Dollar Tree 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

The adjustments recorded in the year ended January 30, 2016 to the preliminary estimates of the fair values of the

identifiable assets acquired and liabilities assumed as of July 6, 2015 are due to continued refinement of management's

appraisals and estimates. The adjustments recorded did not have a material impact on results reported in prior reporting

periods. The fair values are preliminary pending the completion of procedures related to income taxes.

On November 1, 2015, the Company completed the transaction pursuant to which it divested 330 Family Dollar stores, 325

of which were already open, to Dollar Express LLC, a portfolio company of Sycamore Partners. The divestiture satisfied a

condition as required by the Federal Trade Commission in connection with the Acquisition. The divested stores represent

approximately $45.5 million of annual operating income and will operate under the Dollar Express banner. The table above

reflects the effect of the divestiture as required by purchase accounting, as the divestiture was a condition of the Acquisition.

As part of the divestiture, the Company was required to guarantee payments under 316 store leases and the fair value of the

guarantee is immaterial.

Goodwill is calculated as the excess of the purchase price over the net assets acquired. The goodwill recognized is

attributable to growth opportunities and expected synergies.

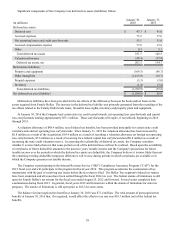

Intangible assets, net consist of three separately identified assets and one liability. First, the Company identified the

Family Dollar trade name as an indefinite-lived intangible asset with a fair value of $3.1 billion. The trade name is not subject

to amortization but will be evaluated annually for impairment. Second, the Company recognized an intangible asset of $629.2

million for favorable Family Dollar leases and a liability of $164.3 million for unfavorable Family Dollar leases (as compared

to prevailing market rates) which will be amortized over the remaining lease terms, including, in some cases, an assumed

renewal. Amortization expense of $45.3 million was recognized in 2015 related to these lease rights. Lastly, the Company

recognized an intangible asset of $5.5 million for a customer list. The allocation of the purchase price to intangible assets as

well as their estimated useful lives is preliminary and may be adjusted.

The Company assumed Family Dollar's $185.2 million of private placement unsecured senior notes which were due

September 27, 2015 and Family Dollar's unsecured revolving credit facilities. Following the Acquisition, the Company repaid

the amount outstanding under the unsecured senior notes and terminated the unsecured revolving credit facilities. The

Company also assumed Family Dollar's $300.0 million of 5% unsecured senior notes due February 1, 2021, which became

secured upon closing of the Acquisition and which had an estimated fair value of $311.8 million on the Acquisition Date.

The results of operations of Family Dollar are included in the Company's results of operations beginning on July 6, 2015.

From July 6, 2015 through January 30, 2016, Family Dollar generated net sales of $6,162.0 million and an operating loss of

$30.8 million. These results included: $73.0 million of inventory markdowns due to sku rationalization and planned

liquidations; $156.8 million of expenses related to purchase accounting, primarily amortization of the step-up of the inventory

value, amortization of intangible assets and higher depreciation expense; and $13.4 million of severance and integration costs.

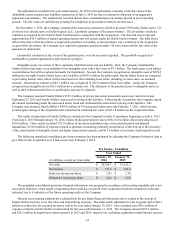

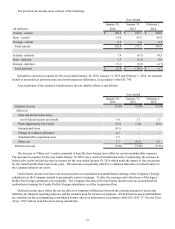

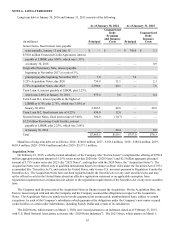

The following unaudited consolidated pro forma summary has been prepared by adjusting the Company's historical data to

give effect to the Acquisition as if it had occurred on February 2, 2014:

Pro Forma - Unaudited

Year Ended

(in millions, except per share data) January 30,

2016 January 31,

2015

Net sales $ 20,168.3 $ 19,225.2

Net income $ 571.4 $ 634.0

Basic net income per share $ 2.43 $ 2.70

Diluted net income per share $ 2.42 $ 2.69

The unaudited consolidated pro forma financial information was prepared in accordance with existing standards and is not

necessarily indicative of the results of operations that would have occurred if the Acquisition had been completed on the date

indicated, nor is it indicative of the future operating results of the Company.

Material non-recurring adjustments excluded from the pro forma financial information above consist of the step-up of

Family Dollar inventory to its fair value and restructuring expenses. The unfavorable adjustment to cost of goods sold of $48.3

million was based on the acquired inventory sold in the year ended January 30, 2016. Also excluded were $90.1 million of

expenses related to Family Dollar's restructuring for the year ended January 31, 2015. The Company incurred $39.2 million

and $28.5 million in acquisition-related expenses in 2015 and 2014, respectively, excluding acquisition-related interest expense.