 million

shares of the Company's common stock, valued at $2.3 billion based on the closing price of the Company's common stock on

July 2, 2015. Additionally, outstanding Family Dollar stock options and restricted stock units were converted into mirror

awards exercisable or to be earned in the Company's common stock. The value of these awards was apportioned between total

Merger Consideration and unearned compensation to be recognized over the remaining original vesting periods of the awards.

The Company's common stock continues to trade on the Nasdaq Exchange under the symbol "DLTR." Following the

Acquisition Date, Family Dollar's common stock ceased trading on, and was delisted from, the New York Stock Exchange.

Family Dollar's results from the Acquisition Date through January 30, 2016 are included in the consolidated income statements.

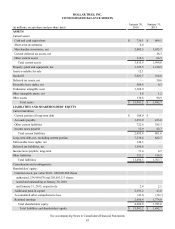

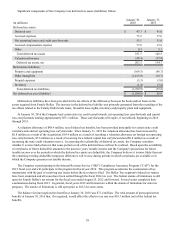

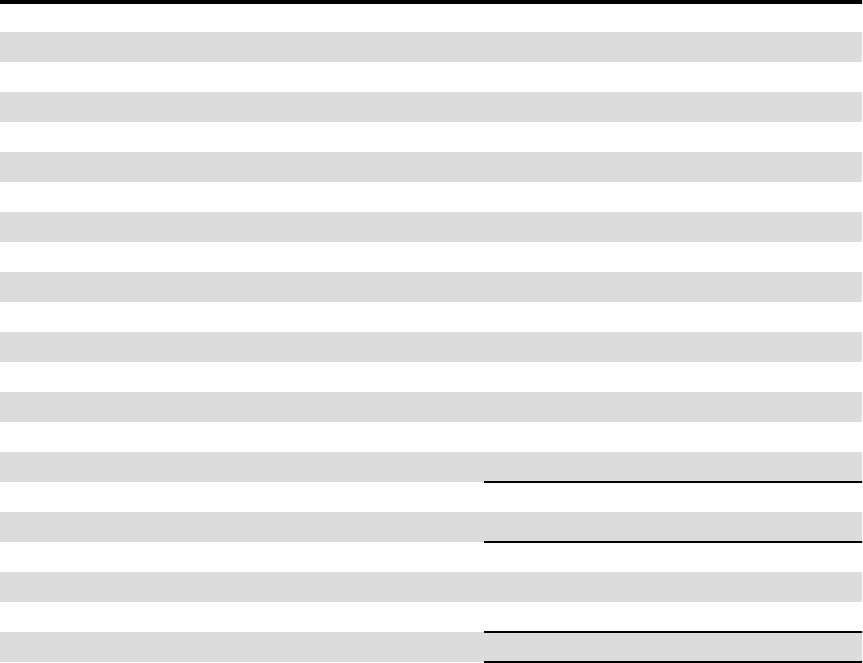

The following table summarizes the preliminary estimates of the fair values of the identifiable assets acquired and

liabilities assumed as of the Acquisition Date of July 6, 2015. The preliminary estimates of the fair value of identifiable assets

acquired and liabilities assumed are based on estimates and assumptions and are subject to revisions, which may result in

adjustments to the preliminary values presented below, when management's estimates are finalized:

As Reported As Revised

(in millions) August 1,

2015 Adjustments January 30,

2016

Cash $ 307.4 $ (2.1) $ 305.3

Short-term investments 4.0 — 4.0

Accounts receivable 71.4 (0.3) 71.1

Inventory 1,764.5 1.0 1,765.5

Taxes receivable — 32.9 32.9

Other current assets 94.2 5.9 100.1

Property, plant and equipment 1,912.8 (19.5) 1,893.3

Assets available for sale — 10.1 10.1

Goodwill 4,819.0 40.9 4,859.9

Intangible assets, net 3,570.3 0.1 3,570.4

Other assets 77.7 0.4 78.1

Long-term debt, including current portion (485.2)(11.8)(497.0)

Accounts payable (633.4)(1.8)(635.2)

Other current liabilities (550.4)(13.0)(563.4)

Deferred tax liabilities, net (1,644.7) 26.3 (1,618.4)

Other liabilities (202.2)(51.4)(253.6)

Total purchase price $ 9,105.4 $ 17.7 $ 9,123.1

Less: Cash acquired (307.4) 2.1 (305.3)

Total purchase price, net of cash acquired 8,798.0 19.8 8,817.8

Acquisition cost paid in common stock (2,272.4) — (2,272.4)

Acquisition cost paid in equity compensation — (17.7)(17.7)

Acquisition cost paid in cash, net of cash acquired $ 6,525.6 $ 2.1 $ 6,527.7