Dollar Tree 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Dollar Tree annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

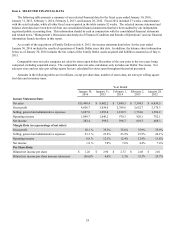

The New Senior Secured Credit Facilities contain representations and warranties, events of default and affirmative and

negative covenants. These include, among other things and subject to certain significant exceptions, restrictions on our ability

to declare or pay dividends, repay the Acquisition Notes, create liens, incur additional indebtedness, make investments, dispose

of assets and merge or consolidate with any other person. In addition, a financial maintenance covenant based on our

consolidated first lien secured net leverage ratio will apply to the New Revolving Credit Facility and the Term Loan A tranche

of the New Term Loan Facilities.

Annual interest expense is expected to approximate $360.0 million in 2016, $20.0 million of which is non-cash

amortization of debt-issuance costs.

Historically we have used cash to repurchase shares but we did not repurchase any shares in fiscal 2015 and 2014. We

repurchased 17.4 million shares for $1,112.1 million in fiscal 2013. At January 30, 2016, we have $1.0 billion remaining under

Board repurchase authorization.

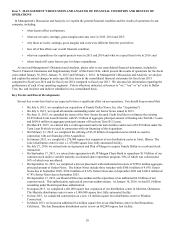

Funding Requirements

Overview, Including Off-Balance Sheet Arrangements

We expect our cash needs for opening new stores and rebannering and expanding existing stores in fiscal 2016 to total

approximately $457.9 million, which includes capital expenditures, initial inventory and pre-opening costs.

At January 30, 2016, we have $1,250.0 million available under our New Revolving Credit Facility, less amounts

outstanding for letters of credit totaling $123.0 million.

Our estimated capital expenditures for fiscal 2016 are between $650.0 million and $670.0 million, including planned

expenditures for our new and expanded stores, the addition of freezers and coolers to approximately 400 stores, the completion

the Dollar Tree segment's eleventh distribution center and the expansion of our Stockton, California distribution center. We

believe that we can adequately fund our working capital requirements and planned capital expenditures for the next few years

from net cash provided by operations and potential borrowings under our New Revolving Credit Facility.

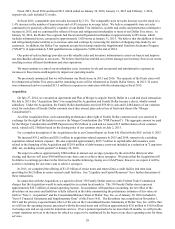

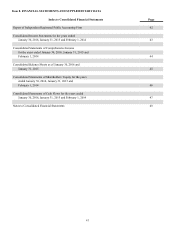

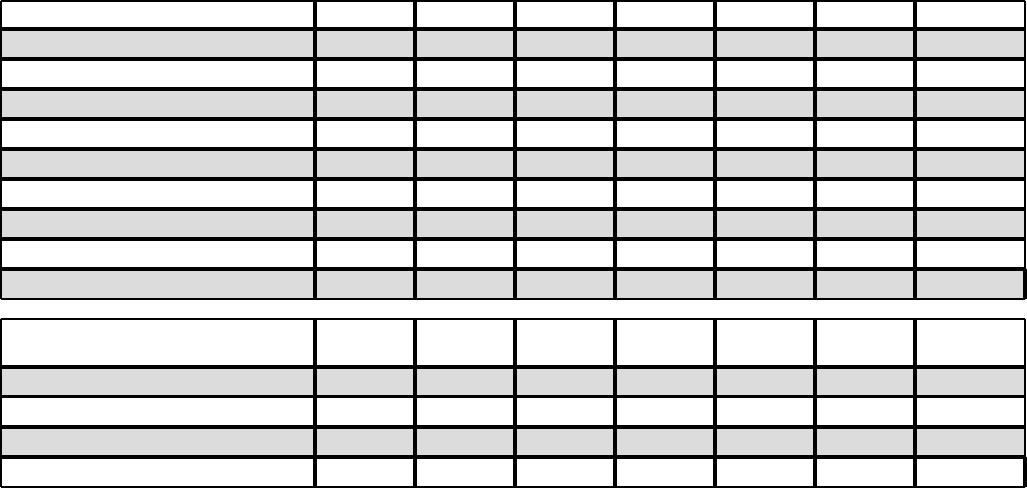

The following tables summarize our material contractual obligations at January 30, 2016, including both on- and off-

balance sheet arrangements, and our commitments, including interest on long-term borrowings (in millions):

Contractual Obligations Total 2016 2017 2018 2019 2020 Thereafter

Lease Financing

Operating lease obligations $ 7,349.4 $ 1,235.4 $ 1,206.7 $ 999.5 $ 838.3 $ 644.6 $ 2,424.9

Long-term Borrowings

Acquisition notes 3,250.0 — — — — 750.0 2,500.0

Term loans 3,908.5 108.0 158.0 183.0 658.0 33.0 2,768.5

Assumed secured senior notes 300.0 — — — — — 300.0

Forgivable promissory note 7.0 — 0.2 1.4 1.4 1.4 2.6

Interest on long-term borrowings 2,064.3 331.2 334.1 325.8 324.9 277.3 471.0

Total obligations $ 16,879.2 $ 1,674.6 $ 1,699.0 $ 1,509.7 $ 1,822.6 $ 1,706.3 $ 8,467.0

Commitments Total Expiring

in 2016 Expiring

in 2017 Expiring

in 2018 Expiring

in 2019 Expiring

in 2020 Thereafter

Letters of credit and surety bonds $ 381.0 $ 376.5 $ 4.3 $ 0.2 $ — $ — $ —

Technology assets 7.0 7.0 — — — — —

Telecommunication contracts 142.7 38.1 34.6 32.5 32.2 5.3 —

Total commitments $ 530.7 $ 421.6 $ 38.9 $ 32.7 $ 32.2 $ 5.3 $ —